The Key is to be in Position

Dear Partners,

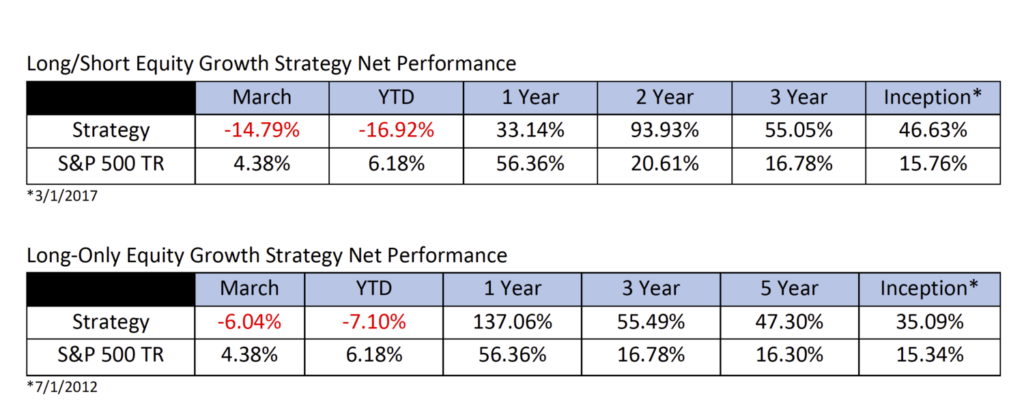

In Q1 2021, our long/short equity growth strategy returned -16.92% net of fees, and our long-only equity strategy returned -7.10%. This was compared to the S&P 500 TR of 6.18%.

Since inception in March 2017, our long/short equity growth strategy has annualized returns of 46.63% net of fees, compared to the S&P 500 TR of 15.76% over the same time period. Since inception in July 2012, our long-only equity growth strategy has annualized returns of 35.09% net of fees, compared to the S&P 500 TR of 15.34% over the same time period.

Please see below for results since inception.

Please see here for composite presentations for additional information and disclosures.

Although prices did not go our way this quarter, the businesses that we own are doing well and we’re happy with their progress. Right now, the most important question is this: Are we still finding attractive opportunities that we believe will build future value over the next few years? The answer, emphatically, is yes.

To be clear: Our outlook is as bullish as ever. With significant industrial upheaval comes significant opportunities—but also volatility. For stock pickers, that’s what we like to see. There will be some bumps along the way, but we believe the key to outperforming over a period of years is to be focused on the best opportunities in the market—and to simply get into position for the years to come.

In our experience, time and patience should reward this approach.

Over the last few months, nothing material has changed in our fundamental view or approach. Our businesses have grown in a pretty linear fashion, even as their stock quotes bounced around. Right now, we’re feeling comfortable with our positioning heading into the summer months, and we’re optimistic about the remainder of the year—and certainly the next few years ahead.

•••••

Now, some musings on the quarter.

Despite the recent pullback in prices, which has roiled through the high-growth technology sector, our businesses have performed well. They have grown, and, in most cases, exceeded even our own optimistic internal projections of their goals.

As we have talked about in previous quarterly letters, the importance of owning dominant companies in today’s market cannot be overstated. Owning high-growth businesses with global addressable markets (and significant margin expansion opportunities) is, we believe, perhaps the best way to enable outperformance.

In the short-term, these high growth opportunities have tended to display relatively more volatile price action that — in some version of this order — will run hot, consolidate, pull back, and then eventually run up again, starting the cycle over anew.

Trying to read too much into monthly or quarterly price movements is a fool’s errand. It’s also just a poor way to gauge the relative success of a business. Is a business “worth” 10 or 20 percent less because its stock price is down 10 or 20 percent? Of course not. In public markets, time is our best arbitrage. The longer our expected investment horizon, the more time we give ourselves to allow our investments to fully express themselves.

