Playing the Long Game

Dear Investors,

The last few months, and the year overall, have been disappointing. While the stock quotes for several of our core businesses have been getting pushed around by the public markets, we view their long-term fundamentals as healthy and growing. I know negative performance this year has been frustrating for you—it has certainly been frustrating for me and my team as well, given the amount of time and effort we put into our research and analysis.

In the past, temporary volatility and underperformance in a particular position was typically smoothed over by the outperformance in others. However, that has not been the case this year, and we’ve unfortunately had weakness across the portfolio. But let me assure you outright: Despite the underperformance this year, I am confident in our approach, and the potential for outsized returns over the next several years. Our thesis and outlook have not changed on any name or sector. When we put aside the recent stock price movements and look under the hood, things appear to be playing out much how we believed they would.

As I have said before, but will say again, public markets—driven by Wall Street—tend to get overly focused on the short-term. This can be exacerbated by the herd mentality and reactive, price-chasing behavior from sell side analysts. There are also incentives in place, especially among vocal short sellers, to drive prices down. But one of our principal advantages in this environment is our long-term patience through industrial changes and market confusion. We see several large-scale shifts unfolding, many of which are unprecedented. This has created plenty of market chaos. While the exact timing is impossible to predict, in the not too distant future I believe our performance across the portfolio will move back quickly in our favor—a rubber-band “bounce back” effect. In the meantime, we’re in a bit of a holding pattern.

In this letter, I’ll provide some commentary on the disruptive growth we’re seeing across our core holdings—as well as a bit of analysis around the potential for a massive market shake-up in the next couple of years, particularly in the auto industry. Earlier in the last quarter we trimmed our short book while making a couple of new investments into high-growth, large cap businesses that we believe were trading at particularly attractive valuations. These additions have made our strategy a bit less concentrated—while giving us access to flourishing, high-tech business models in emerging markets.

I’ll first focus on our position in Tesla, which I believe is the next Amazon in terms of growth and market dominance. Today, TLSA’s market capitalization is roughly $44 billion, which is severely undervalued from our perspective. Our analysis is based on a variety of metrics, the most important of which being topline revenue growth and unit sales, along with a market-leading value proposition in a vertical with vast end markets.

