Investing for the Long Term

Dear Investors,

Both in life and in investing, it is often easier to be negative than to be positive.

Especially today, living in an endless stream of news and information, there are near-constant reminders of the imperfections, the problems, and the risks that we all live under. When looking at the news, oftentimes the cumulative effect is to create a level of pessimism that pervades society. In this context, revealing a sense of optimism about the future opens you up to the possibility of being cast as foolish or naïve.

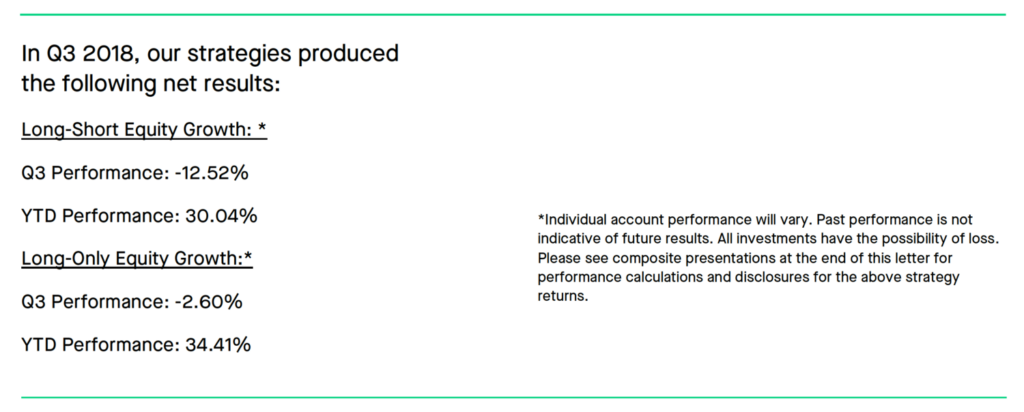

Please see here for composite presentations for additional information and disclosures.

All that said, I continue to be optimistic about the future. As I have written for several years now, I believe that we are in a Cambrian moment: An “up-for-grabs” environment perfectly suited for individual security selection. I see us heading towards an economic model increasingly based on automation, efficiency, and tremendous scale. I continue to be excited about the coming decade and believe it has the potential for amazing opportunities.

This quarter featured a relatively high degree of headline news and market movements. While this unfolded, we saw our portfolio companies continue to grow, and we believe increase their intrinsic values. We have written extensively in the past about our core companies, and while we are always willing to discuss any particulars in detail, our outlook remains the same. We have continued conviction that our portfolio is concentrated in what we believe to be unique pockets of the equity market with the potential to provide additional attractive returns going forward.

Of course, we will not necessarily experience linear progressions in public equity value movements. The results could be periodically lumpy and the connected nature of the global securities markets may increase short-term volatility and increase correlations regardless of company-specific fundamentals.

In the short-term, we can have price movements to the extreme—on both the positive and negative side of our portfolio. We are not market timers or day-traders. We are investors seeking multiple returns on capital as tax-efficiently as possible, over an extended period of time.

Our investment conviction comes from our focus on longer-term thematic trends and an unwavering determination to understand past, current, and future business dynamics. While the future is uncertain, we continue to remain confident that our companies will continue to provide excellent growth opportunities and that we have significant opportunities still ahead.

When investing, stark differences of opinion may often provide the greatest opportunity, especially when industries are experiencing a period of massive potential disruption. In every transaction in the equity market, there are two parties: a buyer and a seller. Outside liquidity needs notwithstanding, each transaction results in either an individual successfully purchasing a security for less than its intrinsic value—or overpaying. I have been consistent in my belief that in certain industry groups

(verticals), we are seeing enormous redistributions with the pie being divided anew.

We have seen this dynamic in prior cycles, and have looked to profit from them – mainly in the transition from on-premise storage to cloud-based storage, the breakup of traditional media, and in the change from brick and mortar to online retail. What we have observed is that the key to success in a rapidly changing environment, in our opinion, is an obsession on pleasing the end-user or customer, which we call “value proposition.” This certainly doesn’t guarantee a successful investment opportunity, but in these areas of business, we view it as a pre-requisite for anything other than short-term success.

In our view, far too often, company executives look past pleasing the customer in lieu of pleasing short-term interests, whether they be Wall Street analysts or short-sighted investors looking to “unlock value.” Rather than

“unlocking value,” we want companies to “build value.”

The famous Warren Buffett quote is applicable here: “Investing is simple, but not easy.” We believe success with customers leads to success in businesses, which over a long enough time-frame is ultimately reflected in an increased valuation in the equity price and a benefit to shareholders.

We believe there are several factors which make achieving success on this premise difficult. Notably, if the market has already priced in the advantage a company has, it may no longer be an attractive investment as you are paying fair value for the equity. Generally speaking, in a stable vertical, easy short-cuts can lead to accurate valuations, as past earnings are likely to persist into the future. In other words, in stable environments, looking at the past gives you a sense of how the future may play out.

Therefore, discounting future cash flows back to a present value is a fairly simple modeling process—and the market as a whole tends to act in a relatively efficient manner.

