Dear Partners,

2022 was an extremely trying year. Over the past several years a multitude of external shocks to the global system, along with unprecedented policy responses, has led to the amplification and acceleration of many cycles. We’ve experienced a global pandemic, major supply chain issues, aggressive fiscal & monetary policy in both directions, inflation, global conflict, and political turmoil. The list seems to go on and on.

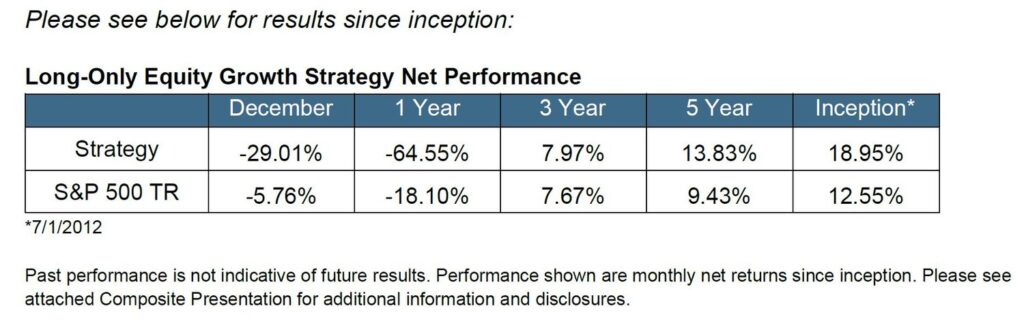

Please see here for composite presentations for additional information and disclosures.

Through all this upheaval, our strategy and approach have remained the same: to place ourselves in position, seeking to capitalize on what we believe are tremendous opportunities over the next 3-5+ years. It’s our strong view that there remains a unique opportunity to invest in a highly selective basket of stocks with vast end markets that we believe provide the potential to compound capital for years to come. While this can inevitably lead to variable performance, our multi-year fundamental thesis has not changed.

Carnage in an equity market pullback can be indiscriminate, but history has shown that select companies with strong balance sheets, material competitive advantages, and a multi-year roadmap for growth can rebound at rapid rates that exceed the overall market once things settle down. As a familiar example, recall Amazon during the financial crisis. In the summer of ’08 it peaked around $4.40 and by November of that year it bottomed out around $1.75. Where was it a year later? $6.50.

Markets tend to swing to extremes. One day everything is perfect and the next the sky is falling. Since early 2020, we’ve seen this dynamic unfold in an exaggerated manner in both time and magnitude. But where does the truth lie? Usually somewhere in the middle, with a positive drift over time.

In this letter we’ll review the year, give our thoughts on the future and its opportunities, and cover specific questions we have received recently on TSLA.

2022

While concentration is core to our investment strategy, it was never our intention to maintain the levels of the past year. We simply go where our research and analysis take us. But as the bull market wore on and speculation grew in 2021, there were fewer and fewer opportunities we found attractive enough to warrant capital.

During speculative periods, many companies reach increasingly high valuations that may be justified over the longer term but can lead to excess risk if profits don’t materialize in short order, or if balance sheets are not strong enough to weather a downturn. When the tide turns, the situation plays out in reverse with many companies reaching unjustifiably low valuations.

2022 began with a significant amount of optimism on our part. We owned several industry- leading companies with solid multi-year runways. This was pared down in a difficult decision as the unabating nature of supply shocks and excess monetary and fiscal actions of the previous years required action. We believed it was best to concentrate in highly select companies that spent the previous decade building out a combination of intellectual property, physical infrastructure (PP&E), and global reach. There were and are a select few names who fit this bill.

AMZN: In Amazon we believe we hold a behemoth with two near monopolies in e-commerce and cloud computing, to go along with several other ancillary opportunities.

The pandemic presented AMZN with unique opportunities and challenges. There was a tremendous amount of immediate demand for their services as social distancing and lockdowns were implemented early on. They had a decision to make. Either invest heavily and aggressively to meet this increased demand, or take a cautious approach and avoid expanding capacity that may be temporarily overbuilt if the environment normalizes.

They of course took the former route and took the necessary actions to meet demand. They benefited greatly throughout 2020 and 2021. But once people went back to more normalized shopping habits, they were left with excess capacity and costs. This hurt their bottom line this past year, however, we believe they made the correct decision. Overall, we feel they accrued significant positive benefits during the period and the equity valuation decrease has been dramatically overdone.

