The Road Ahead

Dear Investors,

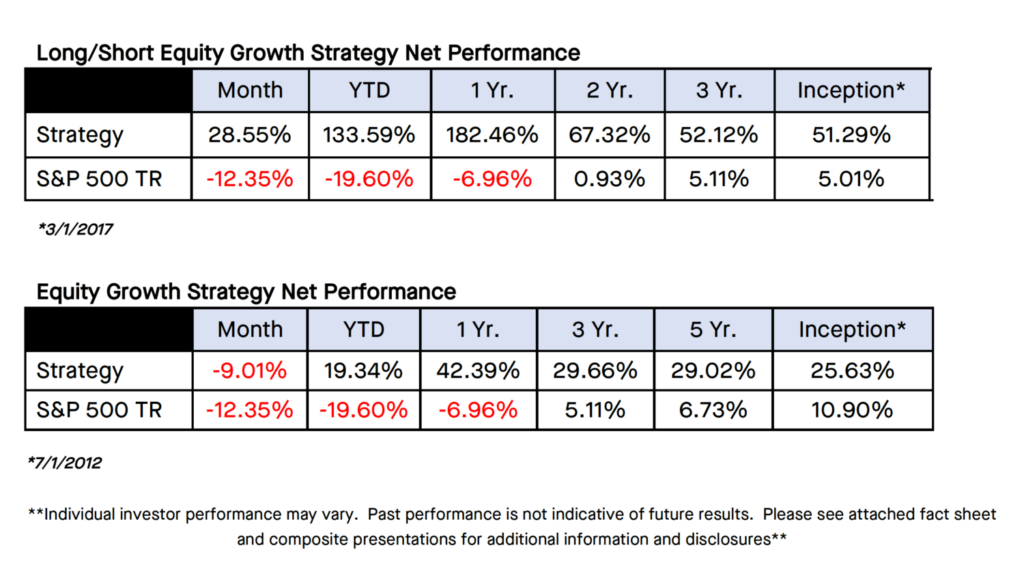

For Q1 2020 our long/short equity strategy returned 133.59% and our long-only strategy returned 19.34%, net of fees. This was compared to the S&P 500 TR of -19.60% over the same period.

Please see below for results since inception.

Please see here for composite presentations for additional information and disclosures.

As we look back on Q1 and the effect the coronavirus has had on the economy and stock market, I think it would be helpful to recap what we have seen developing for quite some time. As we engaged in our research process over the last several years, we paid particular attention to the acceleration of stock buybacks at companies whose business models were undergoing a high degree of uncertainty and change. In lieu of innovation—or a de-risking of the corporate balance sheet by holding cash, reducing debt, or de-risking of shareholder balance sheets via a cash flow in the form of a dividend—we found many of these companies engaged in purchasing their own equity to a staggering degree. This left certain companies with vulnerable balance sheets, in our view. That vulnerability is showing itself in today’s market.

Over the years, we tracked many of these firms closely. We formed a thesis that the moment there was even a minor pullback in the economy, certain U.S. equities—the ones that had particularly increased leverage over the years through excessive buybacks and minimal innovation—would falter. Some companies, we theorized, could even face the risk of insolvency.

In mid-Q1, we began to model out potential scenarios as we tracked the virus through Asia and Europe. We focused on placing shorts and/or put options on individual, vulnerable securities we believe had depleted balance sheets and whose business models could not withstand even minor dips in revenue (especially airlines, retailers, and travel companies). Years of following these companies that we believed to be financially vulnerable allowed us to pivot the portfolio relatively quickly. By March 2020, we had transitioned from a net long bias to a net short bias in our long/short fund. In our long-only fund we increased our cash position.

March 2020 performance for our long/short strategy ended up 28.55% and our long-only strategy ended at -9.01% net of fees, versus the S&P 500 TR of -12.35%. This followed two strong months earlier in the quarter. In 2019, when Tesla was trading at relative lows, we opportunistically acquired long call options, which increased substantially in value from Q4 and up through part of March. All call options were closed in March for a significant overall profit in order to de-risk the portfolio for the current environment. (We spent multiple pages discussing our long-term investment thesis on Tesla in our Q4 2019 letter.)

•••••

In my opinion, we will only begin to see the economy start to recover once fears about the virus itself begin to subside. The economic disruption is unprecedented. Millions of jobs have already been lost and many businesses may never reopen. The fact is, we have no idea what will happen over the next few months. But markets tend to hate uncertainty, and until a vaccine is invented, we are in a daily process of positioning the portfolio for months of potential rolling volatility. This provides risk, but also abundant opportunity.

