Dear Investors,

While 2023 produced improved results, we are continuing to optimize and modify our strategy for 2024 and beyond. In this letter, we’ll offer our recent views on Tesla, how we’re thinking about (and seeking to capitalize on) the boom in AI, and a few updates on portfolio companies.

Tesla

Our long-term vision and conviction in Tesla over the next several years has not changed. We continue to believe Tesla is destined to become a dominant leader across multiple industries, and we see a path to Tesla evolving into one of the most valuable (if not the most valuable) companies in the world. In short, our view of where Tesla is headed by 2030 is unchanged, and we believe the company offers one of the best risk/reward opportunities in the market for anyone with a 5+ year view.

However, looking back two years ago, it’s clear that our internal projections for Tesla’s growth trajectory (and profitability) over the 2022—2024 were aggressive. Forecasting the future cash flows of a complex manufacturing firm disrupting a legacy industry is a notoriously challenging endeavor. But we pride ourselves on getting the details right as close as possible. And clearly, our forecasting was off. There were two main areas that we did not accurately predict while modeling out the previous two years:

- First, Tesla has chosen a strategy of lowering prices aggressively to win market share. However, we did not expect that the company would appear so unwilling to advertise its products before cutting prices. A small amount of advertising, in our view, could have potentially educated and informed customers who do not understand the full benefits of EV ownership (including the long-term savings associated with owning a Tesla vs. an ICE vehicle). While this was successful in increasing volume growth it had a negative impact on the P&L.

- Second, two years ago we simply did not anticipate how polarizing Elon Musk and the overall Tesla brand would become. In our view, Musk’s purchase of Twitter/X has been a net-negative for Tesla’s overall brand premium, demand for Tesla products, and morale among many Musk-owned properties. Regardless of one’s personal opinions on Musk individually or his political views, many institutional investors appear to remain wary of Musk, which puts a damper on valuation and share prices in the short-term. Ultimately, the business value wins out, but these outside factors have kept the share price depressed longer than we anticipated.

With this being said, none of the above on Tesla affects our long-term thesis on the company. Every company inevitably faces challenges in the short-term, and we believe Tesla will emerge from this period stronger than before. In particular, we believe the company’s energy storage division, its robotics ambitions, and its supercharging network are not properly valued by most investors, and the share price is currently trading significantly below our intrinsic value.

Investor Relations Takeaways

As mentioned, following the Q4 earnings release, we had a productive conversation with IR to better understand some nuances of how Tesla is approaching growth in 2024 and beyond. Here are a few takeaways.

- Next-gen platform: As discussed in the earnings release, the company is prioritizing focus on developing the next generation platform as quickly as possible, aiming for a production release in late 2025. The ambitions, we understand from IR, are to achieve an incredible cost compression on this product—down to $20,000 per vehicle. If this level of COGS is achieved, Tesla will be able maintain Model Y-like margins at a much-reduced price point for consumers. In effect, we believe the company will strive to make smaller EVs—with higher profit margins than larger EVs—mostly due to the difference in battery cost and manufacturing techniques. Already, Tesla vehicles are efficient relative to the EV competition. With the next-gen model, the company has an opportunity to commercialize a new mass-market vehicle at accretive auto margins.

- 2024 growth: Much of the public and media commentary following the Q4 Tesla earnings release centered on the company’s language of “notably lower” guidance for vehicle volume growth rate in 2024, and IR acknowledged the vagueness of this term was a complex internal matter. In our view, the likely range of growth for 2024 will be in the mid-teens percentage growth. This is not unreasonable, given the saturation of the Model 3/Y platforms in the marketplace and the Osborning Effect of a newer, less expensive variant on the horizon. Perhaps more importantly, from our perspective, while the market never appreciates a lack of specific guidance, we interpreted the lack of guidance as a potential positive: the company may be less reliant this year on price-cutting measures to achieve production and delivery targets. As there is a one year gap until the next-gen vehicle is live, we believe maintaining margins (even at lower overall volumes) is a prudent strategy.

- Brand and advertising: We were encouraged by our conversation with IR that Tesla is committed to improve its brand perception and overall awareness. As we understand it, the company has built up a new, internal advertising unit and will be testing various campaigns throughout the year.

- Energy storge: Tesla’s commercial energy storage business is a bright spot, in our view. Megapacks are driving the growth here, and unlike new vehicle ramps, the Lathrop Megafatcory lines are on schedule to ramp up to nearly 40 GWh capacity in 2024, according to IR. About ~15GWh was deployed in 2023, so according to our calculations, the business could be setting up for another triple digit growth year.

