The aggregation of marginal gains

Dear Partners,

One of the concepts that we think about quite often as investors is the idea of aggregating marginal gains. The theory, briefly explained, is that the best way to enhance odds of success is to continuously rip apart your process and see what can be improved, even if only by 1 percent. When you accumulate enough of these marginal gains over time—one percent of efficiency here, two percent there, etc.—the results can be dramatic; especially relative to your peers or competitors. Even better, if you apply the process continuously, marginal gains can accumulate exponentially.

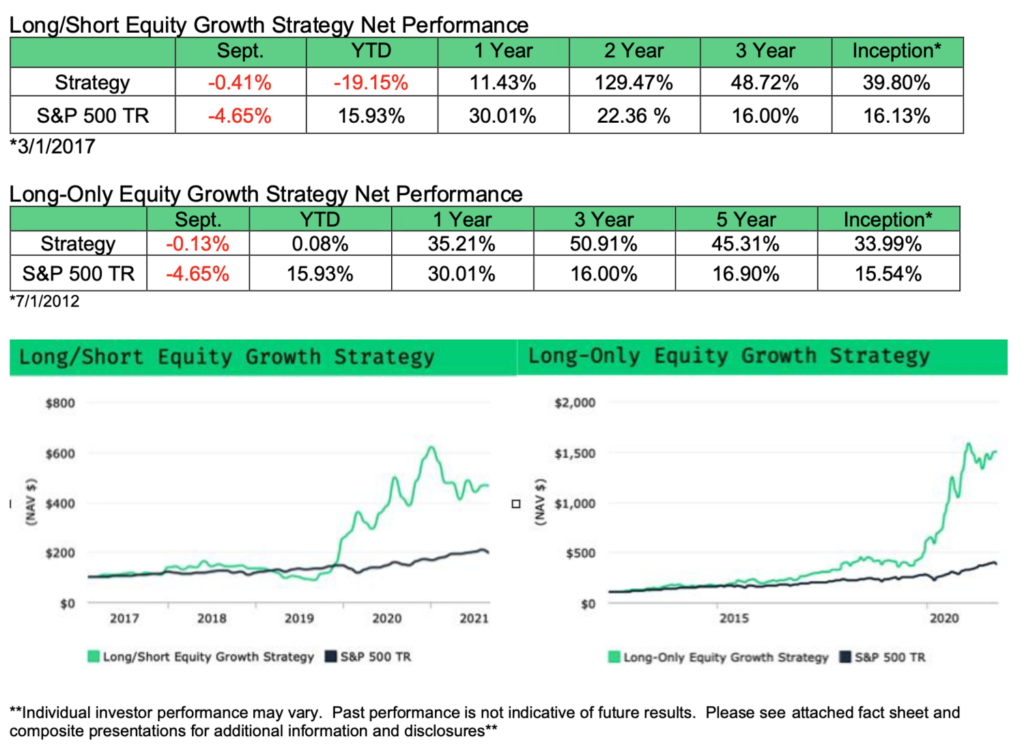

Please see below for results since inception.

Please see here for composite presentations for additional information and disclosures.

One of our favorite examples of the marginal gain aggregation theory—the story that served as the inspiration to our team many years ago—really has nothing to do with finance or investing at all. It was the story of the British Olympic cycling team. The brief history is this: From 1904 to 2003, the British cycling team was, as the Brits might say, rubbish. A hundred years of losses— total mediocrity. Then, in 2003, the team hired a new performance director in Dave Brailsford.

Brailsford, who holds a degree in civil engineering, made a series of cold mathematical assessments: By his calculations, the team needed to improve its lap times by 2.78 percent to have a chance at becoming world champions.

But how? Brailsford did what any good engineer would do: He took everything apart. His goal was simple: Reconstruct everything, but 2.78 percent more efficient—2.78 percent faster. Jamie Staff—one of the team’s cyclists—recalled trying to trim 2.78 percent of his body fat while improving his personal squat record (530 pounds) by 2.78 percent.

