Long-Term Investing Mindsets

Dear Investors,

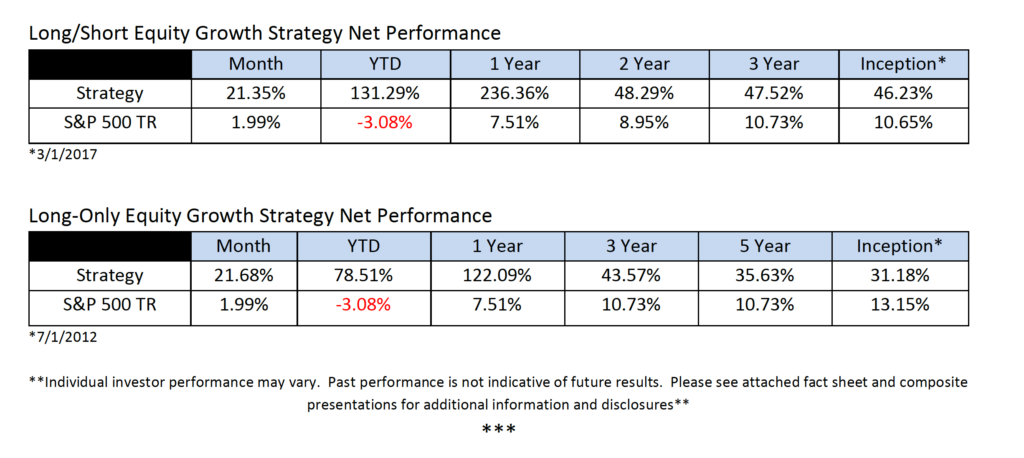

Year-to-date, our long/short equity strategy returned 131.29%, and our long-only strategy returned 78.51%, net of fees. This was compared to the S&P 500 TR of -3.08% over the same period.

Please see below for results since inception.

Please see here for composite presentations for additional information and disclosures.

As a long-term investor, I try not to get overly concerned with month-to-month volatility in asset pricing. It’s pointless to me to get mired in the daily, weekly, or even quarterly fluctuations of the market. On any given day, or any moment in time, a quote is not necessarily an accurate reflection of fundamental business value, good or bad. Quotes go up, and they go down. What is true, however, is that over time—years—the stocks of solid, high-growth businesses go up. And over time—also years—the stocks of bad, declining growth businesses go down.

Easy, right? Not always. In reality, having the patience to let specific investments play out over time is hard work. Like Oscar Wilde once said, “To do nothing at all is the most difficult thing in the world—the most difficult and the most intellectual.” All we can do as long-term investors is focus on and seek to identify the best businesses in the world that are winning customers on the ground level—and compounding growth.

If the business value is increasing to our own internal calculations, we can gain higher conviction—even if the quotes don’t reflect the underlying valuation.

Over time, markets will reward this sort of diligence and patience, even if the returns are lumpy month-to-month, quarter to quarter, or even year to year. But sometimes—and this year has been a good example of this dynamic so far—the market catches up quickly. And can all at once.

For example, Spotify—which entered our portfolio in 2018 and has become a top holding as you know—didn’t do much for us for a couple of years. And it was a relatively small position when it first entered the book. But as we continued to study the business model, quarter after quarter, year after year, we developed more and more conviction in the company. Slowly and opportunistically, we accumulated more shares in early 2020. Again, we don’t try to time the market. But we believe our edge comes down to forward-looking valuations, and when we see any of our favorite portfolio companies trading at extreme discounts to our internal price targets, we like to load up if possible. And that’s exactly what we did with Spotify—both in shares and in LEAP contracts.

By May 2020, the market appeared to see what we had been tracking since 2018: Audio is a massive opportunity beyond music, as evidenced by Spotify’s exclusive deals with Joe Rogan, Former President Barack Obama, and many more who have inked partnerships on Spotify.