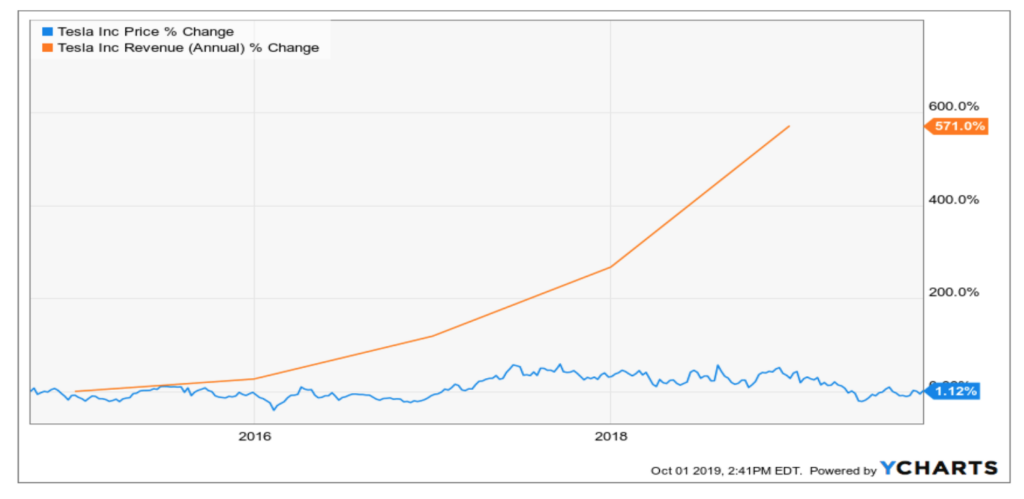

Despite the daily onslaught of headlines (some positive, many negative) the simple reality is that Tesla is compounding growth at an exceptional speed. It’s also winning among customers, much like the iPhone did in 2007. This is a fact that is widely underappreciated—and somewhat shockingly ignored, in my opinion. After all, customers are the ones who decide what products win or lose, not Wall Street analysts or bloggers. Regardless of the negative headlines, or even potential issues with the car or service, most customers —including myself—seem to absolutely love the Tesla product. In 2019, based on a survey of 60,000 car owners, Auto Trader named Tesla the most-loved car brand in the world1. Unfortunately, in periods of chaos and industrial upheaval, public markets can act irrationally—which helps explain that, despite revenue growth of nearly 550% in the last five years, Tesla’s share price has lagged.

There are several ways to measure the growth-rate of a company, but perhaps the simplest—and most elegant for a car company, at least—is in unit sales. On this measure, we believe Tesla is the fastest-growing manufacturing company at scale in the world today. Since 2014, Tesla’s CAGR in terms of unit sales is roughly 50%. That is an unprecedented figure—I’d challenge any investor to find a publicly-traded manufacturing company with a 50% CAGR unit sales.

Despite these impressive growth rates and historic CAGR, public markets can be fickle and overly focused on quarterly (or even monthly) performance targets, headline noise, or unfounded risk. This habit tends to obscure the broader, more important foundational changes to an industry or an economy.

When taking a step back and looking at the big picture, it appears clear to us that Tesla is wreaking havoc in the auto industry, forcing incumbents to radically readjust their business models and supply chains. In 2019, nearly every OEM has announced plans to electrify their entire fleets. But in our view, Tesla is at least five years ahead of the competition on every aspect of electric vehicle production—from battery supply to cell chemistry to global logistics. In fact, this dynamic recently inspired a research report that we published, titled The Big (Auto) Short.

Internationally, Tesla appears to be booming, achieving record delivery and production in Q3 2019. Tesla has taken the European market by storm and neared completion of its Shanghai Gigafactory (set to open shortly). In Norway, the Tesla Model 3 became the country’s best-selling vehicle. (Note: Not best-selling electric vehicle, but best-selling vehicle overall, in the entire country.) Most immediately, though, I’m excited about the opening of the Chinese Gigafactory, which I believe will represent a turning-point for the company.

China is the world’s largest auto market, and Tesla is a beloved brand among Chinese consumers. Reports on the ground indicate that Q4 may see explosive growth for Tesla. Crucially, the Chinese government also has rallied behind Tesla, giving us even more confidence in Tesla’s success in the Chinese market. One particularly telling development in Q3: Despite an overall slowdown in Chinese electric vehicle purchases in the last few months, Tesla purchases appeared to accelerate. “Tesla’s deliveries to real, actual people are still rising at a triple-digit pace, despite being hamstrung by import duties, a flagging auto market, and a historical inability to tap EV subsidies,” an analyst noted in late September.

This is all fantastic news, but as one of the most heavily shorted stocks in the market, we believe there’s been a significant campaign of disinformation against Tesla. Make no mistake, there is political willpower and powerful lobbying efforts at play. Per a recent investigative scoop in Politico, titled “The oil industry vs. the electric car,” incumbents are spending millions of dollars on lobbying and regulatory blitzes to curb the electric vehicle industry. “Groups backed by industry giants like ExxonMobil and the Koch empire are waging a state-by-state, multimillion-dollar battle to squelch utilities’ plans to build charging stations across the country…” the article notes. “The motivation for the lobbying push stems from an existential threat facing the global oil sector in the rise of the electric vehicle.”

This existential threat to the oil industry is warranted—but we believe big oil will lose. Electric cars are cheaper, safer, and more consumer-friendly than combustion engine vehicles, which pollute the planet and kill thousands of people every year6. My feeling: Good riddance. We’re here for the electric car revolution, and we’re looking to profit from it handsomely.

