The Tesla Story — A Case Study of Disruption

Dear Partners,

The American satirist Mark Twain once quipped, “The reports of my death are greatly exaggerated.” I believe Tesla is in a similar situation. Turn on CNBC or open up a copy of the Wall Street Journal, and there’s a good chance you’ll find a supposedly juicy Tesla story blasting the company’s Model 3 “production Hell” or its latest executive departure. As the company ramps up its international growth, the media narrative has become decidedly gloomy at best; apocalyptic at worst.

But is this the reality of Tesla today? I do not believe so at all. In fact, I believe we are just beginning to get a glimpse of the radical future Tesla is building—and a confirmation of what made me so excited about this company when we first bought it in 2015.

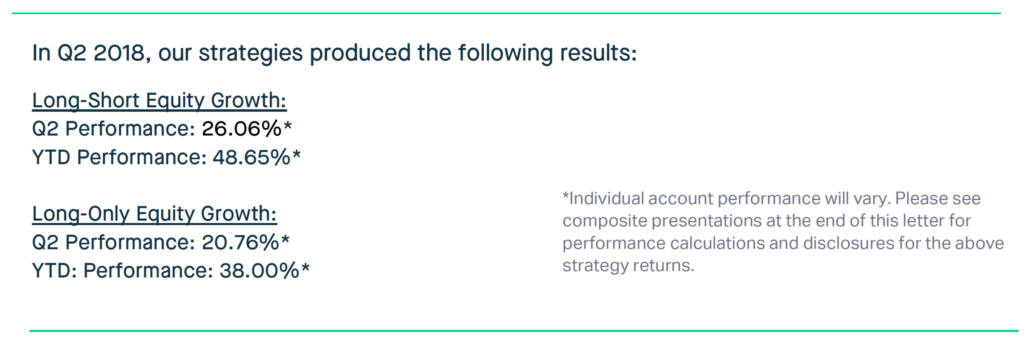

Please see here for composite presentations for additional information and disclosures.

First off, I am not surprised that Tesla receives so much attention—it is, after all, attempting to radically transform the multi-trillion-dollar auto industry. But what I am surprised by, however, is the relative lack of quality information (and, I would say, even misinformation) about Tesla’s long-term advantages, its cutting-edge technology, and the abundant pressures they are putting on traditional Internal Combustion Engine (ICE) automakers.

Over the following few pages, I’d like to offer my perspective on the company. Our team conducts extensive independent research into Tesla’s progress, with a particular focus on the company’s battery technology—and the opportunities for scale made available by the Tesla’s state-of-the-art Gigafactories. Digging beneath the surface at what’s actually happening in the automotive industry, things are getting very interesting, and I hope you’ll read below.

Make no mistake: any upstart business setting out to redefine the world energy system will face myriad challenges, setbacks and market cynicism. This is a natural course for any disruptive technology, but our investment ethos and valuation theory prepare us well for this sort of volatility and market pressure.

In many ways, Tesla is a case-study for the famed “innovator’s dilemma”: A new technology arrives in an entrenched vertical, offering what some view as a superior product. While the upstart spends on innovation and progress (and takes expected heat for lack of short-term profitability), the incumbents dig their heels into business models structured around preserving the status quo, optimizing for the short-term, and moving too slowly to adapt the new future.

As long-term investors, we care less about backward-looking financial metrics, and more about discounted future cash flows. We believe, as a firm, this is where we have been and should be able to continue providing superior value over our competitors. While this requires more advanced modeling, it is crucial in evaluating opportunities in disrupted verticals. We cannot emphasize enough how dangerous using prior earnings with simple run rates is when the underlying competitive landscape has changed.

In disrupted verticals, it is crucial to determine who is providing the best value to customers. Who is winning on the ground level? This focus on street-level value proposition is an important and difficult step that requires a great deal of analysis and constant challenging of long-standing beliefs. It is also what allows us to determine if an opportunity may exist for mispriced securities.