In a broad sense, heading into the summer, we are focused on a few areas for our short book that may feel the “second order” and “third order” effects of this particular style of economic collapse. They include:

- Subprime auto debt: As part of our multi-year review of global transitions in the automotive market, we had been studying the subprime auto loan market in detail over the past several years. In October 2019, we published “The Big (Auto) Short” detailing our thesis that, inevitably, historic levels of subprime auto loan values were bound to collapse. The originators and servicers of those loans—including Santander Consumer USA (SC) and Credit Acceptance Corporation (CACC)—appeared to us, even before the economic crisis of March 2020—to be challenged business models in an environment of escalating delinquencies and increasingly risky loans that, much like the mortgage collapse of 2008, were being securitized and sold off to unwitting buyers. We continue to be short CACC and SC, and both positions performed well for us in this quarter.

- Brick and mortar retailers and auto dealerships: We have spent multiple years of research on specific brick and mortar retailers that face existential threats as consumers increasingly migrate to e-commerce. Some retailers will survive this transition, others will not. Some have already collapsed. We had been short many of these securities heading into March 2020, and while we opportunistically covered some positions in late March, I continue to see opportunity in individual companies that, in my view, are likely heading towards bankruptcy. Many of these companies have debt obligations and other long-term liabilities with little cash reserves.

- Consumer entertainment: This is a more nuanced trade with a shorter-term focus to hedge against our long exposure, but in March 2020 I initiated short positions on firms that, for the next several months, have virtually no paper value as their business models have all but ceased to exist in a stay-at-home, quarantined world.

There is considerable game theory that comes to mind when forming our strategy. Our focus is now turned to the second and third order effects that will be evident over the next few months, and potentially quarters.

•••••

Notes on long positions and innovation during downturns

One of my core observations as a long-term investor is that, in times of chaos and dislocation, businesses with the most compelling value propositions often become stronger as a result of a crisis. Economic shocks tend to make the strong stronger, and the weak weaker. Our strategy was predicated on this notion, and it certainly helped us during the quarter.

Two out of our three top long positions—Tesla and Amazon—had positive attribution through the quarter. While traditional auto sales slumped in Q1—and will likely plummet dramatically in Q2—Tesla had its best Q1 ever, delivering 88,400 vehicles. Naturally, we expect challenges ahead, but my long-term view remains unchanged: Tesla is destined to become one of the most valuable companies in America, and it remains a must-hold for the next 5-10 years. While we trimmed our position earlier in the quarter, anticipating a Fremont shutdown, we remain incredibly bullish about Tesla’s long-term prospects in transportation, self-driving networks, electric trucking, grid-level battery storage, and so on.

The fact is, I believe we are headed to an all-electric and renewable energy future. Taking a long-term view, we may come to realize how this global pandemic only accelerated this transition.

Taking a step back, I have expanded our long portfolio—we now own several additional smaller positions I believe have attractive value propositions focused on renewable energies, e-commerce, and cloud computing. While we remain fairly concentrated in our best ideas, we are slowly building positions into firms we believe are accelerating growth in times of upheaval. Many are positions we’ve been watching for some time but were waiting on a more attractive entry point. These positions include Chewy (e-commerce pet retailer), Avalara (automated tax compliance), and Shopify (e-commerce software). Our research indicates these firms stand to benefit from industrial consolidation, and an acceleration of global trends that were already put into motion over the last few years.

•••••

Some thoughts on stock buybacks

Over the years, we had shared many of our concerns with the investment community about the potential consequences of buyback excess. Many of these issues are playing out today.

In December 2016, for instance, I published one of my first articles directed at American Airlines, alerting investors that American’s aggressive buyback program was depleting its cash reserves, and risk was not being properly priced into the value of the equity.

That article was titled “Why Is American Airlines Buying Back Its Own Stock?” In it, I warned investors that American Airlines executives were adding an inordinate amount of leverage on shareholders.

I wrote in 2016:

- “Notwithstanding American Airlines $19 billion in debt, executives at the Fort Worth, Texas-based corporation poured $9 billion in cash back into the market the last two years, according to the company’s financial disclosures. This maneuver drastically reduced the airline’s cash assets, and — most importantly — it occurred without input from the rightful owners of that cash — American Airlines shareholders.”

- “For shareholders that invested in American Airlines stock, did they really want executives to go crazy with leverage, emptying the savings account, with a business less than two years after bankruptcy? To go from over $5 billion in cash ($19 billion in long-term debt) to $550 million in cash with the same debt load?”

In 2019, American Airlines spent $1.1 billion on buybacks, at an average cost of $32.09, according to company disclosures. In fact, from July 2014 to December 2019, AAL spent $12.4 billion on stock buybacks at an average weighted cost per share of $39.76, according to disclosures.

As of this writing, in mid-April, American Airlines’ market cap is less than $5 billion, and the stock is trading at around $10. The numbers boggle the mind. American Airlines spent nearly three times its current value on stock buybacks over the last six years. Doug Parker, American Airlines’ CEO, said in a January 2020 earnings call that “when we believe the stock is undervalued, we think the best way to return that to the shareholders is to repurchase some shares…”

Our strategy significantly benefited by moving into a short position on American Airlines (along with several of the other airline and related firms) in March. However, countless other individual long-term investors who hold American Airlines (through index funds, pension funds, etc.) have likely been irreparably harmed, especially if the stock continues to plummet.

