Dear Investors,

At its core, investing is an act of curiosity.

It begins with simple questions: What’s changing? Why? And how will it ripple through the world?

The best investors, like the best scientists and engineers, refuse abstractions—they go see for themselves. To understand a business, an economy, or a transformation like the one unfolding today, you walk the factory floors, talk with coders, and scout for seeds of progress before it shows up in the data.

We view investing as part investigative journalism, part detective work, part pattern recognition. It demands constant learning, emotional balance, and the ability to stay calm amid noise.

In a world drowning in secondhand information, shoe-leather research remains a durable edge.

For that reason, we spent much of the summer on the road. The best insights come from pairing digital research with real-world observation. In our view, filtering the vast flow of online information, then validating it on the ground.

Arne Alsin, CIO of Nightview Capital, studies global trends and the long arcs of technological change. His approach to investing is part detective work, part treasure hunt—searching for hidden signals beneath market noise.

While Arne focuses on the big picture, our research team is on the ground turning ideas into observation. In August, Dan Crowley, CFA, traveled through China’s robotics corridors, meeting engineers, entrepreneurs, and factory operators driving the next industrial wave. Meanwhile, Eric Markowitz, Director of Research, traced Europe’s manufacturing heartland—speaking with executives and employees across France, Switzerland, and Portugal to see how legacy industries are adapting (or not) to automation.

The contrasts were striking: Shanghai’s neon intensity and AI-fueled momentum versus Europe’s slower, deliberate pace. Shenzhen’s improvisational inventiveness in sharp relief against France’s methodical restraint.

Yet across these differences, one pattern was clear: the machinery of modern life is being rewired by artificial intelligence, automation, and new forms of autonomy.

Our fieldwork is complemented by a long-term partnership with InPractise, which connects us directly with respected former executives and industry analysts. Through several in-depth interviews each quarter—with former Tesla engineers, semiconductor veterans, robotics specialists, and supply-chain leaders—we test assumptions against firsthand experience.

This blend of ground-level observation and expert insight helps us separate narrative from reality and identify where durable advantage is forming.

Zooming out from daily chatter, a deeper alignment comes into view. Technologies that once moved in separate orbits—machine learning, robotics, manufacturing automation, electric mobility—are converging into one synchronized wave. And it isn’t theoretical. It’s visible now in factory lines, logistics networks, and urban streets.

This letter explores five dominant threads of that convergence:

- The Great AI Expansion — a capital-spending boom reshaping global supply chains

- Robotics Comes Alive — the physical manifestation of AI’s intelligence

- Automation as the Real ROI — where technology becomes measurable productivity

- China’s Next Chapter — a complex, adaptive economy finding new momentum

- The Road to Autonomy — where software meets motion and begins to think

Each theme meshes with the others like gears in a larger machine. Taken together, they depict an economy transforming rapidly—and unevenly—all at once.

I. The Great AI Expansion

In our view, we’ve entered the infrastructure phase of artificial intelligence—the period when words like “training” and “inference” appear in corporate earnings calls as frequently as “revenue” and “margin.”

Capital is pouring into silicon, data centers, and electrical grids at a scale unseen since the dawn of the internet. The purveyors of picks and shovels are the early winners here while the gold miners strike out with the best tools close to $1 trillion dollars in CAPEX can provide.

What’s striking is the scale of this boom. The cost of compute is falling fast, yet total spending keeps climbing faster. That paradox—the cheaper it gets, the more we use—has repeated across every technological revolution. Just as cheaper electricity fueled an industrial explosion a century ago, cheaper AI is now multiplying demand rather than satisfying it.

In 2025, global AI investment could exceed $1.5 trillion, according to Gartner. This level of spend is visible not only in the hyperscale cloud providers’ budgets but in every downstream industry: healthcare, logistics, finance, design, retail, even agriculture.

In Europe, we met with manufacturers that use generative design algorithms to optimize components once drawn by hand. In China, engineers showed us AI-driven quality-control systems that identify micro-flaws invisible to human inspectors.

In our view, what makes this cycle somewhat different from past tech manias is that cash flow is paying for it (or at least most of it). The biggest spenders are profitable incumbents—global platforms, industrial conglomerates, and energy utilities—reinvesting operational surplus into intelligence.

Behind that investment, three forces are aligning:

- Falling marginal cost of intelligence. Each iteration of hardware and model optimization brings down compute expense per query.

- Expanding use cases. Once a model exists, the incremental applications—forecasting, design, support—are almost limitless.

- Competitive reflex. No executive wants to be the last analog company in a digital race.

We view this as a multi-decade capital cycle—analogous to the build-out of electrification or the interstate highway system.