This is a relatively nascent industry, but at this point, we have a high degree of conviction that Spotify has built the go-to platform for the future of audio. By the end of Q1 2020, Spotify had 130 million paid users, growing 31% YoY, ahead of the company’s forecast— with 286 million daily active users. Make no mistake: Spotify is going after a monster end-market, and I still think most of the market under-appreciates the long-term opportunity here. As Daniel Ek, the founder/CEO of Spotify, has put it this way:

- “To really understand, take the current value of the video industry. Consumers spend roughly the same amount of time on video as they do on audio. Video is about a trillion dollar market. And the music and radio industry is worth around a hundred billion dollars. I always come back to the same question: Are our eyes really worth 10 times more than our ears?”

Since early last decade, I have been fascinated by these messy, multi-trillion-dollar industries undergoing a high degree of disruption and technological change. My fascination started with Amazon—the move to cloud computing and the associated hyper growth of AWS—but media, on its own, is another category undergoing a high degree of disruption. From my perspective, things are moving at a high velocity, and they only seem to be accelerating. So what gives me my conviction on Spotify?

On a high level, the Internet and “smartphone era” has ushered in an entirely new paradigm shift. Consumers—myself included—prefer to interact with digital streaming technologies and instant access to our favorite creators. The key word here is “instant.” Unlike previous cycles, the power in this disruptive ecosystem has shifted from the distributors (i.e. record labels, movie studios, etc.) to the platforms (i.e. SPOT, NFLX, etc.). It’s no longer just about who owns content and controls its destiny—it’s about who can create a sticky platform that serves consumers the content they enjoy—and also serves as a recommendation engine for new content discovery in the future.

In our view, Spotify is crushing it in this domain. Podcast consumption on the platform is up triple-digits YoY, according to the company. There are now more than 1 million podcasts available on Spotify, and, much like YouTube enabled a new generation of creators on its platform, Spotify is helping launch the next generation of podcasters through its acquisition of Anchor. (According to Spotify, Anchor-powered shows accounted for more than 70% of new podcasts launched in Q1.)

This platform will, in my opinion, become a significant driver of margin, and I have likened Spotify to the “Google of Audio.” I wrote a longer thesis on this in mid-May [link] but the gist of it is this: Podcasts today are much like blogosphere in the late 1990s: highly fragmented, rich with creativity, but lacking a central business model to enable creators a profitable way to reach advertisers and make money. In the late 90s, Google profited by creating an elegant solution: by uniting website owners with advertisers through a frictionless advertising platform, creators enjoyed the ability to monetize their content, advertisers got to reach highly targeted customers, and Google won the best prize—a highly profitable and fast-growing advertising business that enjoyed fat margins, which eventually (but significantly) dropped to Google’s bottom line.

Other core long positions fared well for us during the quarter. This includes Tesla, which continues to be a top holding.

As I think back on the last 12 months in regard to our position in Tesla—it has been a top holding for the last several years—I feel both vindicated, but also frustrated with the current state of investment research on Wall Street.

As I prepared to write this letter, I began reading some of my previous letters to you. Looking at the Q2 2019 letter, for instance—which I wrote and published one year ago this month—I was reminded, for instance, that in May 2019 Morgan Stanley put out a $10/sh bear case price target on Tesla.

As I write this letter today, in early July, Tesla is trading at over $1,300/sh.

Frankly, it’s disappointing to me what is considered by some to be valuable investment research, or even valuable investment “discussion” on popular financial-related TV shows. The fact is, this sort of low-level, cheap research gives us an advantage as deep, fundamental research investors with longer time horizons and patient, intelligent capital.

It also gives us an edge as fundamental investors in disruptive innovation, and this conviction enables us to hold during periods of volatility.

