Dear Partners,

Our strategies have performed positively in the first half of the year and there has been some reversal in both the portfolio and several of the issues pressing on the market in 2022. Inflation, while exceedingly complex, appears to be coming down and the Federal Reserve will potentially pause rate hikes in the coming months. While the immediate term still offers uncertainty and these negative macro issues rarely recede in a linear manner, we remain confident that this decade remains one of opportunity.

There is always a cyclical element to markets, but our longstanding view is that compound business growth, over an extended period of time, has the ability to generate significant returns for investors. Despite the swings in market sentiment and the volatility of individual stock prices, we stay focused on business execution above all else.

Tesla, our largest position, had yet another record-breaking quarter—and has made significant leaps in their ambitions around artificial intelligence, which we’ll discuss below. It’s also worth noting that while we stay focused on the execution of our current holdings, we also maintain a “farm system” of new ideas on our research watchlist.

Bear markets—though painful—often provide fruitful opportunities to buy these businesses at discounted prices. Over the past six months, we’ve done just that: we’ve accumulated shares in several businesses that we believe are trading at relatively discounted prices. To use the baseball “farm system” metaphor, we’re calling these businesses up from the minors and giving them a chance in the big leagues. Above all, these are businesses we admire and have been following for many years. We expect some will stay in the portfolio for the long-term, depending on how they perform. Others, which could potentially reach our calculated view of fair value quickly, may be “retired” as new positions come into the fold. Overall, we believe this is a great opportunity to pick up attractive businesses at highly reasonable prices.

Looking forward, we continue to believe that there are tremendous opportunities for patient and disciplined investors. Our approach is to keep things simple and stay concentrated in our best ideas. We always want to do what we believe is best for our current clients with a long- term view. This is a discipline that we continue to refine, and we do so with one goal in mind: To compound your capital for many years to come.

As always, we appreciate you trusting us with your family’s hard-earned capital. Below, we’ll get into the weeds of what we’re studying—and what we’re excited about in the months to come.

***

In poker, as in investing, what’s most important for long-term outperformance is to be able to consistently try and understand what hand your opponent is holding. In this sense, we’re always on the lookout for opponents with potentially weak hands. This is why we make a habit of studying the bearish arguments made by the largest critics of any of our positions, but especially Tesla.

And yet, the emphasis of much of our research—over a cumulative number of years—has consistently revealed that Tesla’s advantages, and its potential for extreme outperformance, are broadly misunderstood.

Perhaps one of the most misunderstood (and fascinating) elements of Tesla’s business model is the company’s approach to software and artificial intelligence.

In previous letters, we’ve written at length about Tesla’s verticalized approach to manufacturing, its battery engineering process, its factory layouts, and much more.

Over time, we anticipate that Tesla’s automotive gross margins will improve, largely as a result of its commitment to verticalized hardware manufacturing, intense cost control, and design simplifications. We also anticipate a top-line manufacturing growth rate significantly above Wall Street’s estimates, which could result in consistent upwards revision of earnings estimates (in addition to significant upward stock price appreciation).

While Tesla’s manufacturing process is impressive, it’s no longer much of a secret among Wall Street analysts. However, what’s less well-understood by traditional analysts—and potentially far more exciting than the company’s hardware innovations—is the company’s future in supercomputing, software, and artificial intelligence.

Over the last several months, the market has become captivated by the promise of artificial intelligence. Interestingly, however, Tesla’s ambitions in artificial intelligence receives little valuation credit from Wall Street. As investors, we’re content with this dynamic: This means that the stock effectively contains “free” option bets should these ambitions in AI and supercomputing come to fruition down the road (and be recognized by other investors).