Everything was on the table—the size of tire tread, the wheel and bike-frame design, changing the material of the skin suits and helmet the team wore. Brailsford hired nutritionists, sprint coaches, psychologists—anything that might improve outcomes for the team. He took the aggregation of marginal gain theory to what some might label “extreme.” He advised cyclists to lie in their beds at night in certain positions, keep the same pillow when traveling (to improve sleep), and even made sure they scrubbed their hands in a certain way to reduce the likelihood of getting sick around the time of competition.

It was a constant search for fractional advantages, but at the core, the key was always experimentation to improve outcomes: Nothing was too crazy or outlandish to try, as long as it could feasibly improve outcomes even by a small margin. “They’re tiny things,” Brailsford told a reporter a few years ago. “But if you clump them together it makes a big difference.”

You might have guessed where this is going. The accumulation of marginal gain theory has worked. The team has since enjoyed unprecedented levels of Olympic success, with scores of gold medals since 2004.

This is one of those stories that has become something of lore among our team. It’s also something of a guiding principle of how we think about investing and gaining an edge in the market.

Back in 2013, Arne, our CIO, wrote a bit about how he re-oriented his research and investing process to improve the likelihood of outcomes for positive long-term performance, in a period of increasing technological disruption.

He wrote:

My weapon is my biochemical computer and the quality of its decision-making process; brain science shows performance is highly variable. Elimination of distractions, rituals, there’s all kinds of things you can do to think better. I’ve found if I consciously slow down the research process, I get the best results. Really dive deep into one thing at a time, to the exclusion of all else. Make it personal, get obsessed sort of thing…

I’ve developed lots of silly time-savers. Same sandwich for lunch everyday, you’d be surprised how much time that saves, no more where to go, what to eat. No football watching or playing golf for last two years. (Of course, I hope my opponent enjoys such things, and to the fullest extent.)

A bit tongue in cheek, maybe, but these aren’t just simple time hacks. These are tools we can deploy to gain an edge over our competitors. Investing is the most competitive game in the world, with the highest stakes imaginable—and we want to win. But how? Our view of edge is… everything. It’s a search for marginal gains at any corner of the process to optimize the research and portfolio management effort.

We think about this constantly: No extraneous internal meetings. Very little marketing (you won’t see Arne on CNBC). Avoid checking stock quotes too often. Focus on the businesses we own, and the businesses we might own someday soon. Read more books, listen to more podcasts, cut out the noise as much as possible in the pursuit of becoming experts in the industries we study. (Want to listen to 50% more audio content? Easy. Set your speed at 1.5x.)

Our view of investing edge is, in many ways, that it’s simply a continuous search for accumulating marginal gains to optimize our portfolio for the best possible outcome over a multi-year period.

This idea doesn’t just apply to our own process. In practice, it’s a heuristic—a tool—we use to identify companies that we want to own.

Our core portfolio as of this writing—TSLA, SPOT, SHOP, ABNB, and AMZN—are all premier examples of companies that use the concept of aggregation of marginal gains to continuously improve their value proposition for customers. After all, what is innovation if not just a continuous search for fractional advantages in business?

Amazon, for instance, accumulates marginal gains by compressing their costs year after year for consumers, creating an infrastructure and logistics network unrivaled by its peers. In the short-term, the market can often misunderstand the intentions of the “marginal gain accumulators,” but over time, their value-creation becomes obvious in hindsight.

The way we see it, Tesla is perhaps the generational example of the marginal gain aggregation theory. It’s also been our largest position for several years now. There are many ways to characterize and value this business (see previous letters for longform write-ups), but perhaps the best way to think about the company is that it is a highly vertically-integrated software and hardware firm that’s devoted entirely to aggregating marginal gains across its organization. The goal? Lower costs, improve thruputs, and dramatically enhance the value proposition—at scale—for consumers.