Going back one year ago, here is what I wrote in Q2 2019 when the stock was trading in the low $200s and I refused to sell our position:

- “The recent downturn in performance was principally attributed to the avalanche of attacks on TSLA that have deflated the company’s share price. I’ll dive deeply into Tesla in a moment, but in terms of intrinsic, long-term business value, competitive advantages, and customer approval — we see our companies (and especially TSLA) performing incredibly well on the ground level. There is no change in our view from the beginning of this year regarding Tesla, or any of our core positions, including AMZN and NFLX, which we plan to hold as we have since our initial investments in 2012 and 2014 respectively. Stock quotes can diverge from reality for a period of time and we believe Tesla is a perfect example of this: In our view, the company is worth far more than the stock quote currently suggests. As long-term investors, we have the advantage of time and patience. Despite the decline in the stock price, we are steadfast in our conviction. We see no reason why we can’t make several multiples on our Tesla investment over the next five years from current levels. According to my valuation analysis, right now TSLA should be worth several multiples of its current share price. The company competes in massive, trillion-dollar end markets, and it has an unbelievable technology- enabled lead on the competition. The value proposition they provide in the automotive space is truly unprecedented from our perspective. Frankly, our position in TSLA today reminds me of AMZN five years ago. In January 2014, AMZN was trading at roughly $400. By May 2014—after AMZN missed Wall Street earnings targets by a few points—some investors began to panic that the company would never turn a profit—and AMZN’s stock price slid to the $280s. This divergence represented a decline of nearly 30% in market value in a span of less than six months. Was the company “worth” 30% less because of a couple of missed EPS targets? Of course not. (Imagine the criticism you would have received if you suggested you could make ~5x in just 5 years at January 2014 AMZN prices? Probably the same backlash that comes from making the same statements about Tesla today)… Ultimately, there is much more to be said, but the most important nugget is this: we believe Tesla stands ahead of the competition in nearly every category driving massive changes in the auto industry. As for the short-sellers and short-term FUD, while it is not enjoyable, it also can’t last forever. I see the potential for a “rubber band” effect— a snap back in the stock price as truth wins out and shorts cover their positions. While the short term is hard to predict, I see several tremendous catalysts over the next six months or less, and certainly over the next year, and expect to be back on track in relatively short order.”

Since that publication last year, Tesla’s share price has now increased more than 5X as of this writing in early July. The “rubber band” did indeed snap back—and many shorts were forced to capitulate.

Another position we have built up over the quarter is Shopify—similarly named to Spotify but a very different business. If you’re unfamiliar with the firm, it’s a software e-commerce company that enables thousands of businesses to run online shops. I like to think of them as an international online mall: Customers (i.e. Shopify store owners) pay rent and other payments to the landlord (i.e. Shopify) for backend support and front-end customization. Shopify is also quickly expanding its fulfillment network, as well as growing its capital lending programs to small and medium-sized businesses. As you might expect, they are growing rapidly—it’s a firm we’ve been watching for a significant amount of time, but given the pullback in March 2020, we believe we were able to get in at a discount.

Shopify is an interesting, and in my opinion, complementary, position to our stake in Amazon. The two e-commerce players are not in direct competition to each other but, importantly, they both display winner-take-most dynamics in their respective domains. Like any good platform business, again, we’re watching flywheel effects take place in the model: The more sellers on the Shopify platform, the more services can be offered at a discounted rate, incentivizing more new Shopify customers who are looking to migrate their business online. Post-Covid-19, I anticipate an acceleration of the move from brick and mortar to online commerce.