A company can’t afford to lose its positioning in the market or have its advantages compromised. Once a customer switches, it’s hard to get them back, so keeping them happy is of the utmost importance and we believe will ultimately pay off. They are already taking the necessary steps to scale back down to appropriate levels, and we see profits rebounding materially in the coming years. In our view, this combined with the still highly promising returns in their two core businesses will provide exciting business and equity prospects for many years to come.

TSLA: Even as rates rose and the macro environment devolved, we believed Tesla was best positioned to grow and thrive, even through a period of extreme uncertainty. They are the market leader in rapidly growing end markets and have spent the past decade growing their competitive advantages and building out physical infrastructure with worldwide reach. While we believe we were right regarding the direction of fundamentals, this was overcome by a vast array of factors we didn’t anticipate that negatively impacted the price.

By and large, Tesla had amazing execution in 2022. They managed to achieve 40% YOY delivery growth. In addition, revenue growth should exceed 50% and profit growth should exceed 120% YOY once Q4 numbers are released. This was accomplished while navigating a myriad of difficulties including a prolonged shutdown at their most productive plant in Shanghai. They scaled two factories on different continents while maintaining industry-leading margins and continued to make advanced progress in transformational technologies that have fast future cash flow potential like AI, software, and manufacturing. Through all the noise a lot of remarkable progress was made.

So, with all this success on the surface, why did Tesla’s price perform so poorly? To simplify, it was a combination of a tough market overall, non-fundamental yet very negatively perceived actions by Elon Musk, and significantly renewed concerns about the long-term demand for their vehicles. All these factors came to a head around the same time and compounded each other, creating a very painful situation that accelerated in the back half of the year, and we’ll expand on these items in the following Tesla-specific Q&A.

What are your thoughts on Tesla’s demand?

I really see no problem with demand and think the impact of global economic issues are overblown. Tesla is by far the low-cost leader – they had levers to pull as needed to spur growth while still maintaining profitability, and you’re seeing that now with price cuts across the board. There was, and still is, a lot of confusion around the IRA tax credit and many think Tesla was getting the short end of the stick. They pretty much said screw it, we’re going full-court press.

And I absolutely love the move. Combined with the IRA tax credit, they’ve greatly increased their total addressable market and have secured demand for years to come in my opinion. Based on Kelly Blue Book data from November, the average price for a 3/Y after the price cuts and including the tax credit ($46,365) is now lower than the average price of a new luxury vehicle ($67,050), a new vehicle overall ($48,681), and almost on par with a new non-luxury vehicle ($44,681). I think we can put the recent demand concerns to bed and get back to focusing on the future and growing production. No other auto manufacturer is in the position to do this. None. I really don’t know how they’re going to be able to compete. And sure, Tesla’s margins will get hit a bit, but I don’t think as much as some are expecting. Input costs are coming down, new factories are scaling, and efficiencies are growing. All these are margin tailwinds that have been underappreciated in my opinion.

And given the adoption and growth rate of EVs globally I just don’t see the worldwide system having a problem absorbing well over 2 million Tesla’s this year if production really scales up faster than expected.

I’m sure they got pinched a bit in China towards the end of the year due to a variety of factors, not the least of which being the continued effects of a highly diminished economy due to Covid for several years. They may not have had boats to pick up the December factory build-out for overseas delivery. So, it makes sense, why build them out? Take the last week off—that’s what I think happened. Frankly, that makes me happy because it will help the P&L.

One of the surprises I think we’ll eventually see is 40% gross margins. Even with Model 3. If they can build them for $25,000 and sell them for $35,000, that’s almost a 30% margin right there. And if we assume a long-term 50% take rate on FSD at $15k, that’s another $7,500 of almost pure profit per car. We’re not there yet, and this of course assumes that FSD is solved. But I think over time, maybe in a couple years, we’ll get there as battery costs decrease and efficiencies increase, and that will be a big surprise.

Again – the whole idea of a demand issue may be more of a problem four or five years from now. But it’s just way too soon to be talking about a demand problem. The basic global market is 90 million cars. A lot of those are cheaper cars, so just think in terms of 50 million mid-market cars. I don’t think selling a couple million cars will be a problem. Tesla is pulling the demand levers that nobody else can pull. They’re really in an amazing position, and I don’t think many realize this. People get too caught up in all the noise.