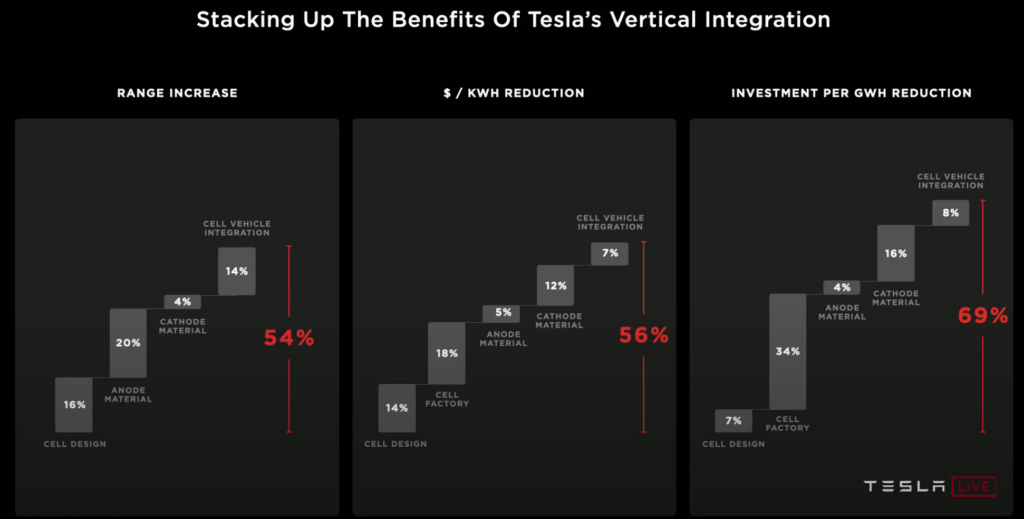

The slide below was presented last year at Tesla’s Battery Day, and it shows the story of marginal gains in practice. For any investor focused on the energy transition, we’d argue this is one of the most important slides of the decade. (Again, not obvious now—but in hindsight we think this will be obvious.)

By experimenting with every component of its battery—from cell design, anode material, cathode material, to the process by which cells are placed into the vehicle, to even the design of the cell factory itself (!)—Tesla is working to achieve an astounding vehicle range increase of 54% while simultaneously decreasing the cost of produce thruput by 56% (i.e. expressed as $/kWh of battery production).

We believe we’re at the very early stages of exponential growth in electric vehicles, and value (along with talent, capital, and other necessary resources) will accrue to the winners of this radical disruption cycle. This dynamic also reflects the power of increasing returns on invested capital, which, in complex manufacturing, can take years to drop to the bottom line.

What’s shocking to us is how much of a winner-take-most dynamic this is shaping out to be—a dynamic that is just beginning to play out in the marketplace. At a recent crisis meeting held at Volkswagen, the largest auto manufacturer in the world, chairman Herbert Diess told his employees that, “If everything stays the same, VW is no longer competitive [with Tesla].” One of his top lieutenants later noted that Tesla is producing its EVs about three times more efficiently. “Tesla,” he said, “is in a different dimension in terms of productivity and profitability.”2

The dynamic unfolding is sort of like the mechanical hare at an old-fashioned greyhound race— the dogs can chase the hare, but they’ll never catch it. It’s an unfair race—Tesla is just too far ahead, and the lead expands by the day. To be clear, right now no other company across the automotive or energy landscape is even close to catching Tesla—on batteries, vehicle production, autonomous software—in large part because other firms simply do not have the organizational DNA that prioritizes the continuous aggregation of marginal gains at scale above everything else.

And this makes sense. Mature organizations that enjoy significant cash flows and profits rarely have the financial incentive to radically upend their business models overnight. There’s no incentive to pivot, let alone pivot quickly, which is arguably the major challenge (and opportunity) of the next decade for investors.

Rather than risk investing in unproven business models, large organizations tend to suffer from status quo bias, and only transition when it’s too late. Organizations serially underestimate the rate of change, and particularly underestimate the rate at which customer preferences can change—sometimes overnight. This is a particularly serious problem for any firm engaged in complex manufacturing.

Overnight, consumers may change their minds about what they want—but in the case of vehicle production, it can take years for manufacturers to hit profitable production run-rates. This creates existential risks for these firms, and it’s also a good reminder of why it’s so important to listen to customers—not CEOs—when thinking about investing.