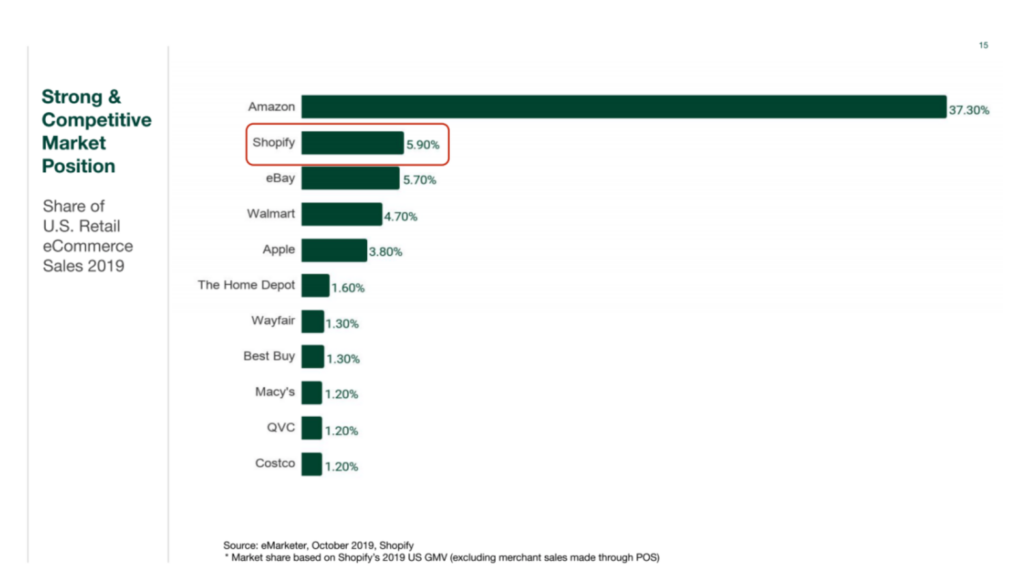

One under appreciated aspect of Shopify, in my opinion at least, is how quickly the company has become the second largest online retailer, just behind Amazon, in terms of share of ecommerce retail spend.

Source: ShopifyLong-term, the company has plenty of runway for international growth and in my opinion, that’s going to be the long-term driver of Shopify’s GMV. Last year, roughly 68% of revenues came from the USA, but e-commerce is increasingly international and cross-border.

•••••

This quarter certainly had challenges, as well. At the end of March, as I was writing the Q1 Letter, I made one prediction about the following few months: For equity investors, navigating this uncertainty would be challenging. In general, I hate to make short-term predictions, but this one I was fairly confident about. Turns out I was right – in our view, at least.

As the real economy imploded downward in April and May (i.e. historic levels of job losses, bankruptcies, loan defaults, etc.) the market rocketed back upward from its March lows. At the end of the June, stocks had their best quarter in decades—even as the business outlook for many of these firms remained, in my view, dismal. So while the rebound helped the long side of our portfolio, many of our short positions were adversely affected, especially in April in May.

Why the bounce back? Truthfully, I try not to make these sorts of market diagnoses or Monday-morning-quarterbacking calls, though I suspect a mix of low interest rates, support from the Federal Reserve, and retail participation, among other factors.

For instance, many of the auto dealerships (SAH, ABG, LAD, among others) that we had been shorting moved significantly against us in April and May—along with some of the brick and mortar retailers and travel related stocks—many of which seemed to surge upwards against us at even the slightest bit of

“good” news. I continue to believe many of these business models are terminally challenged over the long-term, but we did cover some of these positions to protect from any runaway risk.

There are still certainly risks ahead, so heading into Q3, we’re currently short roughly 20 companies. These firms represent a variety of industries we study, from combustion engine firms, fossil fuel producers, and brick and mortar retailers. For instance, we continue to be short General Motors (GM) and Exxon (XOM). In the move to renewables, these are companies that, I believe, will face a long-term decline in value. Ultimately, if they cannot transition, and I don’t believe that they can, I believe they could become obsolete. And it could happen relatively quickly.

•••••

The fact is, we are living through a historically fast-moving cycle with accelerating technological advancements and low interest rates. Certain businesses that are small today can become behemoths by 2030. Long-term, this is very exciting. Finding, studying, and ultimately investing in these disruptors is my great passion—but it’s not easy.

The work we do is purely research and valuation: We commit to top-down, fundamental research on industries undergoing technological disruption. Over time—and I mean years—this process has enabled us to develop the conviction (and patience) to hold a select few businesses who are compounding growth and winning on the customer level, even if their stock quotes periodically dip. As long-term investors, we think in years-long cycles—not months or quarters. This strategy can lead to higher monthly volatility, but in my view, that’s fine. In fact, it means I’m probably doing something right.