Quarter-to-quarter, owning a concentrated portfolio will yield more volatility relative to a benchmark like the S&P 500. However, we believe more volatility is precisely what enables absolute returns for investors over the long-term. Many investors attempt to almost pathologically avoid volatility—whether through over-diversification or offsetting positions—that outperforming a benchmark over a period of years becomes nearly impossible—even if their monthly statements appear “smoother” in the short-term.

From our perspective, attempting to optimize a portfolio for smooth short-term returns creates a near-certain path towards long-term mediocrity.

Historically, the market has tended to reward those investors who had properly sized their bets, held patiently and with conviction during difficult periods, and understood the full potential and value of the opportunity they owned (i.e. they did not reduce or exit the position “because it already went up a lot.”) These may sound like simple or obvious investing theories—buy, hold, etc.—but there are challenges and pressures to this model.

The fact is, the business model for most stock picking today can be misaligned for actually delivering long-term returns for investors. The industry around money management often prioritizes short-term trends and allocating capital towards managers who can supply whatever strategy happens to in vogue that month, quarter, or year— but this is not how we choose to invest.

Frankly, that’s why we wanted to build something different with Nightview—a true long-term partnership with our investors that could last not just years, but decades. As we reflect on this quarter, it’s worth sharing that when we set out to build our firm, we did so with the intention of building a business that focused on concentrated stock picking based on fundamental research with a long-term investment horizon. The key differentiator, in our minds at least, was that we existed to serve current partners exclusively—even if that meant not necessarily appealing to new investors. Our focus will always be on serving our partner’s best interests—and never deviating from that plan.

Part of our culture is built around the idea that the work is never done—we’re always pressure-testing news ideas, learning about new businesses, and discovering new elements of the companies we own—to the point where we strive to know our businesses better than anyone else in the world. Our credo is this: We don’t need to be early, we just need to be right, and we just keep focused on the current landscape.

Our goal was—and always will be—to enable our partners to receive the maximum long-term potential return and reward for each investment idea that we harvest, and to abstain from any portfolio management decision that would detract from our ability to do so. The alignment between investment managers and their investors is, in our opinion at least, a key determinant of long-term successful returns—and so we are grateful to have such wonderful partners in this mission.

In essence, we created a vehicle to manage capital just as we’d want capital managed for ourselves, our family, and friends.

This has gone well, by the way. Our business and our team are growing. Very little marketing has a nice side benefit as well: We get to do what we love, which is simply research: We spend time on the businesses we own, understanding the industrial dynamics, and seek out new ideas.

On that front, we remain not just optimistic about the upside in the coming years, but profoundly bullish about the opportunity set for the sectors in which we’re invested in.

Disruptive innovation has accelerated, creating big winners and even bigger losers. We think academic models built during relatively stable periods are increasingly losing relevance in a world where creative destruction is compounding. And while we’ve tweaked the portfolio a bit in recent weeks —reduced some exposure on the short side, trimmed down some of our largest holdings to expand into new positions—there have been no fundamental changes to strategy, our thesis on various sectors, our positions—or even positioning.

•••••

Speaking of positioning: Getting into position is more important than ever, especially over the last few months. This is what we talk about constantly internally as a team: Position, position, position. Timing the market is impossible, so we focus on what we can control. What we can control is our positions and their relative sizing, which strive to reflect the opportunity we believe exists over the coming years.

Position is also all the more important when the media narrative and sentiment is working against you, e.g., when the folks at CNBC talk about a supposed “rotation from growth to value” or another “tech bubble” type of doomsday story.

Let’s just cut to the chase here—all investing is value investing, and the intersection of technology into every aspect of our lives means that a “technology business” is simply a semantic way of referring to a “business.” Setting aside valuations—and there are certainly some frothy pockets of the market—we believe the pertinent question all investors must ask themselves is this: Do you want to own a company that is growing incredibly fast and harnessing technologies to deliver more innovative products that makes customers’ happy? Or do you want to own the fading stars of the 90s that’s hoping to resurrect their business models? That’s not a rhetorical question, by the way.