It is also our belief that current disruption cycles have, and will likely continue to have, more concentrated winners than previous cycles. While we have been consistent in this belief for years, and the market has begun to become more accepting of this idea, we still don’t believe the valuations have adjusted for this level of concentration.

This is all true of other core positions in our portfolio, including both Amazon and Netflix—which I discuss further below—but it’s remarkable to watch this drama unfold in real time for Tesla. And, given the amount of negative publicity the company has received, I believe it’s ever-more important share some of our perspective and research that gives us this confidence.

Ultimately, I believe we’re at an inflection point for a new chapter of transportation, free from the chains of the fossil fuel industry. The next three-to-five years could produce an incredibly exciting time as the world could transition from dirty, polluting cars to an all-electric transportation systems. The renewable energy future is within reach—and I believe Tesla has the opportunity to lead this charge.

•••••

A Brief History of Electric Vehicle Adoption Rates And Gigafactories

First, investors must understand that most (if not all) adoption rates for any new technology are speculative by nature. Any investment analyst can project out an adoption rate based on historical metrics, but when entire categories are redefined, the process becomes explicitly more complicated.

As we have stated previously, we strongly believe that the transition to electric cars will be quicker and more widely accepted by the consumer market. This dynamic has serious and meaningful implications for value that we believe are not being priced adequately into Tesla’s value.

The foundation of our belief comes from one of our core investing philosophies of focusing on “value proposition”—a blend of economics and product satisfaction. While EVs have technically existed in the United States since 1890, it is the advent (and improvement) of lithium ion batteries that have made economical electric cars a possibility.

Even into the 1990s when GM was making it’s (in)famous EV1, they were still using lead acid batteries. Lithium-ion batteries changed everything, and will likely be one of the biggest driver of energy change going forward—with significant implications for trillion-dollar verticals. If you follow this hypothesis, you will quickly come to the conclusion that the market as a whole is out of step and not adequately pricing in the potential for change. While this is negative for incumbents, this should provide us with ample opportunity going forward.

So, what has changed, exactly? The refinement of lithium batteries has already allowed for computers in our pockets, and going forward for Tesla, it’s the Gigafactory—a massive battery manufacturing plant that aims to enable EVs to achieve overall price competitiveness with combustion engine vehicles.

With vertical integration at its Gigafactories, Tesla has and will be able to reduce the cost of battery cells, allowing the company to offer lower-cost and higher range vehicles for the mass market. In a sense, we believe batteries will one day be considered Tesla’s “secret killer.” “By reducing the cost of batteries, Tesla can make products available to more and more people, allowing us to make the biggest possible impact on transitioning the world to sustainable energy,” the company notes.

Previously, one of the main barriers for EV adoption was the price of battery storage. To offer some context, the price of energy storage started at about $1,000 / kWh in 2010. In the next year or two, we believe it is possible the Gigafactory can produce batteries at $100 k/Wh.

Musk himself hinted at this at the recent annual shareholder meeting:

- “We think at the cell level probably we can do better than $100/kWh maybe later this year … depending upon [stable] commodity prices…. [W]ith further improvements to the cell chemistry, the production process, and more vertical integration on the cell side, for example, integrating the production of cathode and anode materials at the Gigafactory, and improved design of the module and pack, we think long-term we can get below $100/kWh at the pack level. Which is really the key figure of merit for a car. But long-term meaning definitely less than 2 years.”

In addition to this order-of-magnitude reduction in price, we also see continued reduction in price based on improvements in volumetric energy density, cell chemistry, and efficiencies of scale pushing the price further down.

One of the critical advantages Tesla has over its competitors—and a piece of the puzzle that can’t be understated—is the company’s control over the supply chain in the form of the Gigafactory.

This vertical integration could also allow for further reduction in price, especially compared to competitors, who are purchasing battery packs from Korean or Chinese manufacturers. One of the frequently championed (yet, in my opinion, lazy) short theses of Tesla is that traditional OEM’s can simply flip a switch and start producing “Tesla Killers” whenever the mood strikes. “Tesla faces a formidable set of competitors, and they’re coming in with guns blazing,” Anton Wahlman told the LA Times last year.

