“Pessimists sound smart. Optimists make money.”

-Nat Friedman, CEO of GitHub

Embracing Disruptive Innovation

Dear Partners,

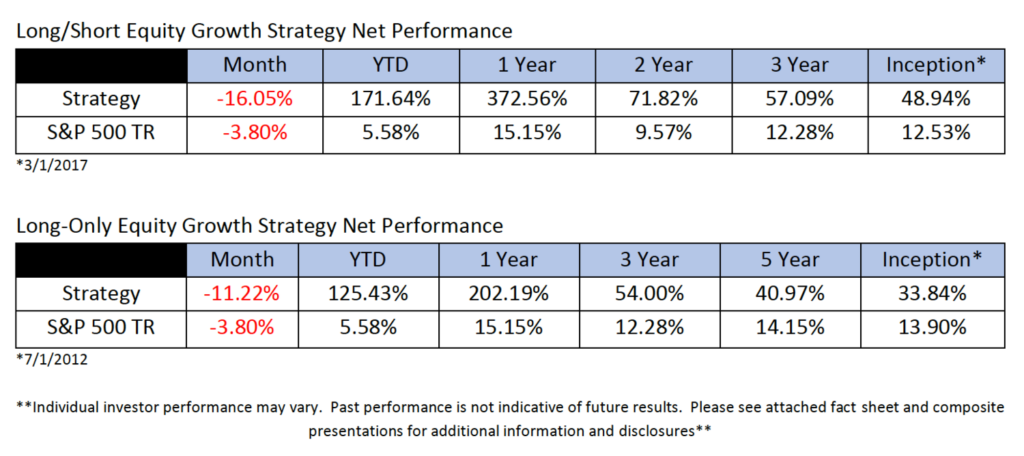

Year-to-date through Q3 2020, our long/short equity strategy has returned 171.64%, and our long-only strategy has returned 125.43%, net of fees. This was compared to the S&P 500 TR of 5.58% over the same period.

Please see below for results since inception.

Please see here for composite presentations for additional information and disclosures.

It’s been a strong year so far, but it’s my belief that, long-term, we’re really just getting started.

From my perspective, the opportunity set for our strategy only appears to be increasing in scope. The industries that we study—energy, transportation, retail, cloud computing, digital entertainment—are in the early stages of rapid change. We’re entering what I like to call the disruption “super cycle.” I believe there will be a handful of winners, but perhaps an even greater number of losers.

Our process is designed for this type of “messy” market situation. We believe that disruption will ultimately impact most, if not all, industry verticals in the developed global economy. This opportunity exists not only now, but consistently going forward through the decade and beyond, in our view.

In particular, we’re most focused on the energy and transportation sector. I don’t think investors realize just how profoundly the energy industry is being disrupted by low-cost and more efficient renewable technologies. The implications are massive, and in my opinion the opportunities for significant upside are unparalleled in the market. Put simply: We believe there are fortunes to be made in the transition from fossil fuels to renewables, and we have every intention in participating in this once-in-a-generation disruption.

The impact of this transition cannot be overstated. Consider the enormous magnitude of wealth created by the economic paradigm dominated by the oil and gas industry. Then consider the second, and third-order effects and fortunes that have been made on a personal, corporate and sovereign level. What if that paradigm is on the verge of being uncompetitive?

Right now, we are heads-down focused on researching a variety of new investment opportunities, from battery energy storage to distributed energy technologies to international decentralized virtual power plants. I will share more in the coming months at what we’re looking at. Next week, we’ll be publishing a Q&A I did with our Director of Research, Eric Markowitz, on this subject. Stay tuned.

•••••

Since my last letter in July, the largest positions in our long portfolio have not changed considerably, though I do make minor adjustments to our short book fairly often.

While July and August delivered strong performance in our core holdings, we faced a bit of a correction in September. The September pullback was not terribly shocking, and overall, I viewed the correction as a healthy market development. In fact, down months often create wonderful opportunities for buying, and we did re-enter a position in Alibaba (BABA) in mid-September.