And all the renewed talk about competition coming to eat Tesla’s lunch is as ridiculous as it’s always been in my opinion. I’m just not seeing it. And this is something we follow very closely – we test drive every EV we can. It’s been coming “next year” for about 10 years now according to media pundits and bears. Outside of China, nobody can build EVs at scale. And nobody can make a material profit doing it besides Tesla. The price cuts put the competition in an even more precarious position. I don’t care how many EV models get announced. I don’t see that as a risk if they’re inferior or can’t be produced at scale. The same thing was said about all the “iPhone killers.” The majority failed because at the end of the day, people wanted the best product. And that came from Apple. It didn’t matter that Nokia had dominated the phone market in the past. That doesn’t help if the future landscape is different. It’s the same thing with legacy auto. Who cares if they are good at making ICE vehicles? Talk to me when there is an EV someone can sustainably and profitably produce at scale that is comparable to the value you get from a Tesla. And if that happens we’ll adjust our analysis, but right now I don’t think the landscape has really changed.

What do you make of Elon selling and his overall behavior?

I look forward to just a few months from now and I think Tesla is going to be one of the favorite stocks to own out there. This whole Elon stuff with Twitter—it’s going to blow over—everybody’s going to forget about it in a few months. But it definitely—definitely—ruined the whole year. I mean the timing was horrible. Of course, I had no idea it would get this bad. Since the deal was announced in April it’s been a constant barrage of negative catalysts all tied to this one event – tons of drama, negative press, and share sales.

The problem that I saw a couple of months ago was when it became public that he needed money to cover the costs of Twitter, and that he was thinking of taking a margin loan— once that’s out, everyone knows it, I mean it’s everywhere on Wall Street. So, not many are going to touch the stock on the long side if there’s even a perception that he has to liquidate. And then he does—he’s forced to sell at the worst time. The terms of the Twitter deal really boxed him in – he tried to get out of it but couldn’t.

But the Elon selling should be done and much of the drama has played out. Investors who wanted to sell because of all the noise have probably done so already.

What about the Tesla brand? There’s a lot of concern right now that Elon has damaged it, and that will lead to lower sales.

I’ve seen these kinds of things before, and they always blow over. It seems to me that a year from now, nobody will really care. You won’t hear about it. Look, the most important thing is who makes the best car. That’s it. I don’t think many people are going to start driving a Volkswagen ID 4 because they don’t like Elon on Twitter. I know that’s the opinion of the moment. And people will say things like “I’ll never buy a Tesla now.” Okay, they probably had no plans to buy one anyway.

I just don’t think it’s a permanent problem. It just isn’t. Elon’s a smart guy, he makes mistakes, and he corrects himself, and I think you’ll see it. He gets intensely focused after screwing up and that is when he does some of his best work. But it’s like a lot of things in media — for a while, it’s all anybody can talk about and then suddenly people are talking about other stuff.

People move on, they get bored. Just look at VW. They were the main perpetrator of the emissions scandal. Nobody cares about that anymore. I haven’t heard a single person say they won’t buy a VW these days because of “Dieselgate.”

How about Q4 numbers? Are you concerned?

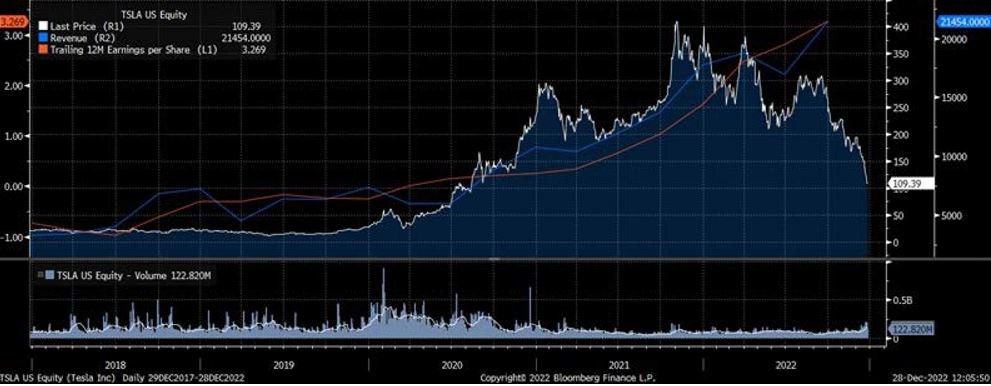

No, I’m not. It’s how Wall St. works but I’m just so sick and tired of their myopic vision quarter-to- quarter because when you stand back and look at this five-year growth pattern, nothing has changed. As long as Tesla continues on this trajectory, we know where they’re going. Wall St. is so fixated on wiggling this way or that way. Nothing happens linearly, yet every recent data point, good or bad, gets extrapolated out into the future, regardless of what the longer trend may indicate. All that matters to me is where we’re headed over the next 3, 5, and 10 years. To me that future looks bright. Just look at the 5-year chart below of revenue, trailing 12-month EPS, and stock price. The things that matter are heading in the right direction. Stock prices always follow the fundamentals over the long term but as you can see, things can get very out of touch in the short term.