The problem with this flawed thesis is that Tesla has been planning for, and implementing, solutions for future roadblocks years in advance, most notably through the Gigafactory, which was planned to double the world’s 2014 battery capacity. The entire capacity will be consumed by Tesla’s automotive and energy products.

- “We’re going far upstream in the cell manufacturing process… We’re actually going all the way back to literally where the raw materials come from. Even those materials costs can be reduced if you drive the right volume and drive purchasing power into how you’re buying them.” – JB Straubel, Tesla CTO (2014)

This leaves their competitors in the less-than-envious position of outsourcing arguably the most important aspect of EV production. This is analogous to Ford not controlling production of their truck engines. Tesla’s lead in battery production is not only significant, but one that is growing.

Their ambitions surprised even their long-term partner Panasonic at the time in 2016:

- “Three years ago I thought this gigantic Gigafactory idea was crazy. Because then the production of the factory would exceed production of the industry. I thought it was a crazy idea. But I was crazy, and I was wrong after seeing extreme success of the announcement of the Model 3 and the strong demand.” – Yoshiki Yamada Panasonic COO

It is not a stretch to say that the future of a sustainable planet hinges on the creation of efficient batteries to store and distribute energy. Batteries are particularly crucial to success in the automotive space, and a lack of control over supply chain, we believe, is a categorical mistake. We also believe that legacy OEMs are now only beginning to half-hazardly work on securing large scale battery production for the future.

The Gigafactory also opens up the stationary storage energy markets, a business whose value, we believe, is not being priced adequately by the market, either. The economics of the energy business are fantastic for utility-scale consumers—we won’t get into too many details here—but Tesla’s recent renewable energy project Australia reduced grid service cost by 90%. The economics are highly compelling and at utility scale levels, implementation will likely progress faster than expected.

Of course, many of the legacy OEM’s are now giving serious lip-service to the production and adoption of electric transport. However, there is myriad hypocrisy at play. Take, for instance, GM, which professes to believe that electric cars are “the future,” yet whose CEO, Mary Barra, has privately lobbied the Trump administration to cut back on electric vehicle incentives.

The dynamics here are similar to what we have historically observed in other verticals, such as cloud-computing, where a new product was both championed publicly yet downplayed internally by rival incumbents in order to appear future-thinking to shareholders while privately maintaining the status quo to preserve profits through business-as-usual strategies.

Ultimately, these strategies don’t work and the incumbents can’t hide forever—value proposition and customer demands in a capitalist environment, where the best product wins, dictate how these stories eventually play out to completion.

•••••

More on Batteries: Cylindrical Lithium Ion / Prismatic / Pouch

Earlier, we mentioned batteries at the pack level are Tesla’s “secret killer.” Here’s why we believe that to be the case. An EV battery pack consists of cells which are packaged into modules and then assembled into a battery pack which stores energy and provides power to the vehicle.

There are essentially three common ways of producing an EV battery pack – cylindrical lithium ion cells, pouch cells, prismatic cells. Tesla, as well as most other EV companies that are built from the ground up, have chosen to use small cylindrical lithium ion cells.

Tesla currently uses a cylindrical lithium-ion cell built at the Gigafactory that they have designed in conjunction with Panasonic—the 2170. We believe that small cells are the correct technology and offer several advantages over their competitors. According to Elon Musk, the 2170 is “the highest energy density cell in the world, and also the cheapest.”

The 2170 cells going into the Model 3 use a NCA (LiNiMnCoO2) chemistry for the cathode, as compared to the NMC (LiNiCoAlO2) chemistry used by its competitors, such as BMW. The main difference is the use of Aluminum in NCA to stabilize, versus Manganese in NMC.

Based on available data, the NCA cathode has a higher energy capacity than NMC —and has dramatically reduced the cobalt weighting in the 2170 cells to roughly 3%. Panasonic and Tesla also believe they can reduce cobalt dependency to virtually zero going forward. Right now, the industry average is about 8 percent, meaning the Model 3 battery pack “requires 65 less percent Cobalt than the average.”