- Cybertruck delays: While the delays around Cybertruck have been frustrating, we were encouraged by commentary from IR that some of the initial production ramp issues have been resolved and the company will be ramping production significantly in the first half of the year. According to IR, the Cybertruck ramp has been notably less challenging than the initial Model 3 ramp.

- V12 software / AI: Based on Tesla’s latest earnings call and our conversation with IR, it appears to us that Tesla AI’s training needs have changed since the original deployment of its D1 Chip. Nvidia’s software moat is proving tough to crack—which means the company will likely continue buying external chips to build up its computing needs for FSD and future generative AI projects. According to IR, V12 offers a significant improvement to previous versions, and the company is actively working to convey (via data) safety improvements of V12 to both regulators and customers. Despite several years of improvement, full autonomy remains elusive, and many customers are simply unwilling to spend $12,000 to redeem the FSD software package. While we believe Tesla’s vision-only approach to autonomy is ultimately the correct technical modality to pursue, and could create a tremendous amount of shareholder value, the amount of compute and data required to achieve Level 4 or 5 is immense. Over the next few weeks, we’ll be watching the implementation of Tesla’s V12 software closely to gauge the level of improvements relative to previous FSD versions.

2024 & Beyond

As so much of Tesla’s value in our mind is future focused and difficult to model this has caused excessive volatility in the equity. We believed the market would provide higher valuations for some of the ancillary products (FSD, Robotics, AI) at this time but now believe that the market will realize valuation in a more step- like manner. We will be keeping a keen eye on various progress metrics within the company and will always be looking for opportunities to benefit the portfolio.

Towards this end, we will be making some shifts to reallocate some duration in options and slightly diversify our holdings in the near-term. We see significant opportunities throughout the market at this current time and we will be deploying capital to attempt to boost the return profile and lower volatility. We will still maintain a highly concentrated portfolio but will use a portion of Tesla allocation for several opportunities we believe have the potential for outsized return profiles over the next couple of years.

Overall, we feel this is the most attractive pathway allowing our partners to benefit from both a considerable Tesla allocation (with potential generational returns if their business continues to progress along our expectations), while increasing diversity and capitalizing on opportunities presented by the higher interest rate environment. Our long-term belief in the company is, in many ways, stronger than it has ever been and we remain highly optimistic about the future.

Beyond Tesla, we will discuss a bit how we’re thinking about the revolution unfolding in AI right now, as well as a few new positions in the portfolio. The fact remains that we are quite excited—and bullish—about the opportunities unfolding in the market today.

How AI impacts us as investors

Like any new technology shift, AI’s consequences across the industrial, financial, and economic landscape are almost impossible to forecast. But we can say with certainty that it will inevitably create both risks—and profound opportunities—for active investors looking to achieve market-beating returns.

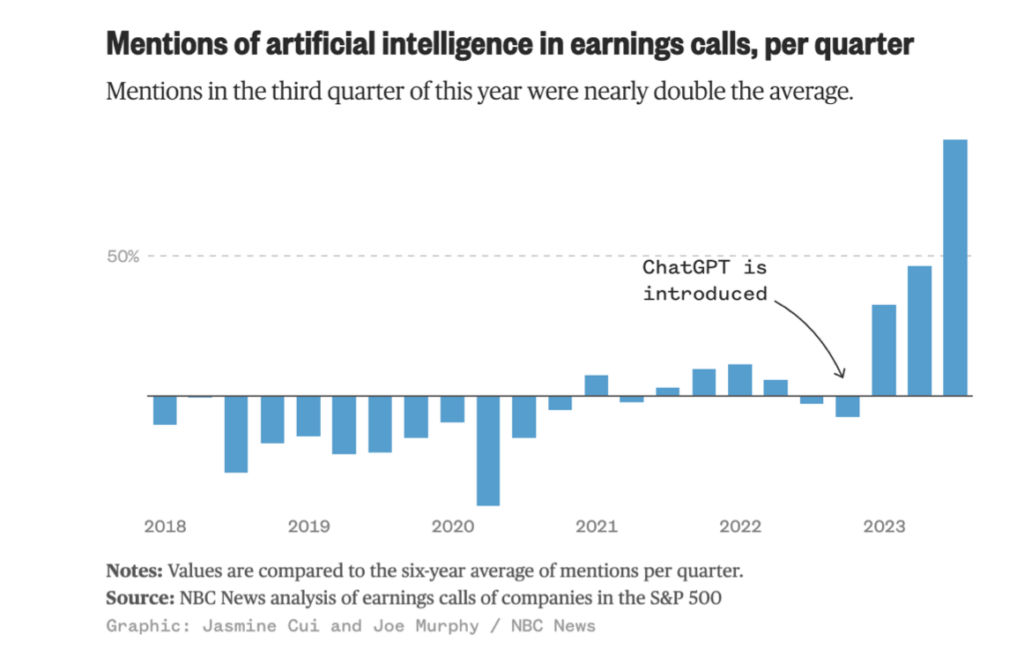

In 2023, it became a bit of a running joke how often “AI” was mentioned on earnings calls (e.g. see the chart below).