Over the years, we continued to ring the alarm bells and push for more accountability. In November 2017, we published the first large tranche of our findings in a 59-page report titled, “Stock Buybacks: What corporations are not telling you.” As a forensic accountant, I noted several instances of risky capital allocation decisions. The writing was on the wall, at least to us, that many individual firms would face a day of reckoning.

In 2017, I published an open letter in Forbes magazine to Larry Fink, CEO of BlackRock, the largest asset manager in the world, asking: “Dear Larry Fink: Is BlackRock Doing Its Job?”

In the piece, I detailed how certain brick and mortar retailers—including Macy’s and Bed, Bath, and Beyond—were facing disruptive threats from e-commerce, but company executives continued to pour money into buybacks—liquidating their balance sheets to pursue perhaps the most risky form of capital allocation for long-term investors. In late March 2020, Macy’s was removed from the S&P, harming long-term investors who saw absolutely no benefit from the stock buyback.

Meanwhile, our firm covered our short positions in Macy’s and Bed, Bath, and Beyond—both for a significant profit. The list goes on. Three years ago, I openly called out General Motors for failing to invest adequately in the future of electrification, instead allocating capital to buybacks. In March 2017—before Tesla’s wildly successful Model 3 was launched—I wrote in Forbes:

- “The car industry is in the throes of a once-in-a-lifetime disruption towards electric vehicles, but traditional car companies—like General Motors—are, in my opinion, out of position. It’s a classic innovator’s dilemma. Instead of using capital to invest in the future (i.e. Gigafactories), it’s my belief that GM is squandering shareholder cash by buying back company stock. The numbers tell the story: In the five years from 2012 to 2016, GM spent $16.8 billion on stock buybacks. Just to give you some perspective, that cash represents 30 percent of the value of the company, assuming GM’s current market cap of $56 billion. Meanwhile, Tesla is investing $5 billion to build the Gigafactory, which will dramatically lower the price of electric vehicle batteries, and help Tesla produce their Model 3 at scale.”

GM, too, has been one of our best-performing shorts this year. And so has Ford. (We initiated both positions over three years ago.) Both companies are loaded with debt and combustion engine products that, in my opinion, will rapidly lose market share to a new generation of EV buyers. Buying back stock has only hastened their demise.

Tesla, meanwhile, has been one of our best-performing longs, up 25% in the first quarter, though we trimmed our position in early March. Tesla and the majority of our long positions have never spent a cent on buybacks, instead directing cash flows to their innovation pipeline and gaining market share among customers.

We are by no means in the clear yet, considering the devastation much of our country now faces. Millions of people are now unemployed. We are potentially heading into dark period as a nation. But it gives you some context to our strategies and the research process we employed to protect and grow your capital this quarter, and it is the same strategy we will continue to use, repeatedly, over the next quarter and years to come.

We prefer to own a concentrated book of names. It’s evident, to me at least, that the more diversified portfolios have actually had a relatively high degree of risk through recent investment cycles, but that risk was obscured by a rising bull market. This fact is plainly evident through performance attribution and the dramatic reduction in equity value in certain individual securities over the last two months.

Frankly, risk can be defined in multiple ways. Historically, we have been told by the so-called experts that to defray risk, owning a diversified portfolio of many names decreases risk to an “acceptable” level. We view this current economic environment as fundamentally different than previous investment cycles. Historic and well-known companies are not guaranteed survival based on business inertia. All companies cannot be saved. We’ve already seen once-iconic brands go bankrupt in the past. It is foolish to believe today’s iconic brands can’t share the same fate.

•••••

Thoughts about the future

Our strategies have been built to capitalize on economic and technological disruptions. Heading into Q2 2020 and beyond, I anticipate an acceleration among many of the investment themes we have been studying for the past several years.

Despite the challenges and uncertainties of the next several months, I am excited and invigorated by the future. Innovation takes hold during challenging times, and make no mistake, the next few months and quarters will be extraordinarily challenging. But we are prepared and confident about our playbook and strategy.

We appreciate you as clients, and I hope you are staying safe and healthy.

Arne Alsin

Disclosures:

This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital. The opinions expressed herein are those of Nightview Capital and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward looking statements cannot be guaranteed. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. This is not a recommendation to buy, sell, or hold any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Nightview Capital makes in the future will be profitable or equal the performance of the securities discussed herein. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request. Past performance is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income. The S&P 500 Total Return is a market-value-weighted index that measures total return, including price and dividends, of 500 leading companies in leading industries in the U.S. economy. The volatility (beta) of the accounts may be greater or less than benchmarks. It is not possible to invest directly in this index. Nightview Capital Management, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-20-04.