Now, when it comes to valuation of these business models, during periods of relative industrial stability, it makes sense to value them as a multiple of an historic metric—earnings, cash flow, etc.

But we’re not living in a period of relative industrial stability. We’re living through industrial chaos, and so an investor’s valuation strategy must adapt as well. We need to look forward to find value—not backwards. In other words, it’s silly to value a business as a multiple of historic cashflows if there exist high odds that those cashflows will diminish significantly over time—and potentially very quickly. Certain businesses—because of their inability to adapt and innovate—should arguably be valued at near-zero today, at least until they can at least prove they have an ability to compete and generate meaningful cashflows in the future.

General Motors is, in our opinion, one of those businesses—it’s a prime example of a mature business model that could face obsolescence. We’ve been writing about this dynamic since 2017 (see: Why General Motors Has Already Lost to Tesla) but this quarter— with a $2 billion recall of every single Chevrolet Bolt ever produced—was an early indication of what may lie ahead the future for General Motors.

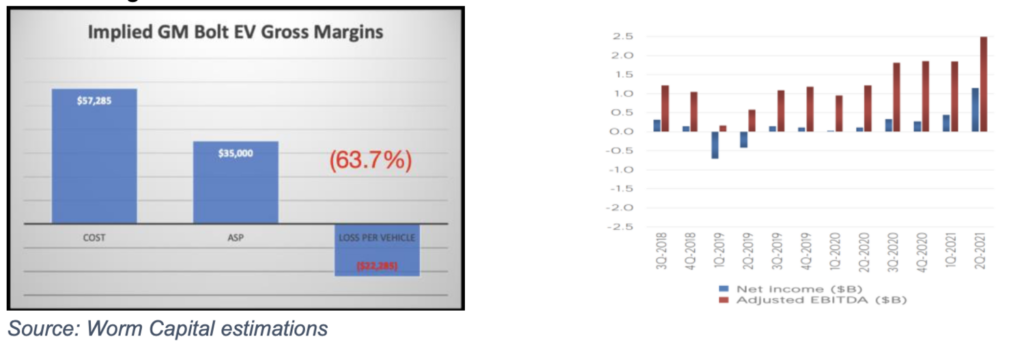

Our view is that GM—and many of its incumbent peers—are simply not structured to aggregate marginal gains to its new line of EVs. Here’s a quick example of how this plays out: Our rough estimation is that GM continues to lose about $8,000 for every Bolt it sells[3]. The company has sold about 142,000 Bolt vehicles since production began in late 2016. (By comparison, Tesla delivered more than 240,000 vehicles this quarter alone—at around 30% gross margins.)

With the recent $2 billion recall for 142,000 Bolts [4], that represents a cost of about $14,000 to fix each vehicle. If GM was already losing $8,000 per Bolt, that puts the retroactively implied Bolt gross margin at a loss of more than ($-22,000) per vehicle, or an implied (-63%) gross margin profile per car produced.

Tesla, meanwhile, has achieved phenomenal returns on their invested capital, and as a result, it has enjoyed accelerating net income growth over the last 5 years. Again, this is the power of aggregating marginal gains at scale: improved margin dynamics through vertical integration and cost-cutting innovations.

The beauty of continuously accumulating marginal gains is that it has a profound compounding effect over time: If your goal as an individual, organization, investor—whatever you are—is trained on the belief that you should always be improving, there is the potential for exponential growth.

Spotify is a wonderful example of this dynamic as well.

Although the market has pummeled this position in recent months, falling more than 35% from all-time highs—and has contributed significantly to our negative year-to-date performance—the company is meeting and often exceeding our internal expectations. Spotify is expanding territory, reducing frictions for creators, enabling the next-generation of audio advertising (a high margin opportunity), and continuously experimenting to improve the experience for both creators and fans to create an essential platform.