The last few months of relative volatility are a good reminder of one of my core tenets as an investor: Price is not value. Rational investors do not sell a stock simply because of a change in the price, whether it went up or down. Traders do this—but we’re not traders. We’re selective long-term investors with a multi-year horizon—and we think like business owners. We only want to own the most fabulous business models in the world that are compounding growth and disrupting trillion-dollar industries with a superior product or service.

An increase (or decrease, for that matter) in a stock quote is not in itself a reason to sell: A stock price is simply a bid on our ownership interest in a business. Some days we get low bids, other days we get high bids. But if you think like a business owner, you’d be crazy to sell your business for anything less than what you think it will be worth, factoring in future growth and production.

Know the intrinsic value of the businesses you own, and things become easier. Tune out Wall Street analysts, stop listening to the “experts” on CNBC, and while you should listen to company management, do your own independent research, fact-checking, qualitative and quantitative financial analysis. Obsessiveness in this domain tends to help, too: Cut out distractions. (I’ve optimized my time and our firm to be focused exclusively on yearly returns. I’d much rather spend my time making money than raising money.)

It’s also important to develop your own theories around portfolio construction. In the simplest sense, I’d rather own one very big stake of an amazing business—versus owning lots of little stakes in several decent businesses. I’m paraphrasing Warren Buffett here, but if you know how to analyze and value businesses, you’d be crazy to own 50 or 100 stocks instead of concentrating on your ten best ideas.

We’ll never go completely all-in on one stock, but when we see a significant deviation of price and value, I’d consider it a failing—irresponsible, even—to not push our chips in. Great investing requires conviction. It requires patience, too—and knowing how to ride your winners without capping your upside when they make incremental gains.

A good example of riding our winners this year is Tesla, which we have studied down to the cell-chemistry level since 2015. In August, for instance, the bid for Tesla increased some 70%. Was this increase in bid itself a reason to sell our ownership, or even to trim? No. Tesla continues to be dramatically undervalued relative to its long-term, multi-year intrinsic value, in our view. As I have discussed in previous letters, I believe Tesla is perhaps the single best investment opportunity in the market today: It is a true disruptor competing in vast end markets (transportation, trucking, energy storage) that are each worth trillions of dollars of potential market cap.

By 2025, I expect Tesla to be trading at multiples of where it’s currently priced today. Of course, month-to-month or even quarter-to-quarter we may see the prices bounce around, but we don’t attempt to time the market. As a rule, industry juggernauts in their early stages tend to be more volatile. That’s why we think in terms of years and not days: It gives us the flexibility of opportunity to make multiples on our invested capital.

Of course, part of the challenge of investing in this environment—and riding winners—is successfully tuning out the noise and misinformation that can lead to bad decisions. I recall that back in 2013, Amazon, was repeatedly slammed by analysts and the press with the same “overvalued” critique after a surge in price.

Here’s one example: From October 2013, CNN Business – “Amazon is one of the most overvalued stocks”

- “Amazon.com’s stock has climbed more than 40% this year to a record high of nearly $370 a share. According to StarMine analysts, that’s almost 10 times higher than where the price should be and makes it the most overvalued stock in the S&P 500.”

Whoops. Nearly 1,000 percent later, and we continue to see multiple years of compounding growth ahead for AMZN.

•••••

While picking and riding winners are key to success in long-term investing, another less-discussed element is avoiding the landmines. And there are many of them, especially in this market environment.

I’ll give you an example of a landmine we recently avoided. Last fall, a relatively unknown company announced a major battery breakthrough that, they claimed, would compete with Tesla’s Semi all-electric truck. We began digging into the company, its founder, and the supposed technological breakthroughs. What we found was bizarre: Despite a charismatic CEO who claimed major advancements in cell chemistry that would improve vehicle range and efficiency, we couldn’t independently verify the company’s claims. Needless to say, after much digging, we passed on the investment.

That company, Nikola Motors, went public this summer. While retail and even institutional investors rushed into the stock, Wall Street analysts championed the company. It appeared, to us at least, that little diligence had been completed on this company. Cowen analyst Jeffrey Osborne, for instance, rated the company a “Buy.” His analysis? “We see Nikola as an intriguing investment opportunity,” he wrote. In a two-month period, its shares surged roughly 450%.