With the advent of any new technology, there will be an element of exaggeration or hyperbole for those looking to ride the coattails of any new trend. With that caveat, it’s becoming clear to us that even historically stable, “simple” business models are proactively integrating AI and LLMs (large language models) into their systems to increase efficiencies and productivity—and to remain competitive.

At a high level, we view the introduction of generative AI into modern industry as something like the introduction of the Internet in the 1990s: Some business models could be made profoundly more efficient and profitable, while others may cease to exist entirely. Likewise, some of the biggest companies of the 2030s and 2040s may not even exist today. The future is deeply uncertain, which can be unnerving. But this dynamic opens the door for staggering new opportunities.

One thing is clear: the creative use cases of AI are already beginning to flourish, and it’s becoming clear that there is no such thing as a “non” technology business now: All businesses must leverage new technologies to stay competitive. No business is immune to this rule.

Consider that a firm like Proctor & Gamble, nearing its 200th birthday, recently rolled out an internal generative AI tool for its employees. Even an analog business such as Coca Cola has recently begun leveraging OpenAI’s DALL-E2 generative image model to integrate AI-augmented animation with live action for its new advertising campaigns.

There are many frameworks to consider as investors when approaching AI. One heuristic we’ve adopted is to consider where a potential business exists in the technology stack when it comes to AI. For instance, a question we have been asking is this: Which companies (or even industries) will benefit from the explosion of AI the most?

The most immediate beneficiaries of the AI boom thus far have clearly been the providers of tangible hardware, such as NVIDIA, AMD, and Intel. The bottle-necking demands for GPUs created an incredible acceleration in both revenue and profit in 2023, and this demand could very well persist into 2024.

But over the next couple of years, we anticipate a second wave of AI beneficiaries to materialize, and in particular, the cloud service providers (CSPs)—such as Amazon and Google—stand well-positioned in the technology stack to reap the benefits of a boom in AI.

At the recent Amazon AWS re:Invent 2023, for instance, Amazon (which remains a core holding) announced a slew of updates, from its Titan text-to-image AI model (geared towards an enterprise customer-base) to its chat tool dubbed Amazon Q, which businesses can utilize to ask specific questions to their companies. Another important development from the event was Amazon’s revelation that AWS is developing a chip that could potentially solve fundamental quantum computing problems. (Here’s a good quick video from the Wall Street Journal on AI chips.)

There’s a few major takeaways as we assess AI’s impact on cloud and hyperscalers.

The first is that the boom in artificial intelligence will, in our view, lead to increased spend on cloud services over time, driving overall cloud revenue growth. AI requires significant amounts of computing power, which is largely provided by cloud vendors. This is important, especially as cloud growth among the major hyperscalers has seen some stagnation over the last couple of years. In effect, we believe the explosion in AI applications will act as a general tailwind for the CSPs, providing its next leg of growth and a strong lever of demand.

Second, we believe a renaissance in chip manufacturing and overall optimization in chip architecture could lower the cost of cloud computing, resulting in the potential for improved margins for CSPs and increased utilization by end-users.

One key element of AWS’ significant moat—and Google Cloud Platform’s moat, for that matter—is its ability to lower costs for end-users while increasing the quality of its services. In our view, few companies have the scale, data, and resources to compete with the largest CSPs, which could create a flywheel effect of growth. In other words, “big tech” might only get bigger.

Another key consideration in our analysis of AI is the level of exclusivity of the source data for training models. Again, companies that reside high up on the tech stack—and who benefit from scale—appear poised to benefit from integrating generative AI and machine learning. Firms like Airbnb, for instance, have access to terabytes of exclusive user data, which can be trained to help AI models predict where future customers may like to travel to.