With the price down so much since our last Q&A, does that change your price targets?

There has been a ton of technical damage to the stock in the past couple of months, probably more than ever before. Way more than what we experienced in 2019. There was just a lot that happened in such a short period of time that needs to be overcome – Elon selling, tax-loss selling, margin calls, Twitter drama, demand concerns, etc. So, I think we’re pushed back a bit in the near-term, maybe 6-12 months. But over the longer term, 2-5 years, my price targets haven’t really changed. I still think the company is on track and should continue to grow around 50% for the next several years at least.

I go through this exercise constantly: I start with a blank sheet of paper and ask, ‘What do we own?’ With Tesla, we own shares in a company with an incredible current product line and future roadmap—one nobody else can compete with in my opinion. On the auto side they have the S and X in the premium segment, and Model 3 and Y in the mid-tier segment. These are all top sellers in their respective categories. And the semi is just starting to ramp up too. Later this year they’ll have the Cybertruck and hopefully by early 2024 a cheaper sedan in the $25-35k price range (or some variation on the Gen 3 platform). These coming products have enormous end markets. Way bigger than the markets combined for the current products. Then on the energy side there’s the Megapack, Powerwall, and Autobidder. There are also four major factories on three continents. These are all massive facilities that still need to be scaled up further, but I think in about 4 years, even with just these existing factories, they can get to about 8 to 10 million cars produced and delivered. In the next couple of months, we should hear about official plans for a new factory. We’ve already been hearing lots of rumors about it, but nothing has been formally announced.

So that’s the physical stuff. What else is there? I think they have one of the strongest balance sheets in the market, and not just within the auto industry. The most underappreciated, intangible asset in my opinion are the people. The top engineers want to work at Tesla or SpaceX. And that shows up in their unprecedented execution. I look at General Motors, who have been talking about new products for 10 years without actually putting up the numbers. Tesla’s manufacturing approach, in my opinion, is just totally reinventing the entire industry. Everything they’ve done from Gigacast to the structural battery pack, vertical integration, emphasis on speed, it’s just amazing. And the manufacturing innovations inside the company keep progressing. They’re a few steps above everyone else and seem to keep accelerating their lead. I don’t see how anyone can touch them.

Lately, Tesla seems to get no credit for anything from Wall Street. It’s been amazing. Just one thing after another last year, terrible, terrible, terrible. But I think there are 5 catalysts that will play out over the next couple of years that can really drive the stock higher from here. Three this year and two more in 2024.

In the first half of 2023 I think the energy segment is going to start showing some serious growth now that the Lathrop Megapack factory is coming online. In the second half it is Cybertruck production. And throughout the year I think the demand concerns will prove to have been overblown, and we’ll see that in the quarterly deliveries. In the first half of 2024 I see a cheaper Tesla coming online. Maybe it’s a new model or just a cheaper Model 3. I’d like to just see them make the model 3 as cheaply and efficiently as possible, even if it has to be a bit smaller. In the second half of 2024, I think that’s when we can expect to see a material benefit from FSD. It could come sooner, but that is the timeframe I’m thinking about.

What about your projections on Tesla’s earnings and cash flow?

I think they should generate earnings growth of around 50% for the next several years, but I don’t expect it to be linear. It never has been and there are too many factors that impact the bottom-line year to year. But I think the number one thing most people miss or don’t understand about Tesla is their ability to generate cash – its cash conversion cycle.