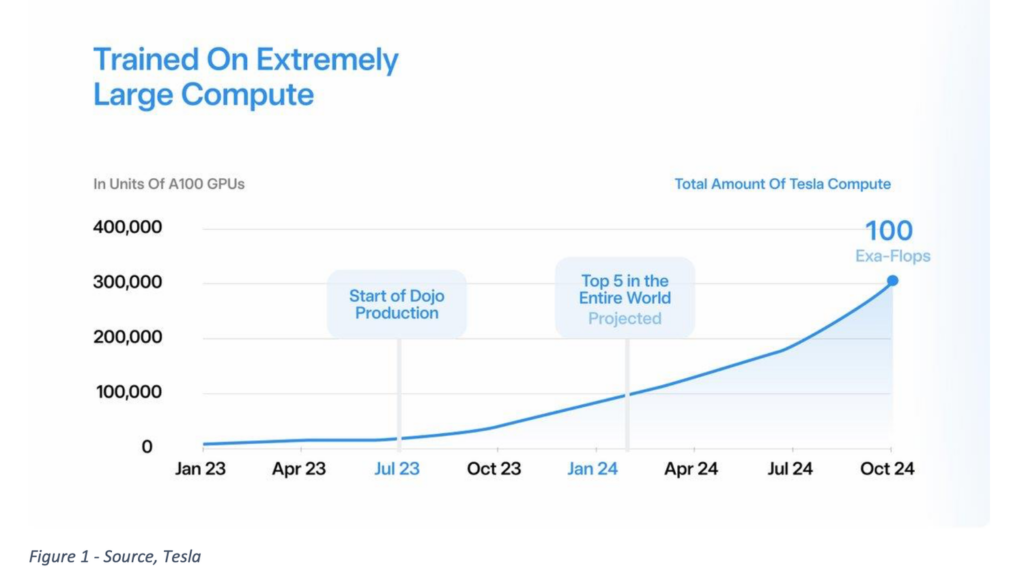

This month, the company will be entering the production phase of its high-powered training computer called Dojo. We anticipate that this supercomputer, designed over the last three years, could enable Tesla to make significant breakthroughs in AI, particularly focused on real- world applications like autonomous driving and robotics. It’s effectively the brains of Tesla’s cars and humanoid robot divisions.

But perhaps what’s even more compelling—beyond using Dojo as an in-house tool to advance towards full autonomy and AI—will be the company’s potential to license the core IP to other auto manufacturers and hardware OEMs.

This potential is, in our view, severely underappreciated by most conventional analysis of Tesla’s long-term operating model (and its effect on operating margins and net income).

If successful, Tesla could add a new line of revenue with significant contribution margin, further enabling the company to reduce the prices of its cars and accelerate it’s production CAGR through 2030.

Perhaps the closest analogy here would be when Amazon launched Amazon Web Services in 2006. Few analysts at the time realized the profound long-term impacts that AWS would have on Amazon’s P&L, as well as Amazon’s ability to consistently lower prices for consumers in its e- commerce division as a direct result of the AWS profitability engine.

In fact, on the most recent conference Q1 2023 call, Musk himself directly noted the parallels between Dojo and AWS: “Dojo also has the potential to become a sellable service that we would offer to other companies in the same way that Amazon Web Services offers web services, even though it started out as a bookstore,” Musk said. “So, I really think that, yes, the Dojo potential is very significant.”

So, what exactly, is Dojo—and what problem does it solve? Let’s start with the problem: Turning unstructured data into useful information.

As Tesla scales its global fleet of vehicles, each equipped with 8 cameras, the company is seeing an exponential rise in the amount of data being fed into its neural net system. The goal of autonomy would be impossible without a system to turn that raw data into actionable information. Previously, Tesla used an NVIDIA GPU-based supercomputer that was one of the largest in the world. But ultimately, this supercomputer was not powerful enough to turn billions of raw bits of data into actionable training models for its neural net system.

To control their own destiny (and ultimately not rely on a third-party like NVIDIA), Tesla embarked on a radical new project to build a supercomputer tailored for Tesla’s specific needs around autonomy and artificial general intelligence. That was Dojo.

With custom-built chips, Dojo will be able to process exabytes of data in record time, training the AI models more efficiently and improving the likelihood of achieving fully autonomous capabilities.

Of course, Dojo’s future is far from proven. As Musk reiterated on the Q1 2023 call:

“I’d look at Dojo as like kind of a long-shot bet, but if it’s a long-shot bet that pays off, it will pay off in a very, very big way… Like in the multi-hundred-billion-dollar level. But I’d still put it in the long shot category, but long shot with a multi-hundred-billion-dollar potential outcome. And – so it’s a bet worth making, but not one you can sort of take it to the bank type of thing.”