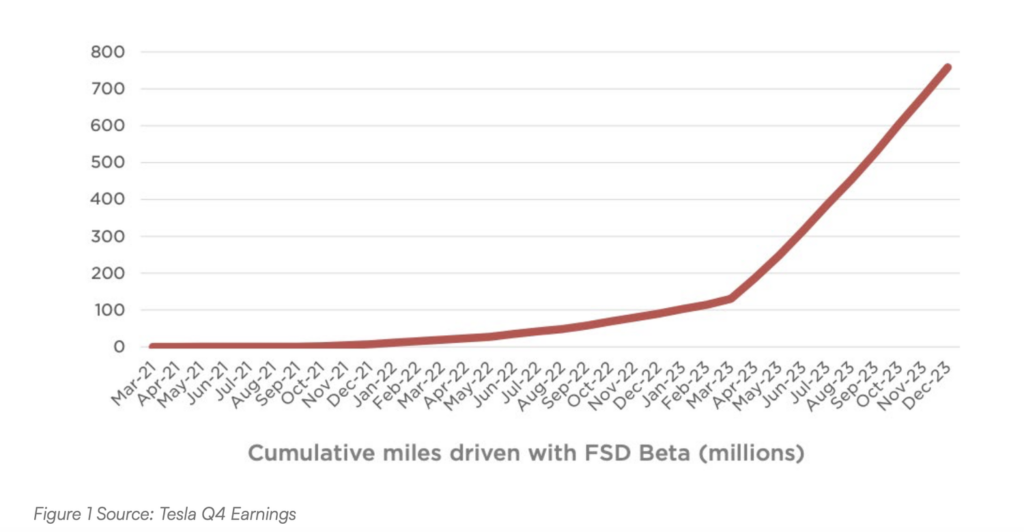

Another good example of this data dynamic can be observed in Tesla. In particular, they own exclusive access to an exponential dataset of miles driven as it builds out its full-self-driving capabilities. Having this exclusive dataset provides, in our view, an insurmountable lead when it comes to the development and application of non-lidar-based autonomous driving systems.

As seen below from Tesla’s Q4 earnings release, the cumulative number of miles driven with FSD Beta continues to grow at an exponential rate. This data is the raw ingredient necessary to train its neural net— and no other firm has close to the amount of data that Tesla has to train its systems.

The importance of scale—and the exclusivity of data—is of utmost importance as we think through the risk/reward scenarios for the next few years. Companies need exclusivity of data to train customized models; if they don’t, they run the risk of being disintermediated. For example, the online education firm Chegg saw its stock plunge 48% in a single day in May 2023, after the company revealed that ChatGPT was stealing market share. While we are naturally focused on finding the winners of the AI boom, it’s fair to say that we’re equally concerned with making sure we don’t own a loser as well.

In 2024, we expect much more to be written about generative AI and we’ll continue to share our thoughts as the field evolves. Of course, we acknowledge that there has been an element of hype to the topic.

However, in our view, the potential impact of AI across multiple industries—from advertising, to media, to transportation, to travel, and so on—should not be understated.

At the forefront of every investor’s mind should be a simple question: How does the potential impact of AI affect my investment thesis? This is the salient question, and one that we are considering daily.

***

As always, a core part of our strategy is to locate, analyze, and invest in industry-disruptive firms that we believe can offer market-beating returns for investors. At the same time, we believe that right now there are a great quantity of investable companies trading at attractive valuations in the market. While the core of our strategy remains unchanged, we are taking actions to capitalize on allocating capital to new companies to expand our portfolio.

As we progress into 2024, we anticipate building several new positions in the Long Only fund—several of which we have already established. One vertical we are particularly bullish on is travel and entertainment, and we are selectively taking positions across the field. Airbnb (ABNB), for instance, is a current position that has offered relatively stagnant returns since its IPO, but one that we believe may reach escape velocity in 2024 and beyond.

Airbnb offers a classic example of a company that was strengthened by crisis: In 2020, at the onset of the pandemic, the company saw revenues decline precipitously. Acting swiftly, management right-sized the company’s cost structure while enabling future growth on the platform by prioritizing the needs of its customers (i.e. hosts). In our view, Airbnb is now fostering a renaissance of travel: total nights booked on the platform will near 450 million in 2023, revenue growth remains solid, and cash flows are inflecting due to operating leverage. Airbnb will close out 2023 with roughly $3.6 billion of EBITDA, according to company filings.

Another company significantly off its all-time highs we believe has the potential for a significant rebound is Zillow (Z). The dominant U.S. portal for residential real estate with 63% market share of consumer traffic, they are the premier platform company in their industry. This is double the traffic of their closest competitor RedFin and over 80% of that traffic comes organically, directly, and for free with less than 5% of users coming from paid search engine marketing or digital ad spend. Traffic to their website was most recently an average of 224 million monthly unique users and while monetization has lagged, we believe they are positioning themselves as entrenched players in several income streams. We believe the market has failed to accurately incorporate this progress in the current trading value.