It all comes down to valuation. Early last decade I developed our current strategy from scratch: I realized that the new paradigm shift in technology needed new valuation models. A new approach. It’s a strategy that has served us well over the years, and I suspect it will continue to serve us well for years to come. The next industry vertical that I believe is entering into a state of chaos and disruption could be the biggest one yet. I believe it’s bigger than transportation or even retail or media.

That industry is energy.

Energy is a multi-multi-trillion-dollar vertical that is undergoing a radical transformation. We are moving headfirst into a fully renewable energy system led by low-cost and high-efficiency technologies. Whether they realize it or not, fossil fuel companies are destined to decay. Many of them are already stranded assets, only waiting to be written down. I’m not yet ready to discuss the companies we’re studying in this field, but for me, it’s very exciting. Both battery energy storage systems—and software that optimizes the grid—are areas we are going deep on right now.

On a high level, I have to say: It’s a great time to be a stock picker. I see the 2020s as a deflationary cycle with low interest rates—money is cheap and it has to go somewhere. That said, it will be a challenging time for many investors who do not (or refuse to) adapt to the fundamental disruption cycles that we’re seeing today. Businesses are dying at a faster rate than ever before. The environment is Cambrian, and only the strong will survive. It’s also an environment that calls into question how we as investors define risk.

Risk, to me, is the percentage chance that an investment goes to zero. Very often—too often, in fact—I see investors getting tripped up by viewing “cheap” companies as “safe” or “less risky” companies. For novice investment managers, this can be an expensive mistake to learn: Just because a company is cheap does not by definition make them less risky.

Is General Motors “safe” or “less risky” simply because it trades at a lower multiple than Tesla? In my opinion, absolutely not. My view is that the risk of near-term obsolescence (and even insolvency) of a company like GM is high. This may seem counterintuitive to some, but it all comes down to valuation during periods of chaos on change. If you can’t figure out valuation, and you can’t see how consumer patterns are changing, it’s my opinion that you really don’t stand a chance to invest well in this environment, much less beat a benchmark like the S&P 500.

Concentrated portfolios like ours in the short-term will tend to appear “volatile” or “lumpy,” but that does not necessarily make them risky in the traditional sense. On the other hand, diversified portfolios tend to be less volatile, but that does not necessarily make them “safer” over the long-term. In my opinion, our firm has generated outsize returns not because we lean into risk—but actually because we avoid it. Risk is avoided by avoiding investing in businesses that do not have compelling value propositions. Opportunity is found by developing conviction in, and understanding, high-growth businesses models who are competing in vast end-markets and taking market share from incumbents.

As I wind down here, I’ll leave you with this: I’m fundamentally optimistic about the future. This is a hard time for many people: whether it’s the coronavirus, or the geopolitical system, or civil unrest, there’s a lot to be concerned about. But from my standpoint, the 2020s have the potential to be transformative.

Cleaner air and cleaner oceans. Better education. Safer cars and transportation. More fun and entertainment. Direct transparency. Instant access to information. Mind-bending new healthcare technology advances. Space exploration! I do feel we’re on the cusp of major change, and I’m happy to be the steward of your capital—and peace of mind…

As always, feel free to get in touch with any questions.

Best,

Nightview Capital

Founder/CIO – Arne Alsin

Disclosures:

This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital.

The opinions expressed herein are those of Nightview Capital and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward looking statements cannot be guaranteed. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. This is not a recommendation to buy, sell, or hold any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Nightview Capital makes in the future will be profitable or equal the performance of the securities discussed herein. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request.

Past performance Is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income. The S&P 500 Total Return is a market-value-weighted index that measures total return, including price and dividends, of 500 leading companies in leading industries in the U.S. economy. The volatility (beta) of the accounts may be greater or less than benchmarks. It is not possible to invest directly in this index.

Nightview Capital Management, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-20-10