One thing to remember as you see critiques of Tesla’s business model: As long-term investors in disruptive innovation, we prioritize revenue and gross profit growth over more short-term focused metrics like P/E ratios or net income. We want our businesses to focus on expansion, development, and innovation. This is why Amazon redirects its profits into AWS expansion, and why Netflix will spend $15 billion in 2019 on content this year. What Jeff Bezos, Reed Hastings, and Elon Musk all understand—and what so many on Wall Street struggle to see—is that a customer-focused approach to innovation requires heavy capital investments, which often detracts from short-term profitability. History has shown that if a run rate can’t be applied to EPS growth, Wall Street has a hard time valuing stocks. Such is often the case for disruptive, high growth companies.

Another perceived threat against Tesla, which has been continually touted for years, is the threat of coming competition from incumbents. To be frank, this “threat” does not concern us. Our view may be different if a competitor came out with a superior product or value proposition, but when looking objectively at the specs, nothing seems to compare to a Tesla. The narrative was the same with

“iPhone killers” seemingly coming out left and right a decade ago, but in a post-Internet, fully transparent era, the best product wins. Always. Rational people will rarely pay an equal (or higher) price for an inferior product. It’s that simple. Given how capital intensive and costly automobile development can be, rolling out an inferior product will, in our view, hurt the competitor more than it would Tesla.

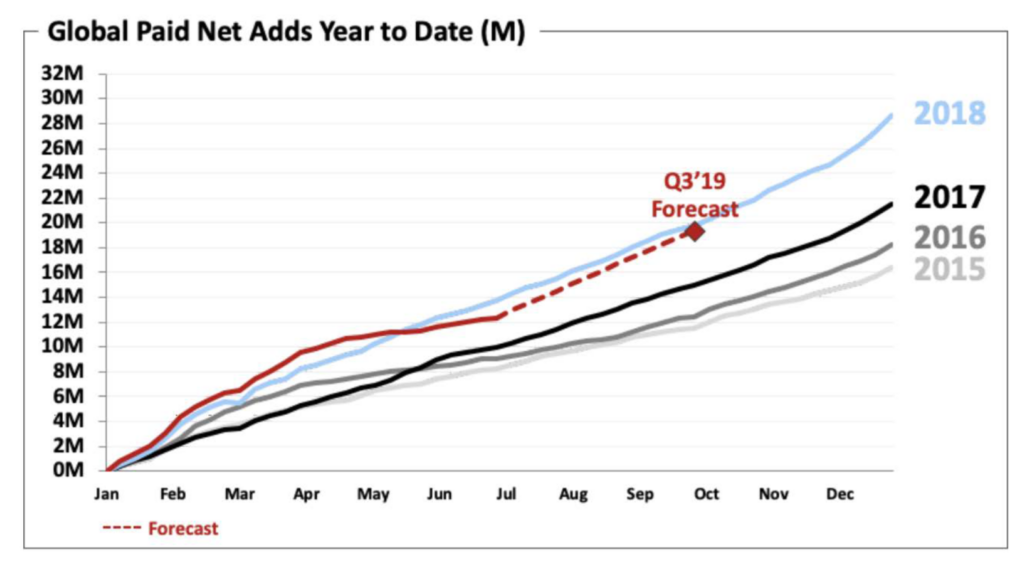

We saw depressed share prices at a couple of our other core holdings in the last quarter, including Netflix. Netflix is the world’s leading video streaming platform, and despite some choppiness in subscriber growth in Q2 (which isn’t out of the norm), I’m pleased in particular with the company’s growth in the last year—and excited about the company’s international growth opportunities and initiatives. In the most recent quarter, NFLX reported that streaming paid memberships increased 24% year over year, growing total paid subscriptions to roughly 151 million.