It really takes an accountant-level understanding to figure out cash conversion cycles for certain companies. Having experienced the path of Amazon starting over a decade ago, the knock on the company was that they’re not making any money, and they won’t make money for years. Its cash conversion cycle shocked me. Many forecasted a decade of no earnings. But that couldn’t have been further from the case. Cash kept swelling and ultimately billions in bottom line profit started coming, seemingly out of nowhere, smashing Wall St. expectations mid to late last decade. This was largely a function of the cash conversion cycle. Over the long-term, cash that is built within a company should ultimately hit the bottom line, assuming it’s not just coming from debt/equity issuance or short-term accounting tricks that are unsustainable

With Tesla it’s the same. Five years ago, they had net debt of $7 billion. Then they had net cash of $5 billion, then $10 billion, and at the end of the last quarter they had a net cash position of $15 billion. People wonder how Tesla built up $20 billion in cash on the balance sheet so quickly. It’s a function of both bottom-line profit and the cash conversion cycle. A key factor for cash is the location of factories. Notice how Elon has been very careful to put factories on each continent. Because when inventories on ships take five or six weeks to get delivered, that’s a whole different balance sheet than a quick delivery where we get cash more quickly. Building localized factories will cause the cash and profits to hit financials more quickly.

Another still underappreciated aspect is the incredible fixed cost leverage in their model that helps build cash, which will ultimately translate to profits. Most don’t seem to understand this, and why very few forecasted the explosive profit growth Tesla has shown in the past couple years. In 2019 they generated a net loss of $862 million. For the full year 2022 they should generate net income exceeding $12 billion. You have to follow the cash and understand where it is coming from and when it will hit the bottom line.

I know it’s hard to see right now, but I do think they can get to $50 billion in cash by the end of this year. It’s something to observe and watch carefully as the quarterly balance sheet comes out and we can analyze the P&L. It should be quite remarkable. It’s such a beautiful setup because they’ve already got everything in place. They have the factories now and just need to scale them up. And as they scale, these efficiencies enable more cash, more profit, and more earnings power. I think we’re still early for the street to pick up on this. And a similar dynamic should play out as energy starts to scale production.

Can you talk about other parts of the business—software, energy, etc.—that you think might be misunderstood?

I think the market is giving Tesla a zero for FSD, and energy—pretty much everything outside auto is a zero. A couple of weeks ago, Tesla put out the announcement of the launch of Tesla Electric, and my first thought was, “Wow, this feels like the press release years ago when Amazon announced the launch of AWS.” The people who really follow these things and understand them know the potential is huge, and I think we get the same thing with Tesla Electric, with autonomy, and so many other elements of Tesla’s business model. But the truth is that Wall Street largely places no value on these things in my opinion. None. They’re historically terrible at forecasting and don’t adjust until potential has been priced in to some degree. But successful investing is all about figuring things out before the overall market does and getting in position. These are businesses that have the potential to be immensely valuable and throw off cash, but we’re in an environment where investors are thinking very short-term. That’s okay, it’s natural, but it can’t last forever.

Energy is what I’m really excited about this year. I think Tesla can finally start to put the “just a car company” narrative to rest. They have been putting virtually all their resources into auto production. But they aren’t cell constrained anymore and can finally start ramping up energy storage. You are seeing it happen under the hood already – it just hasn’t hit the financials yet. Infrastructure and capacity buildout are the leading indicators, and revenue and profits are the lagging indicators. They have built a dedicated Megapack factory in Lathrop, CA that should be able to crank out 25 Megapacks a day once scaled. That equates to an $18 billion revenue run rate. I think energy should be worth $50-100/share right now and could be $200-400/share in a few years. I’m estimating the long-term margins to be close to those of the auto side. This part of Tesla’s overall valuation can come rapidly once there is clarity. Wall St. has been historically bad at predicting profitability, but when it sees an asset make the turn to sustained profits, it often re-rates hard and fast. We saw it on the auto side in 2020, and we saw it with Amazon last decade. We could start to see some solid growth from energy in Q4 numbers or maybe Q1 depending on ramp status and how long it takes to get Megapacks delivered and online. But I’m expecting material improvements by the back half of 2023 at the latest.

Elon has said he thinks the energy side can be about the same size as auto over the long term and on the most recent earnings call said they see stationary storage growing more like 150- 200% per year – “much faster than cars by a lot.” Nothing remotely close to this appears priced into the stock by Wall Street. Using some rough math, if we assume the energy side can do $10 billion of revenue in 2023 and grows at a compound rate of 75% per year over the following decade (Tesla’s trailing compound revenue growth over the past 10 years) and assume auto compounds at 35% over the same period, that gets you to roughly the same size in revenues. I’m not saying I predict it to work out that way because things are still very early and we need more information, I’m just trying to provide a picture of how they could end up being the same size.