But like all great technological manias, this one will create both extraordinary winners and painful casualties. Every company today is racing to brand itself as an “AI company,” yet history reminds us that most won’t survive the cycle.

This is where we believe active management—and primary research—matters most. In order to outperform today’s landscape, one must be able to separate enduring innovation from speculative imitation.

Our conviction remains that the true beneficiaries will be those operating at the infrastructure and integration layers: the companies building the essential tools and those weaving them into the fabric of everyday business.

Tesla is a prime example—its vertically integrated ecosystem of data, hardware, and autonomy forms the connective tissue between AI and the physical world. Amazon, through its cloud and logistics networks, continues to serve as the digital and physical backbone of global commerce.

And in China, Alibaba’s expanding AI-driven infrastructure—from cloud computing to smart manufacturing—is positioning it as the essential operating layer for the region’s digital economy.

Across our research and travels, we’ve observed both extremes of the AI economy—chip fabrication plants running continuously and small factories where a single AI model manages operations. The connective tissue between them is strengthening faster than many investors realize, driven by one unifying force: the accelerating global demand for computation.

At the center of this demand are the companies designing and manufacturing the chips that make intelligence possible. Advanced Micro Devices, Inc. (AMD) has become a key player in this ecosystem, signing a multi-year agreement recently to supply six gigawatts of GPU capacity to OpenAI, anchored by its upcoming MI450 chips. AMD’s integration of XDNA neural processing units across CPUs and GPUs positions it to serve both cloud and edge workloads.

If AMD provides the brainpower of the AI build-out, Taiwan Semiconductor Manufacturing Company (TSMC) is its backbone. The company fabricates nearly all of the world’s most advanced chips for clients including Nvidia, AMD, and Apple. In mid-2025, TSMC’s revenue rose roughly 40% year-over-year to $10.7 billion in May, driven by surging demand for AI and high-performance computing.

Together, AMD and TSMC form the foundation of the modern AI economy—one designing intelligence, the other manufacturing it. Their combined momentum underscores how the next decade of growth will be powered as much by silicon and scale as by software and data.

II. Robotics Comes Alive

If AI is the brain of modern industry, robotics is the body.

Over the past year we’ve witnessed that body wake up.

In Beijing this summer, we visited an exhibition center that showcased the scale and ambition of China’s robotics industry: humanoid machines replicating factory tasks, robotic dogs performing for attendees, and industrial arms stacking porcelain with extraordinary precision.

The event was not a display of science fiction, but a reflection of state policy: China’s concerted effort to achieve global leadership in robotics, paralleling its advances in solar energy and electric vehicles. Notably, this year’s exhibition highlighted a growing public engagement with automation technologies.

Across the Pacific, Europe’s factories tell a more sobering story, and the broader picture is equally concerning.

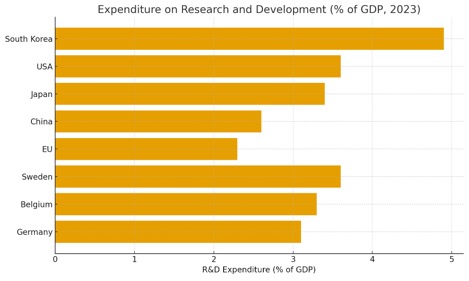

Source: Paulo Portas presentation (EuroNet)

In Lisbon, Portugal’s former finance minister Paulo Portas presented a slide that captured Europe’s innovation dilemma in a single image. The data told the story: while South Korea invests 4.9% of its GDP in research and development, and the United States 3.6%, the European Union averages just 2.3%—a gap that has widened over the past decade.

Europe is in danger, he warned, “of becoming the museum of the world.”

Yet the pace of technological change elsewhere shows no such hesitation. As Portas spoke of Europe’s risk of becoming a “museum of the world,” the rest of the globe is racing ahead.

The robotics revolution, in particular, is entering an inflection point—driven by three converging accelerants, in our view:

Vision systems now see like humans. High-resolution cameras paired with AI allow dexterity once thought impossible.

- Actuators and materials have caught up. Cheaper, lighter servos make robots nimble rather than brute.

- Software standardization. Open frameworks allow code reuse across robot types, shortening deployment cycles.

The economic result could be profound. Where early robotics produced incremental efficiency—weld one part faster, move one box quicker—the new generation is creating entirely new workflows. A robotic fleet that can adapt to changing SKUs or reconfigure for custom orders converts fixed assets into flexible systems. In effect, factories are learning to think.