Spotify is, in many ways, building the essential audio infrastructure for the Internet, much like Google built the search infrastructure to power Web 2.0 or Apple built the hardware infrastructure power the app economy. We think the valuation represents one of the wider deviations between price and value in the market today, but we think time will be on our side here—like all our positions, we maintain a long-term view on the company and certain theses may take multiple years to play out.

In our view, Daniel Ek’s vision for Spotify is far grander than most may realize, and we encourage you to listen to his recent podcast with Patrick O’Shaughnessy. “The value of what you are building is the sum of all the problems that you solve,” Daniel says. “I still think we’re early days with Spotify. There’s so many problems left to be solved.” (We agree.)

Two charts below that help contextualize both Spotify’s lead (largely as a result of aggregating marginal gains, and passing those gains to consumers) as well as a chart that represents just how early we are in the streaming audio era.

Like most great growth business stories, the market tends to vastly underestimate the total addressable market in its early days. We believe Spotify will ultimately prove out to be the Google of audio, and it should command a far higher multiple today. For those interested, Eric spoke in detail about our investment thesis on Spotify with John Rotonti in September – link here.

Again, in terms of fund performance, we understand this year has been frustrating. And we want to again thank you for your trust and patience. Fundamentally, we’re pleased with the progress of companies within our portfolio, and we’re optimistic about their growth prospects heading into 2022. The reality is we must accept short- term pullbacks in the pursuit of great returns over time—it’s simply the price of admission.

On a short-term basis, the market will always misprice the underlying equities in our portfolio. Sometimes they go up too fast, and occasionally they go down too fast. As business owners— not daily speculators—we focus our efforts completely on the businesses themselves, not the market.

It’s funny—while 98% of the news headlines you see are focused on the stock market, we spend very little time analyzing what’s happening in the markets. There’s just very little useful information there.

The market is where we go to occasionally adjust our positions. In other words, most of the action takes place on the field of business—not the market. While the portfolio hasn’t changed much in the last quarter, we’re heads-down focused on several opportunities in earlier stages of incubation.

The key, of course, is deep research, timing, and patience. As the investor Nick Sleep once wrote, “The best investors in the world are not investors at all. They are entrepreneurs that never sold.”

This is how we think of our strategies. Investing is very often a mental game, played out among millions of participants. We happen to believe that this decade will present an incredible opportunity for long-term minded investors who can withstand the swings and drawdowns of the market.

We are so early in so many areas that we study—transportation, energy, e-commerce, digital streaming, entertainment. The power laws of the new industrialized economy are inherently deflationary and potentially exponential. Our job—and frankly our obsession—is to go deeper on these businesses than our competitors, and to get ourselves, and our partners, into position.

If anything, the purpose of the aggregation of marginal gains theory is this: We use it to get in position at a time when positioning is the most important element for investors to consider. We’ve said it before, and we’ll keep saying it: There will be massive winners this decade, and equally massive losers. It’s an exciting time to be an investor, and the key right now is to get in position. We’re early in the exponential curve, but when the inflection hits, it can hit very quickly…

Sincerely,

Nightview Capital

Team

Founder/CIO Arne Alsin

Chief Operating Officer – Zak Lash, CFA

Director of Portfolio Management – Daniel Crowley, CFA

Director of Research – Eric Markowitz

Director of Investor Relations – Philip Bland

Head of Compliance – Emily Bullock

Footnotes:

1 https://www.nytimes.com/2012/07/23/sports/olympics/2012-olympics-how-britain-conquered-the-cycling- world.html

2 https://www.youtube.com/watch?v=zVjd-xnzULg

3 https://www.cnbc.com/2016/11/30/gm-stands-to-lose-9000-dollars-per-car-on-chevy-bolt.html

4 https://www.theverge.com/2021/8/20/22634721/gm-recall-chevrolet-bolt-battery-fire-fix-problems

Disclosures:

This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital.

The opinions expressed herein are those of Nightview Capital and are subject to change without notice. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. Such an offer will be made only by an Offering Memorandum, a copy of which is available to qualifying potential investors upon request. This material is not financial advice or an offer to sell any product. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Past performance is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income.

Nightview Capital Management, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-21-06