Why is this important? Cobalt prices have been skyrocketing as the increased production of EVs has consumed more of the metal. Also, a large amount of Cobalt is sourced from the Democratic Republic of Congo, which has had some serious ethical problems (See: Children Mining Cobalt Democratic Republic of Congo).

While this is just a piece of the puzzle, it is a good demonstration of the years long forward-thinking Tesla employs, and advantages it maintains over its competitors. Tesla saw future problems in their raw material supply chain and began working on solutions before they had the problems. This adaptive, not reactive, thinking is a compliment which cannot be extended to the legacy OEMs.

As lithium battery cells are also highly temperature-dependent, thermal management is important to both performance and overall battery life. Available data show that Tesla’s concept of using many small cells spaced and then cooled with an ethylene glycol cooling system is more efficient at maintaining long battery life spans. This leads to minimal thermal hotspots, increasing safety, and overall longevity of the cell.

Some analysts outside Nightview Capital are beginning to pay attention as well:

- “Among the key improvements made to the already industry-leading thermal management system in the Model S/X are the new aluminum cooling radiators that surround each individual cell in the Model 3 pack,” Alexander Haissl, an analyst at Germany’s Berenberg, recently wrote in a June note. “This technology, which helps to minimise battery degradation and reduce charging times, is a remarkable piece of system engineering that has been largely completely overlooked as a key competitive advantage for Tesla compared to other OEMs offering more primitive solutions.”

Electric car battery packs do lose some of their capacity throughout use and time, and battery degradation is one of the key concerns for all EV owners. However, Tesla’s battery packs have held up considerably better than its competitors. Data available as of April 2018 shows “less than 10% degradation of the energy capacity after over 160,000 miles on Tesla’s battery packs.” Meanwhile, the Nissan Leaf “loses about 20% of their capacity over 5 years.”

•••••

The Supercharger Network

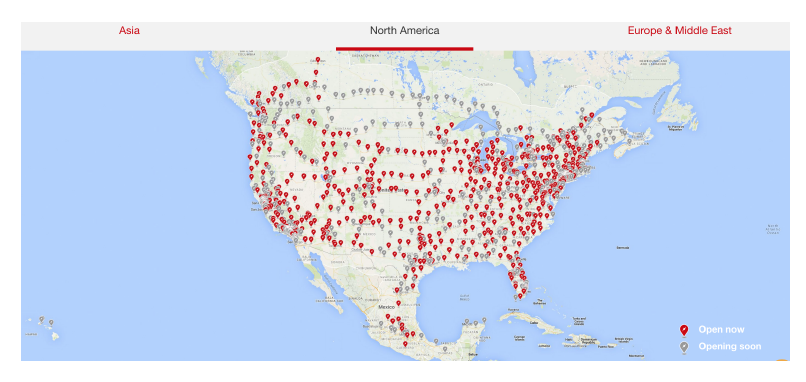

Electric vehicles are limited unless you have built the infrastructure to charge them. Starting in 2012, Tesla has spent hundreds of millions of dollars expanding their supercharger network.

This was to alleviate “range anxiety,” one of the largest concerns consumers had regarding EVs. And this network of charging stations is crucial to creating long-range transportation. According to the most recent data, Tesla started the year with 1,124 stations around the world—and as of July 1 has built 1,314 chargers.

Since none of Tesla’s competitors have yet to embark on any meaningful supercharger network build-outs of their own, we can only be left to believe that they are still not taking this seriously—and like most of their work in this space, they are only committing to half measures.

As of this writing, for instance, VW has yet to break ground its own supercharger network while other OEMs are simply partnering with third-party charging station firms rather than throw skin in the game.

•••••

Why We’re Not Scared of Incumbents

In the big picture, there is a solid strategic reason why we believe Tesla’s competitors and the ICE incumbents are not investing properly to build towards an all-electric future: It doesn’t behoove their business interests and short-term goals.

First, legacy OEMs have a problem with their dealership partners, who rely on service and upcharges to ensure a high level of profitability. Unfortunately for them, but great for consumers, is that EVs offer a very low level of maintenance.