By September, however, the Nikola story appeared to be falling apart. Hindenburg Research, a short-seller, published a damning report, alleging fraud, titled “Nikola: How to Parlay An Ocean of Lies Into a Partnership With the Largest Auto OEM in America.” The report claimed Nikola had inflated its technological prowess, and over the next several days, the value of the stock began to plummet. [Nikola, now being investigative by the DOJ and SEC, denied Hindenburg’s claims.]

Though we chose not to short this company—as a rule, we tend to avoid shorting momentum stocks—it’s a reminder that long-term investment requires patience, conviction—and diligence. I bring up this anecdote to remind investors that, equally important to picking winners, is avoiding the losers. In this disruption “super cycle,” I anticipate there will be many imitators riding the coattails of industry disruptors. My philosophy is to only own the companies with the absolute best value proposition winning customers on the ground-level. This process, in my opinion, provides a significant margin of safety to sidestep the landmines.

•••••

On the short side of our portfolio, we continue to hold a fairly broad and diversified basket of positions (20-30 names) across the brick/mortar retail industry, financials, and legacy fossil fuel industry.

We’re still focused on the oil and gas industry, including Exxon Mobil (XOM). In perhaps a sign of things to come, after 100 years, Exxon was booted from the Dow 30 in late August. Ultimately, we believe all of our short positions face eventual obsolescence and bankruptcy, but in order to protect against any runaway risk, I continue to limit how big a single short position can get.

When I look at both our long and short positions, I’m reminded of a simple fact: The companies in our long portfolio tend to have very happy customers and make the world a better place. On the flipside, for the companies in our short book—oil producers, coal companies, subprime auto lenders, car dealerships—the same cannot necessarily be said.

As I wind down here, I’d like to let you in on a little secret to great investing: Own companies that make their customers happy. This may sound cloying or even corny; it’s not. Customer happiness signals strong value proposition; value proposition signals durability and consumer retention. Durability and retention lead to resilience and growth, which in turn make the company even more formidable to its competitors.

On any given day or month, the investment industry peddles any number of theories—about tech valuations, “proper” diversification, portfolio construction, etc. But when you think like a business owner, you want to see happy customers. Businesses with happy customers tend to be more resilient in tough economic conditions, which gives us even more conviction and a margin of safety to deploy capital.

On that subject – I’m comfortable with our positioning heading into Q4 and 2021. I understand the impulse to be nervous amidst uncertainty—the coronavirus, the election, trade wars, and so on. Of course, there are always reasons to be scared or pessimistic about what lies ahead, but in my experience, the best defense for any of these concerns is to simply be extremely judicious in the companies you own. We believe your capital is well-protected when you own fabulous, durable business models that have extremely happy and loyal customers. So while it’s impossible to predict what may or may not happen in the next few months, I rest easy at night knowing we own some of the finest businesses in the world.

On a final note, I’m very happy to announce our firm is growing and continues to institutionalize our offerings. This quarter, we welcomed a new Head of Compliance, Emily Bullock, and new Director of Investor Relations, Philip Bland. Both are new positions, and I’m thrilled to welcome them to our growing team.

Best,

Nightview Capital

Founder/CIO – Arne Alsin

Team

Chief Operating Officer – Zak Lash, CFA

Director of Portfolio Management – Daniel Crowley, CFA

Director of Research – Eric Markowitz

Director of Investor Relations – Philip Bland

Head of Compliance – Emily Bullock

Disclosures:

This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital.

The opinions expressed herein are those of Arne Alsin and Nightview Capital and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward looking statements cannot be guaranteed. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. This is not a recommendation to buy, sell, or hold any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Nightview Capital makes in the future will be profitable or equal the performance of the securities discussed herein. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request.

Past performance is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income. The S&P 500 Total Return is a market-value-weighted index that measures total return, including price and dividends, of 500 leading companies in leading industries in the U.S. economy. The volatility (beta) of the accounts may be greater or less than benchmarks. It is not possible to invest directly in this index.

Nightview Capital Management, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-20-11.