What happens though, if the future is far more uncertain? What if there is no guarantee that prior earnings will persist in a linear fashion? This scenario—as in a disrupted vertical—leads to a more contentious valuation process. Simple valuation short-cuts are no longer guaranteed to produce accurate valuations. It also leads to the possibility for inefficient pricing, i.e. potential for either undervaluation or overvaluation, which can be translated into investment opportunity.

In the moment, many of these situations may lead many in the investment community—and in the broader public—to misunderstand valuations. Let’s not forget that from 2010 to 2013, Amazon was routinely described as overvalued. (See: CNN: Amazon is one of the most overvalued stocks. Or Fortune: The amazing Amazon stock bubble.) Why was this the dominant theme? I believe most people were using wrong, overly simplistic and surface level valuation tools.

Put it this way: If you’ve ever tried to fix a sink or hang a painting evenly, you know how important it is to use the right tool for the job. Valuation models are our tools, and we obsessively seek to use the right, forward-looking ones. After all, if you use the wrong tools, you might find yourself in a very expensive mistake. No one wants to call the contractor having to explain where it all went wrong.

We believe that there is continued significant opportunity contained within these messy parts of the market. For instance, we believe that energy markets will undergo a massive reorganization over the next decade with a transition from petroleum-based combustion, to technology-powered renewable energy.

While we are glad this has, in our view, a high likelihood of occurring (and also believe it will be a boon to the U.S. economy), this is not altruism, but rather simple economics. If you work off this thematic belief that energy will change, then it is imperative to plan and invest accordingly.

We also believe these changes will happen more quickly than is currently being perceived by the broader market. Disruptions happen quickly, and adoption rates of new technologies can happen with staggering speed, often leaving companies behind and unable to catch up. From 2011, when the first meaningful electric vehicle (EV) production began, it took five years to sell 1 mm EVs, while the last 1 mm were sold in the previous six months, according to Bloomberg BNEF. These are still relatively small numbers compared to the broader automobile market, but we believe EVs will experience sustained, rapid growth for years to come.

As I have said in the past, I continue to believe that it is necessary to pick your spots in the overall market where you have the utmost conviction, especially as the velocity of change is accelerating.

It’s my belief that companies in changing, disrupted industries can and will increasingly hit a wall and find themselves out of position. If you look at a venerable company like GE, they have literally lost hundreds of billions of dollars of market share, while simultaneously buying back billions of dollars of shares. If the underlying dynamic is changing, you simply cannot have a CEO acting as an internal money manager.

This month marked the effective end of a U.S. institution in Sears, which left an indelible footprint on American culture and commerce. Among many other contributions, Sears’ store brand of guitars, Silvertone, provided the starting point for many of the 20th century greatest musicians.

On some level, this is certainly an unfortunate event. But it is also a cautionary tale. In 2006, Sears had a market cap of roughly $22 billion (compared to AMZN’s $8 billion), yet today virtually all of that market cap has been transferred and rearranged.

Did Sears and its employees suddenly become bad at their core competencies? Not necessarily . It’s that the underlying business environment they had been operating under shifted and they were unable to react. Throw in a money manager acting as a CEO and you have a fait accompli. Sears could be a great case study on what we’ve been discussing—what can potentially happen when a company does not focus on pleasing customers or seek to innovate, but rather solely focuses on “increasing/unlocking shareholder value.”

While the Sears story has been essentially finished, there are still many businesses undergoing some form of this process, and in our view, making the same mistakes as Sears. Many companies in difficult and changing business environments are dedicating vast sums of resources to buybacks, even as revenues decline in some cases. If one were to look only at historical earnings, they may appear as attractive investments. However, without appropriate change, these earnings are not guaranteed to persist in the future.

While it is possible to pivot, business inertia is often as strong as it is in frictionless physics. We believe these corporate failures will continue to play out in increasingly rapid fashion, both in transportation and in energy, just as we have seen (now more historically) in IT, retail, and content distribution.

Being on the correct side of the redistribution of industry vertical market share is critical for long-term success in our view, and it requires flexibility of thought and a constant willingness to challenge both our own (and external) assumptions regarding future pathways.

In the moment, holding contrarian viewpoints may be challenging. But we are here for the long-term, so we research, and act accordingly. In short, market disruptions are complicated, dramatic affairs. But for us, they are deeply exciting. And they represent the possibility for enormous opportunity going forward.

Sincerely,

Arne Alsin

Disclosures:

The opinions expressed herein are those of Nightview Capital, LLC and are subject to change without notice. This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. Nightview Capital, LLC does not accept responsibility or liability arising from the use of this document. No document or warranty, express or implied, is being given or made that the information presented herein is accurate, current or complete, and such information is always subject to change without notice. Shareholders and other potential investors should conduct their own independent investigation of the relevant issues and companies involved in this article. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital. The opinions expressed herein are those of Nightview Capital and are subject to change without notice. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. Such an offer will be made only by an Offering Memorandum, a copy of which is available to qualifying potential investors upon request. This material is not financial advice or an offer to sell any product. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. This article contains links to 3rd party websites and is used for informational purposes only. This does not constitute as an endorsement of any kind.

Past performance is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income. Nightview Capital Management, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-18-16.