Dear Investors,

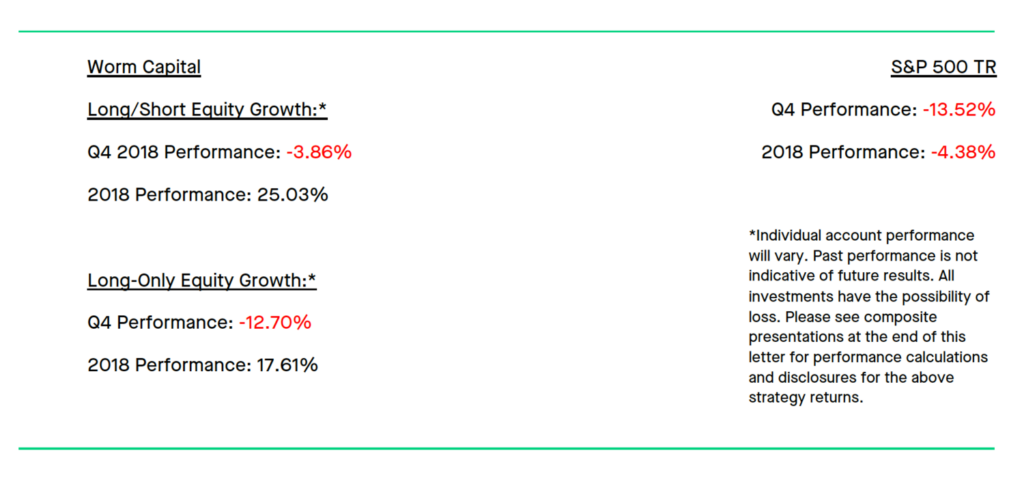

In Q4 2018, our strategies produced the following net results:

Please see here for composite presentations for additional information and disclosures.

While I’m happy with our performance in 2018, I believe there’s ample opportunity ahead—and I’m incredibly excited for the coming decade. But as I tell my team, we can never let our guard down. We must continue to work hard while staying focused and dedicated. I continue to wake up each morning and ask myself the same question: Are we in position today to capitalize on future opportunities?

That’s all that matters to me, that’s all that matters to my team, and that’s what ultimately matters to our partners.

After all, investing is a 24/7 probability-based exercise. If you’re an active investor, you’re making bets on what you think is a likely outcome, given the situation, while simultaneously weighing a variety of risks against an estimated reward. None of it is certain, nothing is assured. It’s critical to recognize where risk abides, and to accurately size up its potential.

Recently, as we’ve begun to raise capital and grow the firm, people have started asking me, “Arne, what’s your edge?” My response is always the same: Several years ago I recognized that technological disruption could profoundly change our world. As a portfolio manager, I recognized I needed a new playbook if I wanted to capitalize on this market dynamic. So I built a strategy from the ground up to invest in disruption. (That’s the 30,000-foot answer, at least.)

Going forward, I happen to believe that 2019 and beyond will present enormous opportunities for wealth creation—but it’s first imperative to understand how disruption can play out. The Internet revolution has democratized access to information, creating network effects among consumers. Increasingly, we’re observing hyper-growth and consolidation of market share among products and services that offer the best value proposition to consumers. In that sense, disruption creates tremendous opportunity—but equally tremendous risk.

Transportation and energy alone, I believe, will radically alter our economy—and the way in which we live. We are moving to cleaner and smarter systems: battery electric storage, self-driving cars, and so on. Our absolute goal is to capture this redistribution of wealth for our partners. We are also long-term, patient investors. We do not act with haste. We think in terms of decades, not months or quarters.

It’s important for investors to understand that innovation takes time, and generally requires upfront investment that hurts near-term operating performance. It’s a big problem for old guard companies that want to be competitive with the young upstarts. Incentives at old companies are designed to optimize earnings, cash flow and other metrics in the short-term (one year or less). This gives the young upstarts, the challengers to the old way of doing business, an opportunity to gain a foothold.

Instead of being encumbered by the need to hit quarterly and annual profit targets, they approach business with an “anything goes” mentality, a willingness to try just about anything. The old guard companies may find it difficult to pivot and compete, burdened by legacy incentives that are built around maximizing short-term metrics. It’s especially true in a disrupted vertical. Disruption within an industry group is effectively a “land grab” competition. I believe the young upstarts are winning in just about every disrupted vertical because their business models are designed for a land grab, while old guard companies fall behind because their business models are optimized for short-term earnings

Again, none of this is easy. The only way to get in position is to put in the work. In 2018, I—along with the Nightview Capital team—spent thousands of hours analyzing dozens of businesses across a variety of verticals. (This isn’t exactly Billions on HBO.) It’s analysis, investigation, and a synthesis of data points to understand the narrative. Not exactly sexy, certainly, but I do enjoy the heck out of it.

In the end, our job is to put in the work, obsess about the future, and seek to understand how different disruption scenarios may play out. Some have asked about broader economic or market trends. They are valid questions but it’s my perspective that slowing economic growth and less accessible debt could even provide positive catalysts, as these factors can force out incumbents even faster. Plus, in an environment of slowing growth, customers tend to double-down on products and services that resonate with them and look to get the most bang for their buck.

It should also go without saying that I don’t believe we need a low interest rate environment to keep our holdings up. After all, if a quarter point rise in interest rates derails your investment thesis on a stock—it probably wasn’t a very good one to begin with.

So I’ll leave you with this: I believe technological disruption will create massive opportunity—but also lurking risks for investors who move too slowly. We’re very pleased with 2018, and will continue to seek out future opportunities while also looking to identify new, unforeseen risks. We value you, our clients, and we look forward to working with you for many years to come. And if you are new to Nightview Capital and want to learn more, please don’t hesitate to reach out.

Sincerely,

Arne Alsin

Disclosures:

The opinions expressed herein are those of Nightview Capital, LLC and are subject to change without notice. This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. Nightview Capital, LLC does not accept responsibility or liability arising from the use of this document. No document or warranty, express or implied, is being given or made that the information presented herein is accurate, current or complete, and such information is always subject to change without notice. Shareholders and other potential investors should conduct their own independent investigation of the relevant issues and companies involved in this article. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital. The opinions expressed herein are those of Nightview Capital and are subject to change without notice. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. Such an offer will be made only by an Offering Memorandum, a copy of which is available to qualifying potential investors upon request. This material is not financial advice or an offer to sell any product. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. This article contains links to 3rd party websites and is used for informational purposes only. This does not constitute as an endorsement of any kind.

Past performance is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income. Nightview Capital Management, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-19-01.