The implications stretch beyond manufacturing. In logistics hubs we visited earlier this year, mobile robots now navigate aisles autonomously, guided by AI traffic controllers that optimize routes in real time. Each 1% reduction in idle travel saves millions of miles a year. The more robots learn, the less human time is wasted.

We view robotics as the natural physical outlet of the AI boom. Compute power, once trapped on screens, is spilling into the world. The curve that began with digital cognition is closing the loop with mechanical execution. We believe humanity could witness its own intelligence embodied at scale.

III. Automation as the Real ROI

For all the excitement around AI and robots, the real measure of progress is productivity—how effectively intelligence translates into economic output. Automation is that bridge.

The narrative arc of every major innovation follows the same path: discovery → hype → disillusionment → integration → invisibility. Automation lives in the last stage.

It disappears into the workflow, which is precisely what makes it powerful. When the technology vanishes, the productivity remains.

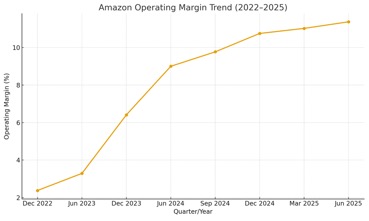

Amazon’s ambition to make AI the backbone of its physical operations is becoming tangible. As of mid-2025, the company has deployed its one millionth robot across more than 300 fulfillment facilities. With the rollout of DeepFleet, a generative AI model that coordinates robot movements like a “traffic controller,” Amazon claims it can boost robot travel efficiency by roughly 10% across its fleet.

Because of the company’s scale, even that modest gain produces outsized benefits: improved throughput, reduced congestion, lower energy use, and the ability to store goods closer to where they’re needed.

For years, digital retail has been defined by razor-thin profitability and high labor intensity; now, the integration of robotics and intelligence is beginning to rewrite that equation. What once depended on scale alone is increasingly powered by efficiency—turning every incremental gain in productivity into a durable improvement in margins.

Source: Amazon Financials

In previous cycles— Enterprise Resource Planning (ERP) systems in the 1990s, cloud computing in the 2010s—automation adoption lagged promise by years. The friction was always integration: incompatible data, siloed departments, cultural resistance. This time feels different. AI’s modularity allows automation to be embedded piecemeal. A company doesn’t need to “become an AI company.” It only needs to instrument one process at a time.

That’s why we believe the next leg of this cycle will show up not in research headlines but in earnings reports. Early adopters already display widening operating leverage. Every repetitive process made algorithmic frees human capital for higher-margin creativity or design. Productivity, long stagnant in Western economies, is beginning to tilt upward—slowly but perceptibly.

Automation is also an equalizer. Smaller firms, thanks to cloud-delivered tools, can now access the same optimization once reserved for conglomerates. In China, digital platforms extend AI logistics to millions of small merchants. In the U.S., even mid-size manufacturers can rent robotic capacity as a service. Technology’s diffusion is democratizing competitiveness.

This, ultimately, is how revolutions compound: not by spectacular breakthroughs but by thousands of quiet efficiencies that stack over time.

IV. China’s Next Chapter

Travel remains the best antidote to narrative.

Western headlines will often portray China as an economy in decline—slowing growth, a property overhang, and demographic headwinds. But on the ground, the reality is more complex, and in many places, far more vibrant.

At August’s World Robot Conference in Beijing, we witnessed an ecosystem buzzing with self-assurance. Dozens of startups were debuting generative-AI platforms, robotics firms were demonstrating humanoids with dexterity rivaling Boston Dynamics, and consumers lined up to test autonomous vehicles navigating new smart-road corridors.

The sense of acceleration was unmistakable: an economy shifting from imitation to invention.

Alibaba’s transformation epitomizes that shift. Once the symbol of China’s e-commerce scale, the company is now repositioning itself around agility and AI infrastructure.

In 2023, Alibaba reorganized under a “1 + 6 + N” structure—splitting into six major business groups, each with its own CEO and board. Since then, the company has emphasized cost discipline and redirected investment toward high-growth areas such as cloud computing and logistics.

Its Tongyi Qianwen (Qwen) large-language-model family—now integrated across Taobao, DingTalk, and Alibaba Cloud—has been adopted by more than 90,000 enterprise customers and is accessible to over 2.2 million corporate users through DingTalk.

The firm’s new mantra appears to be something like “AI + Consumption”— harnessing digital intelligence to drive productivity and domestic demand simultaneously.

For active investors like us, this inflection is precisely where opportunity lives.

Valuations across China’s technology sector remain deeply discounted relative to fundamentals, yet the pace of innovation is clearly accelerating. In our meetings, executives spoke with conviction about deploying AI to streamline operations, cut energy costs, and modernize supply chains.