I really think energy storage will be a business Wall St. loves. It’s uncontroversial, apolitical, and non-cyclical. There are massive end markets with tons of demand. Public perception of Elon is irrelevant. Megapacks are currently sold out into 2024. The estimated delivery date for a new order is Q4 2024. The potential is just jaw-dropping. And it isn’t just large-scale utilities that can benefit from these products. Any large real estate development like apartments or office buildings can utilize them as a backup power source and hook them up to solar panels. This can lead to some big cost savings.

The other big one is of course FSD. There is just tons of noise and skepticism around this and has been for years, and for good reason. Some people think they’re close, some think it’s a pipe dream. Elon’s predictions have been missed time after time. But it’s an unprecedented, extremely complex problem to solve, so I don’t really worry about the missed timelines, I just focus on the progress. Several members of our team use FSD daily and monitor the progress. Is it perfect? No. Is it improving significantly? That’s an emphatic yes. I don’t think many people realize the valuation implications if it is solved. The potential is mind-blowing. I don’t know how else to put it. There is a chance it never pans out, but even if it doesn’t, I still see the stock multiples higher over the next several years. I think of FSD as the biggest call option of all time, and one that has a material probability, over 50%, of paying off.

And when it comes to stuff like Optimus there is obviously huge potential, but it’s not something I think about in terms of valuation for the next 5 or so years. It’s just too far off to be thinking about right now but we’ll incorporate information as things progress.

2023 & Onward

2022 brought about a complete valuation re-set for a multitude of stocks, and attractive opportunities have started to present themselves. As the year progresses and Tesla stock recovers to a more reasonable level, we look forward to deploying capital into new positions and are eager to share more information over the coming months and quarters.

Certain pockets of the market remain largely unscathed from the market selloff – mostly consumer staples and energy – but many of these names were piled into for their perceived safety, much in the same way tech stocks were piled into in 2020 & 2021. Ultimately everyone needs to take their medicine and I believe flows this year will move away from the KO, PEP, PG type equities and back into sectors that were slammed last year. As history has shown, higher growth names typically bottom before the overall market, and the best names can come back stronger than ever, reaching new all-time highs and never looking back, much like AMZN in ‘08/’09.

I remain firmly excited about the future and believe market share in several large industries currently being transformed will be concentrated in a select handful of big winners. Many secular trends like the ones we have experienced and participated in over the past ten years (cloud computing, streaming video, e-commerce, EVs) are set in motion by powers far greater than the 10-year yield or temporary supply and demand shocks. And the trends backing our theses are still intact. EV adoption will keep growing and the slow & steady transition to sustainable energy will continue. And then there are the newer, emerging trends in areas such as robotics, AI/VR, and automation. These are areas in their infancy that we look forward to following and will seek to capitalize on once the landscape and opportunities become clearer. We already have some exposure to them via Tesla and Amazon.

It has always been my goal to position our portfolios to capitalize on opportunities I believe to be highly attractive and sometimes generational, that can provide the ability to compound for years to come. While volatility is expected given the areas in which we typically invest, I try to steer the ship towards the smoothest possible path. 2022 was undoubtedly painful but I firmly believe we are on the correct heading and will ultimately reach the desired destination. My long-term optimism and conviction remain unchanged. I am invested alongside you and have felt the pain, but my concern when looking a couple years out is basically zero.

Thank you all for your continued faith in myself and my team – it means more than you could know. Without you, Nightview Capital would simply not exist, and we’re more driven, motivated, and committed than ever to rebound from last year, and are truly excited about what the next decade has in store.

We genuinely enjoy speaking with our investors, answering questions, obtaining feedback, or simply keeping in touch so as always, please don’t hesitate to reach out to us at any time.

Thank you,

Arne Alsin & The Nightview Capital Team

Team Members

Arne Alsin – Founder, CIO + Portfolio Manager

Zak Lash, CFA – COO

Daniel Crowley, CFA – Director of Portfolio Management

Eric Markowitz – Director of Research

Philip Bland – Director of Investor Relations

Emily Bullock – Head of Compliance

Cam Tierney – Research Analyst

**Disclosures

This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital. The opinions expressed herein are those of Nightview Capital and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward looking statements cannot be guaranteed. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. This is not a recommendation to buy, sell, or hold any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Nightview Capital makes in the future will be profitable or equal the performance of the securities discussed herein. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request. Past performance Is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income. The S&P 500 Total Return is a market-value-weighted index that measures total return, including price and dividends, of 500 leading companies in leading industries in the U.S. economy. The volatility (beta) of the accounts may be greater or less than benchmarks. It is not possible to invest directly in this index. Nightview Capital, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-22-02