Regardless, this is about position for the long-term: Though you may see the stock prices of industrial laggards rise in the short-term, do not be fooled…we believe this is not a place you want to be invested over the next decade. We believe that to participate in some of the most profound industrial and economic changes of the next decade requires that you stay in position, even when prices are moving against you in the short-term.

Rising interest rates? Sure, that’s causing some headwinds, but here’s the reality: despite the relative uptick in interest rates in the last few months, they remain in 40-year decline with a friendly monetary policy that doesn’t appear to be letting up any time soon.

“Interest rates are rising” fears vs The long-term view (interest rates are still low)

The reality, in our view at least, is that this decade will be characterized by technology-led deflationary forces, primarily concentrated in a handful of select winners. Eventually, perhaps 20 years from now, artificial intelligence will make the business of stock picking obsolete, but for now—wow—it’s an incredible time to be an active manager.

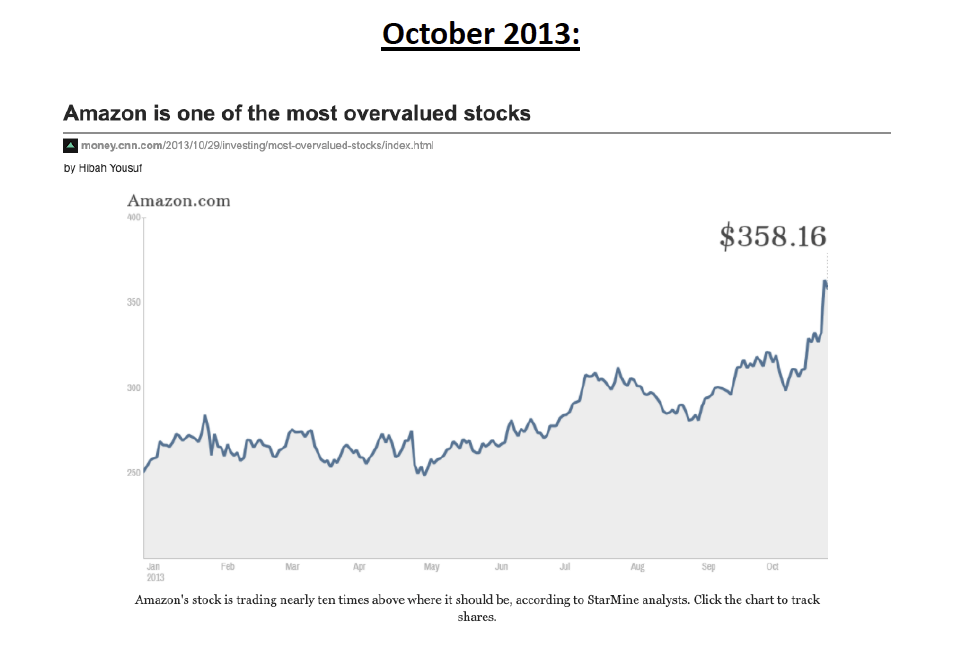

Positioning also does not mean that one has to be early, either. Some historical perspective might be helpful here. When I think back to 2012 on a position like AMZN, it was 15 years after its IPO, and, according to many of the pundits and analysts at that time —“too late.” Articles like the below were commonplace, all through 2012, 2013, 2014, and even remain to this day.

In the early days of our portfolio, AMZN grew as large as 40% of our portfolio—largely because we saw it as two companies (both e-commerce and cloud). This concentration created lumpiness in our monthly performance, of course, but why care about monthly performance when you’re targeting yearly returns of a company that you believe can become one of the most valuable businesses in the world? It makes no sense.

As we look at our portfolio today, we remain deeply concentrated in a handful of firms that we believe are the most remarkable businesses in the world. Each portfolio company is at a various stage of their trajectories, and their weightings reflect the upside we believe remains. On the flipside, many of our shorts tend to reflect those business models we believe will not survive the next decade.

In a recent conversation, we were asked, “Given your high concentration in stocks, how do you know that you are right?” It’s a great question, and incisive in its simplicity. Here’s our somewhat counterintuitive answer: It’s not so much about being right as it is making sure your opponent is wrong.