The tone was not defensive, but ambitious—focused less on surviving the slowdown and more on reinventing their industries. We left convinced that while global headlines dwell on contraction, the real story in China is one of adaptation and renewal.

None of this erases the structural challenges—fragile property markets, youth unemployment, geopolitical uncertainty. But even within constraint, adaptation is everywhere.

For long-term investors, the message is clear: discount the doomsday narratives. Innovation and ambition remain China’s most enduring competitive advantages—and they’re on full display for those willing to look beyond the headlines.

V. The Road to Autonomy

Few technological frontiers capture both imagination and skepticism like self-driving vehicles. The goal has felt perpetually “two years away.”

And yet, in 2025, something fundamental has changed: autonomy is beginning to commercialize.

In June 2025, Tesla launched a limited robotaxi pilot in Austin, Texas, deploying a small fleet of Model Y vehicles equipped with safety monitors in a geofenced area. The pilot marked the company’s first real-world test of its long-promised autonomous service. Tesla’s Full Self-Driving (FSD) software continues to evolve, and recent builds—such as version v14.1 incorporate end-to-end neural network components across city and highway driving in vehicles with the newest hardware.

Regulatory agencies in Texas and California have approved additional limited pilots, signaling a measured but meaningful shift in official posture.

We believe the economics could be extraordinary. Tesla projects that once autonomy scales, robotaxi operating costs could fall dramatically. Based on our internal models, each vehicle could generate $30,000 to $50,000 in annual gross profit when fully utilized, effectively transforming cars from depreciating assets into productive, income-generating machines.

The challenges remain formidable—edge cases, regulation, ethics—but the direction is unmistakable. Every additional mile widens the data gap between leaders and laggards. In the age of autonomy, mileage is the new moat—a compounding data advantage as powerful as network effects were in the internet era.

Why does this matter beyond mobility?

Because autonomy represents the convergence of all the prior themes:

- AI investment provides the compute and models.

- Robotics gives form to intelligence.

- Automation supplies the efficiency logic.

- China and global scale drive cost curves down.

When these strands intertwine, the result is not a single industry transformation but a systemic one.

The horizon may be longer than impatient markets prefer, but history rewards those who look through the windshield, not the rearview mirror.

The View Ahead: Active Investing in an Age of Transformation

It’s tempting to analyze each technological wave in isolation—AI here, robotics there, China somewhere in between. But the true story lies in their convergence.

We believe we’re witnessing the rise of a networked industrial renaissance: a feedback loop of intelligence, energy, and automation reshaping how the physical world operates. Every advance feeds another. The more AI learns, the cheaper robotics get; the cheaper robotics get, the more data flows back to AI.

These loops compound until, suddenly, productivity leaps forward.

We believe the 2020s will mark a reversal of the last decade. The 2010s were defined by software eating the digital world. The 2020s are defined by software animating the physical world.

Industries once written off as mature—manufacturing, logistics, energy, transportation—could be redefined by autonomy, sensors, and real-time optimization.

Yet we believe valuations in many enabling sectors—semiconductors, robotics, industrial software—remain modest relative to their growth potential. This is where active investing matters most. Opportunity now depends less on exposure and more on insight—knowing which companies will harness AI to compound productivity, and which will fall victim to it.

By contrast, the next decade may be a treacherous time to be purely passive.

The S&P 500’s current concentration is the highest in history: the top ten names make up over 35% of index weight. In an environment defined by disruption, not every incumbent will adapt. Some will miss the inflection entirely. Index investors may unknowingly own both the innovators and those they will render obsolete.

We believe this is the most exciting time in a generation to be an active investor—to travel, observe, and invest where technology is visibly compounding in the real economy.

Our philosophy remains constant: focus on companies where time is the friend of value creation, where innovation converts into durable cash flow, and where data and discipline reinforce one another.

We close the quarter with cautious optimism and conviction: the future is not being imagined; it’s being built, and it rewards those patient enough to see it before the market does.

Sincerely,

The Nightview Capital Team

Disclosures

The opinions expressed herein are those of Nightview Capital and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward-looking statements cannot be guaranteed. Readers are cautioned not to put undue reliance on such forward-looking statements, which are not a guarantee of future performance, and are subject to a number of uncertainties and other factors, many of which are outside Nightview’s control, which could cause actual results to differ materially from such statements.

This is not a recommendation to buy, sell, or hold any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Nightview Capital makes in the future will be profitable or equal the performance of the securities discussed herein.

Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. While Nightview uses sources it considers to be reliable, no guarantee is made regarding the accuracy of information or data provided by third-party sources.