This presents an incentive problem for dealerships and their motivation to sell EVs. A traditional ICE has 2,000+ moving parts, compared to an EV which has only twenty moving parts.

What this means is far fewer maintenance on an EV versus a traditional ICE, not to mention the lifetime savings on fuel costs.

Second, dealers of traditional OEMs often get in the way of new EV sales. “Dealerships and sales personnel pose a significant barrier for [EV] uptake,” states a study published in May 2018 in the journal Nature . The current legacy OEM business model highly disincentivizes their sales intermediary from selling EVs. Tesla has no such problem with their direct-to-consumer model, even despite the relative cost of retail stores, which results in higher SG&A cost.

While some automakers like GM and BMW make headlines with pledging to go all-electric in the next several years, some legacy ICE manufactures are sitting out the fight entirely. Subaru’s CEO, Tom Doll, for instance, said in June 2018: “If we put one out now, we’re going to be competing in the teeth of the market with everybody else, this way we can let them kind of sort it out, then we can come in.”

•••••

The Tesla Short Thesis on Competition

Perhaps the most often cited short thesis pushed by activists like Jim Chanos is that Tesla will suffer dramatically when OEM rivals like GM, BMW, Nissan and Volvo push out EV models of their own.

“You now have lots of competition. You have well-financed, profitable companies competing against you,” Chanos, founder of hedge fund firm Kynikos Associates Ltd, said in September 2017. “This stock, probably more than almost any other, is a poster child for the hopes and dreams of this bull market.”

On one point, we will agree. Current OEMs are indeed more profitable than Tesla—currently. However, to understand long-term valuation amidst an industry undergoing radical disruption, more complex value metrics need to applied. We are not blind to Tesla’s lack of profit; we understand every successful company must eventually become profitable. But drumming up short-term profit to appease Wall Street critics is not how a company creates truly disruptive products in its early stages. If that were the case, we wouldn’t have Amazon’s AWS or Netflix, either.

As long-term investors in disruption, our first line of analysis is identifying companies that we believe can create the most compelling value for customers by out-innovating competitors. And to believe the short thesis that Tesla competitors will launch “Tesla killers” is a strategic error that relies on the belief that Tesla is creating a commodity product that can easily be replicated once GM or Ford flips on one of those magic switches, allowing them to completely re-align their supply chain and manufacturing processes.

Many short seller presentations highlight slides occupied by news articles trumpeting competitor EVs, as if the introduction of competitive products were itself an obvious sign that Tesla couldn’t withstand new entrants into the market.

Two points on this. First, strikingly, a vast majority of the headlines included reveal the competition isn’t even here yet! Most of the competitors cited “will” launch their EVs by 2020, or 2022—over a decade after Tesla’s Model S was released. We believe these competitors will soon learn that not having a direct supply chain of batteries and not having an independent supercharger network will be destabilizing to the future success of their products.

Second, the introduction of competition launched by OEM rivals will likely only help Tesla in the long-run.

For a full articulation of this idea, I recommend reading Pale Blue Dot Research’s (PBDR) “The Tesla Short Thesis On Competition Is Wrong”, but the distillation of the article is simply this: Because Tesla is the market leader for a new category (i.e. EVs), any mention of a new entrant being labeled as a “Tesla Killer” will boost Tesla’s status as the ingrained market leader, in our view. Tesla has a zero-dollar ad budget, and there’s a good reason why—other companies are constantly marketing for them. From PBDR, this is how a 2019 sales funnel will look like:

- Through some preliminary research, the consumer stumbles upon a media outlet comparing the I-Pace to the model X as a “Tesla Killer” or jumps on Jaguar’s YouTube channel to find a head to head comparison between the I pace and the Model X. They do some research on the Model X and discover it has longer range, a more extensive charging network, faster charging speeds, very little battery degradation, is already available, has an IIHS 5 star safety rating, and more storage capacity…We have now uncovered the typical scenario where a competitors entry introduced a brand loyal, ICE customer, to a product offering from Tesla through general BEV category education. Even if the brand loyalty was strong enough for the buyer to purchase the I-Pace over the Model X, this owner has now become a new advocate and walking billboard for the BEV category who is now qualified to explain the FAB of the category to anyone who happens to ask, thus fueling category demand as a whole… Even when the CEO’s are trying not to draw comparisons, they end up promoting Tesla.