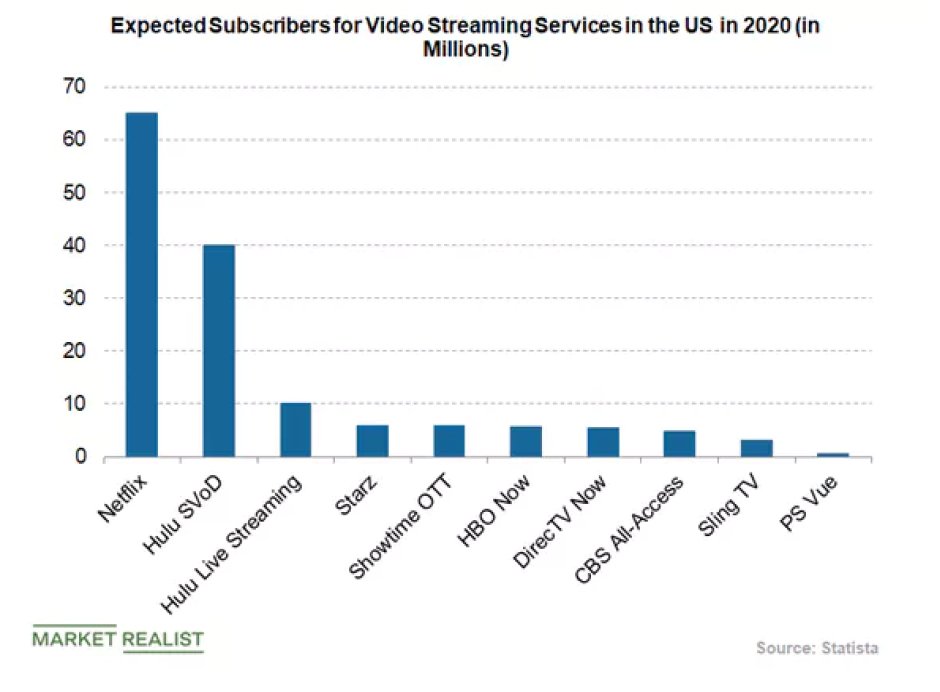

Wall Street reacted negatively to this growth, principally because the total subscriber base grew less than forecast. But, taking a long view, Netflix is clearly dominating the streaming video industry—it’s not even close.

More recently, the expectation of new entrants into this market (from HBO to Disney+ to Apple TV) have created a bit of downward pressure on the market price for NFLX, but many of these competitive fears, we think, are overblown. NFLX bears seem to be focusing much of their analysis on the lower sticker price of new streaming services but ignoring what consumers get per dollar (i.e. the value proposition). The churn rate at NFLX is remarkably low, and it’s fairly obvious why: Customers are happy with the service because it offers vast amounts of diverse content at a reasonable price. For instance, NFLX content dwarfs that of which Disney+ and Apple TV plan to roll out at launch. Content is king, and this reality has helped the platform become the fastest-growing entertainment company in the history of the world. Per CEO/founder Reed Hastings on the July 2019 earnings call:

- “So this year, we’ll add about $5 billion of incremental subscription revenue… that’s faster than any entertainment company has grown in the history of the world. So what we want to do is keep that engine going, keep that subscriber engine going and not get distracted with alternative revenue sources which just don’t add up when you’re growing $5 billion a year.”

Speaking of fast-growing companies, I am pleased with the business performance of the rest of our long book, from AMZN, which grew revenue 20% from the year-ago period in Q2, to SPOT, which grew its premium, paid subscribers globally 31% YoY to 108 million customers, maintaining a solid lead over Apple.8 The stock price of AMZN has been relatively flat over the past year, which isn’t surprising as its performance can be lumpy given their reinvestment initiatives. Reinvestment dampens short-term profits, and Wall Street doesn’t like that.

We added two new investments to the portfolio this quarter: Alibaba (BABA) and Baidu (BIDU). I’ve been tracking these businesses for a couple of years now and I’ve always been impressed with their growth trajectories, market innovations, and management. I made the decision to purchase them now because I believe we were able to get in at a great price: The Chinese trade conflict has caused some market uncertainty, leading to major discounts.