All investing is a zero-sum game at the point of transaction. Either you or your opponent is making a mistake. To develop and maintain conviction in a stock, you must think about the transaction in terms of a game of strategy. As in chess or poker, we can know all the “right” theoretical moves of the game, but the way to consistently beat your opponent is to find the weakness in their strategy, and to exploit that weakness to your benefit. This requires both patience and knowledge arbitrage, two features that can only be acquired through time and research.

While much goes in to developing conviction in investing—qualitative research, fundamental analysis, valuation—ultimately an investor’s slugging percentage comes from identifying the weaknesses and asymmetry in your opponents, and exploiting those weaknesses to your maximum benefit, “maximum” being the key word. This is why we relentlessly spend time on dissecting the contrarian viewpoints to each of our investments, both long and short. We like to imagine our competitors sitting across from us on the other side of the table, and we are fiercely competitive on this front.

So to him, we’d reframe the question: Developing conviction is not so much about knowing that you are right—though that certainly matters—but rather that you are believe to be certain that your opponent is wrong.

And when we look at our portfolio today, we see nothing but strength—in large part because we know the weakness of the arguments being made on the other side of the trade.

•••••

We believe that much of investing is a psychological business, and it requires the ability to go against the grain, especially when it feels most uncomfortable to do so. If one invests with “consensus,” returns are bound by mediocrity. To be able to outperform the benchmarks, then, one must think differently. How?

For one, we believe it’s necessary to recognize that behavior and human psychology can often be more important than academic or professional success to achieve great returns over a sustained time period. It’s our view that the best investors and analysts in the world tend to be natural-born skeptics, outsiders, contrarians, obsessives, and professional doubters.

In the coming months, we’ll share more, but here are a few key principles we talk about internally—

- There is no such thing as complexity. We reject Warren Buffett’s idea of “circle of competence.” Our mindset is that there is no such thing as complexity. At the foundational layer of everything is a simple pixel of data. We view complexity as opportunity, and we are drawn to chaotic industries to seek out new ideas.

- We do not do shortcuts. There is no such thing as a shortcut in investing. Every company, every industry us is a 1,000-piece puzzle. Before considering any investment, we first must understand the qualitative framework to understand how this opportunity is a potential 10x return.

- When we start the analytical process, we practice humility. We never bring opinions or biases into the analytical processes. The first thing to realize is this: One will never be truly right about anything. In fact, we’d go so far as to say all investing decisions are wrong. Even if the outcome is positive, hindsight always provides remarkable clarity into how a position or a trade could have worked even better. This is why we simply do not focus on win-rate, but rather avoiding mistakes. We believe avoiding big mistakes is the most important thing to do as an investor, but it’s rarely talked about, in large part because it’s hard to see—and probably less interesting to hear about.

•••••

Winding down here, we must confess how excited we are for the coming years.

As we’ve often counseled, prices are just prices—a daily quote on what someone is willing to pay for the business today. The beauty of the stock exchange is liquidity—but what we exchange for liquidity is volatility. We believe that volatility isn’t bad—in fact, it’s necessary for markets to reprice our assets as they grow over time.

When we look out at the next few years, we see a landscape primed for opportunity. It will not necessarily be easy, and there will be bumps along the way, but we’re confident in our strategies—and we’re thankful to have such wonderful, patient partners on this journey.

As always, if you have any questions, you should feel free to reach out to our team.

Sincerely,

Nightview Capital

Founder/CIO – Arne Alsin

Team

Chief Operating Officer – Zak Lash, CFA

Director of Portfolio Management – Daniel Crowley, CFA

Director of Research – Eric Markowitz

Director of Investor Relations – Philip Bland

Head of Compliance – Emily Bullock

Disclosures:

This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital.

The opinions expressed herein are those of Nightview Capital and are subject to change without notice. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. Such an offer will be made only by an Offering Memorandum, a copy of which is available to qualifying potential investors upon request. This material is not financial advice or an offer to sell any product. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Past performance is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income.

Nightview Capital Management, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-21-02