In that sense, we encourage new entrants to this market. Good luck to them.

•••••

Beyond Tesla — Examining Our Portfolio

Thank you for taking the time to read my analysis of Tesla, and I hope it clears up any misconceptions about the company you may have had. Of course, there are dozens of other encouraging aspects to Tesla’s business—I didn’t even scratch the surface of the company’s opportunities in mainland China or the long-haul trucking industry, but we will release more commentary on the matter over the next few months when we have more information.

•••••

Amazon: More Consolidation, More Pressure on Brick-and-Mortar Retailers

Moving on: Amazon enjoyed another encouraging quarter, primarily pushed by its widening grasp on retail and its ever-expanding domination in cloud computing. In its first quarter, Amazon reported revenues of $51 billion, outpacing analyst expectations. AWS continues to impress, jumping 49 percent in first quarter and generating $5.4 billion in revenue. As I have stated previously, cloud computing is a strategically winner-take-all endeavor, and AWS leads the pack.

In both verticals in which Amazon competes—Retail and IT—we have observed significant disruptive and consolidating effects, and our portfolio seeks to maximize long-term gains by strategically shorting firms that we believe are succumbing to Amazon’s vice-like grip. Major retailers will close a record number of stores in 2018, and we do not believe this trend will slow down. Similarly, on-premise mainframe IT companies like Oracle and IBM are struggling to compete with the superior price and product offerings from AWS.

•••••

Netflix: Growth of International Subscribers, More Titles, and Panic in Hollywood

In a truly disrupted vertical, incumbents get tied to old business models, fail to innovate, and let upstarts capture market share in winner-take-all dynamics. In other words, if this were a Hollywood production, the stage is being set for an all-out war for media domination.

We’re starting to see the battles. In June, Comcast announced a $65 billion bid for much of 21st Century Fox, which Disney topped with a $71 billion bid. Regardless of how this shakes out, what’s clear is that the media industry is in the throes of consolidation, in no small part because of the disruptive Netflix business model.

Netflix has thrown itself headfirst into dislodging established Hollywood business models by serving customers with unparalleled amount of great content for absurdly low monthly fees. They have done this not just by licensing content, but by buying and creating their own content—which they have begun to do with unprecedented scale.

Here’s a breakdown of recent topline numbers:

- In the first quarter of 2018, the streaming giant added 1.96 million net U.S. streaming subscribers and 5.46 million internationally for the quarter ended March 31. The company’s total net gain of 7.4 million subs in Q1 — a new record for the first quarter — topped its previous guidance of 6.35 million by more than a million. The company counted 125 million subscribers worldwide as of the end of March.

We continue to believe Netflix has a good chance of hitting 200 million total subscribers by 2020, a number that may have seemed ludicrous a dozen years ago. But we believe the company’s relentless focus on quality programming, deep analytical insights, and superior long-term management by Reed Hastings and Ted Sarandos are redefining the entertainment business.

•••••

A Final Note From the Team

We are pleased to say that Nightview Capital is growing, and we are eager to continue our expansion. For the last two months, we have quietly been working on a full “rebrand” of our website and communication materials.

If you are interested in referring us to qualified, accredited investors who want to learn more about our investment strategy, please do not hesitate reaching out.

We love the work we do, and value you, our clients, above all. If we can be of service in any way, just drop us a line.

Sincerely,

Arne Alsin

Eric Markowitz

Dan Crowley

Zak Lash

Nightview Capital

Disclosures:

This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital. The opinions expressed herein are those of Nightview Capital and are subject to change without notice. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. Such an offer will be made only by an Offering Memorandum, a copy of which is available to qualifying potential investors upon request. This material is not financial advice or an offer to sell any product. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Past performance is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income. Nightview Capital Management, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-18-09.