BABA, in particular, has seen notable gains in its e-commerce platforms (both Tmall and Taobao shopping in particular), and driven impressive gains in its cloud computing division. There are now 674 million active Chinese retail customers on its platform—but, incredibly, plenty of room for growth. In its most recent earnings announcement, the company said that nearly 3 out of 4 of those new consumers were from smaller, developing cities in rural China—indicating their push into new territories.

BIDU, Chinese largest Internet search platform, also had a positive quarter. Core revenues rose 12% on the quarter and beating overall revenue expectations. There’s ample opportunity for BIDU growth in our view, especially in BIDU’s artificial intelligence division, which is making some fascinating innovations across a variety of technologies, from self-driving cars to voice assistants. We are happy to own these two new businesses, which I consider to be two of the most innovative platforms in the world—and I’m very glad we were able to get them at attractive prices based on our analysis and long-term valuation.

Our short book has presented challenges; in particular our short positions on car dealerships. Despite a run-up in the share price of these companies at the worst possible time, and thus compounding the short-term underperformance of our long book, our thesis remains unchanged: We strongly believe car dealerships will struggle in the shift to direct-to-consumer electric vehicles. EVs are cheaper to maintain (hurting service revenue) and the OEMs haven’t given dealerships the training, nor financial incentives, to sell their versions of electric vehicles.

We encourage you to read the Big (Auto) Short piece, but in it, we describe what we believe to be a major transformation taking place across the auto market in the next couple of years. In particular, we note that automotive retailers are already facing challenges from declining margins and shrinking new vehicle sales, threatening their core business—which is why they have become so focused on upcharging customers using F&I and service and parts in recent years. Essentially, F&I and service rates are becoming a bigger slice of the pie in dealership revenue—a trend that cannot increase forever.

Since 2009, service and parts sales in the average dealership have increased by 5.5 percent per year on an average annualized basis, according to a recent report NADA. There is no question service revenue has become absolutely critical to the profitability and survival of dealerships. The problem, then, is that the shift to electric vehicles will radically affect the dealership’s ability to maintain profitability over the long-term.

Day-to-day, we’re staying focused on our portfolio—and the technological innovations and long-term trends unfolding within the industries we cover. Despite political instability, macroeconomic volatility, trade disputes, and the chaos that seems to dominate our modern lives, the simple truth is that we continue to be confident and excited about the future of our portfolio and our investment thesis. Technically, we are investors, but we think and act like business owners; this Buffett-esque strategy enables us to hold growing businesses for the long-term, even in times of volatility. We are not speculators trading around the daily movements of a stock price and we’re not interest rate oracles that can read the mind of the Fed chairman. Instead, we focus on the long-term fundamentals of a business, the value proposition, the market opportunity, what consumers are saying, and how management is innovating. Surprisingly, this strategy and long-term focus seems fairly unique among many Wall Street investment firms who seem to manage—and window dress—month to month, or quarter to quarter.

It’s our broad view that we are living through a deflationary period, brought on by rapid advances in technological improvement. In transportation, we are moving to a fully electric future, driven not by altruism or policy—but simply by cost and consumer preference. Similarly, across IT, we’re seeing massive industrial shifts away from mainframe computing and into cloud computing. Same goes for the disruption of e-commerce, stealing market share from brick and mortar, streaming video platforms taking market share from cable providers, and renewable energy platforms disrupting the fossil fuel industry.

We value having you as clients, and we’re always happy to set up a conversation to address any of your questions. Thank you for your continued faith in myself and my team at Nightview Capital.

Sincerely,

Arne Alsin

Disclosures:

This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital.

The opinions expressed herein are those of Nightview Capital and are subject to change without notice. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. Such an offer will be made only by an Offering Memorandum, a copy of which is available to qualifying potential investors upon request. This material is not financial advice or an offer to sell any product. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Past performance is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income.

Nightview Capital Management, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-19-09