We believe the company is perfectly poised to benefit from a world where buyers’ agents are less prevalent and recent class action lawsuits against the NAR may be accelerating this process. Currently, the majority of Zillow’s business comes from advertising fees paid by real estate agents, but they have made solid inroads into distributing mortgage products and we believe they have a solid opportunity to capture a variety of income streams (insurance, moving services, furnishing / interior decoration services, and others). Rentals is also a solid growth engine with revenues up 34% yoy and Zillow remains the #1 most visited rentals platform in the country.

Zillow has also successfully exited their foray into home purchasing through the cessation of their iBuying program. We believe management accurately identified their mistakes, cut their losses, and decided to focus on more profitable and scalable opportunities. This quick realization provides us confidence in management’s ability to remain nimble and work to identify the best ways to monetize their dominant platform position.

Overall, we believe Zillow is perfectly positioned to benefit from a drop in mortgage rates, leading to a material boost in listings and ultimately increased revenue for Zillow. While valuation is complex at this stage of profitability, we believe the combination of a somewhat out of favor industry, dominant position, and the future opportunities available for increased efficiency in a notoriously inefficient marketplace have the potential to produce outsized gains for several years going forward.

Lastly, another position we initiated in 2023 was Disney (DIS). On the surface, there are several reasons to be skeptical about investing in Disney at this moment in time: the complexities of navigating the shift from linear TV to streaming, lower profit margins associated with Disney+, recessionary fears dampening growth across theme parks, and of course the company’s more recent entanglement in the political culture wars. Late in 2023, the activist investor Nelson Peltz (whose firm, Trian, owns $3 billion worth of Disney shares) launched a proxy battle against Disney and its CEO, Bob Iger. Clearly, the sharks are circling; it’s a messy situation.

And yet, it’s these messy situations where we can often find value if we expand our lens over the next couple of years. Given its recent earnings decline, Disney’s valuation has risen above historical standards. While the market has soured on the near-term earnings decline (driven mainly by its unprofitable streaming segment and the decline across its traditional TV operations) we believe the market is being short-sighted: Disney owns an impressive basket of IP and assets, and with some reasonable cost adjustments, the company could be on much more even footing. In fact, we tend to agree with Nelson Peltz’s assessment of the situation: The company could achieve “Netflix-like” margins at its Disney+ streaming service with strategic cuts that could unlock a great deal of value for investors.

In certain ways, the biggest catalyst for Disney shares over the next couple of years could come down to management. With Bob Iger back at the helm, we believe the company is turning a corner and headed in the right direction. At a recent Dealbook summit, Iger doubled-down on his view that the company must return to its roots of quality storytelling over what he called “messaging.” “Creators lost sight of what their No. 1 objective needed to be,” Iger said. “We have to entertain first. It’s not about messages.”

Cost cuts of course reduce expense and helps the bottom line in the short-term. The downside to cost cutting measures is that it can result in lower quality products due to lack of investment. In Disney’s case, however, we believe a significant amount of corporate bloat led to sub-standard content, and counterintuitively, cost cutting could help in the long term: the company will be forced to become more focused on creating high quality content (while not wasting money) like they used to.

Perhaps foolishly, the company has found themselves embroiled in the culture wars, which has been a net negative for shareholders. However, we believe when the news cycle shifts—and they resume building a slate of high-quality content—we could see a rebound in the market’s views towards the equity. In our view, Disney has obsessively loyal fans and a vastly underappreciated basket of IP. With the right tweaks from management, we believe we could see a significant unlocking of value for shareholders.

This is another example of a company whose assets we have long admired, and 2023 gave us the opportunity to buy the stock, which is still down more than 50% from its highs in 2021.

To the year ahead

As we look forward to the year ahead, we’d like to thank you once again for your trust in managing your hard-earned capital.

We wish you all a happy, healthy, and very productive 2024. If you have any questions or would like to discuss the portfolio with us, please don’t hesitate to reach out.

Sincerely,

Arne Alsin + The Nightview Capital Team

**Disclosures

This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital. The opinions expressed herein are those of Nightview Capital and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward looking statements cannot be guaranteed. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. This is not a recommendation to buy, sell, or hold any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Nightview Capital makes in the future will be profitable or equal the performance of the securities discussed herein. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request. Past performance Is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income. The S&P 500 Total Return is a market-value-weighted index that measures total return, including price and dividends, of 500 leading companies in leading industries in the U.S. economy. The volatility (beta) of the accounts may be greater or less than benchmarks. It is not possible to invest directly in this index. Nightview Capital, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-22-02