As Musk alludes, Dojo—used primarily as an AI Infrastructure as a Service—could be licensed to other companies looking to train their own AI models or build out their own custom neural networks.

This quarter, Tesla announced partnerships with both Ford and GM to allow these OEMs use of Tesla’s extensive supercharger network. We view these strategic partnerships as early indications that other OEMs and global Fortune 500 companies could increasingly turn to Tesla for its differentiated IP.

Again, the profit potential for Dojo remains a ways out. But given how little valuation credit the company receives for this enterprise—combined with its potential upside—we view it as an asymmetric bet to the upside. As Musk would say, “it’s a bet worth making.”

***

Over the years, we have often been asked why we do not invest in multiple electric vehicle companies. It’s a reasonable question. If our view is that the global auto industry will shift to electric vehicles, shouldn’t we expect multiple winners in this transition? Couldn’t there be battery companies that emerge? Or electric truck companies? Or even other electric vehicle companies internationally?

The answer is yes, with a big caveat: Risk.

Over the last few quarters, we have seen the valuations of multiple electric vehicle companies and battery firms collapse. We’ve also begun to see several EV firms—including Lordstown Motors, Mullen Automotive, and Canoo—on the brink of bankruptcy. It’s simply a good reminder of why we stay so focused on dominant companies in this environment.

While we spend significant time and resources studying companies like Nio, Quantumscape, Stem Energy, and many others, we have consistently decided to avoid investing in these firms. Building electric vehicles and big battery operations at scale is a notoriously challenging business model. This is also why we view Tesla’s operations as derisked in comparison – they are profitably executing at massive scale.

When we scrutinize a new potential stock for our “farm system,” we ask a simple question: Would we be comfortable owning this business for 3 years if the market were to shut down tomorrow? If the answer is no—and it’s certainly no for many of the speculative EV companies—we avoid them altogether.

For instance, one of the relatively new (and small) positions we’ve entered is Hertz (HTZ). With our allocation in Hertz, we own a business that generates revenue primarily through vehicle rentals. Hertz operates in 160 jurisdictions globally but generates about 45% of its revenue in the U.S. The business has undergone a transformation post-bankruptcy, and our view is that the market has yet to fully realize it. The company is more financially fit—and investing in multiple platform transition ahead of competitors. We believe Hertz is poised for margin expansion in excess of pre-pandemic levels, and a return to normal growth on the top line over the next 3-5 years.

A portfolio is often scrutinized by what’s in it. We’d posit an equally important, but less obvious

trait to a portfolio is what’s not in it. In this sense, defense is absolutely the best offense. We simply want to avoid mistakes, own the best businesses, and own them for many years.

***

As we have seen some rebound in the share price of Tesla, we have made some smaller bets in both portfolios.

While we view Tesla as our portfolio’s “Secretariat”—a generational winner—we see the potential opportunities in these smaller positions as quite attractive over the next several years.

These are companies we have researched for years, and now feel highly comfortable in their operating prospects. Many of them are out of favor by the broader market—which is ideal from our perspective.

So, right now, we are glad to expand our base with Tesla as our dominant core holding. We see the future path of these companies as potentially more predictable, at least from a valuation standpoint, should they meet our internal expectations. The next couple of years should be exciting. With Tesla, we believe we own a once-in-a-generation opportunity. And now, we also have the benefit to expand the portfolio with several new companies that have gone out of favor in the latest bear market. There will be risks along the way, and nothing is certain, but in our view, this is one of the best setups for growth we’ve seen in a long time.

***

We’ll have more details in the coming months regarding the ETF and other business updates.

Again, we want to thank you for your trust and conviction. We continue to be excited about the opportunities ahead, and we are here to answer any questions you may have.

We hope you have a happy and healthy summer.

Sincerely,

Arne Alsin and Nightview Capital

**Disclosures

This has been prepared for information purposes only. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Nightview Capital. The opinions expressed herein are those of Nightview Capital and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward looking statements cannot be guaranteed. This is not an offer to sell, or a solicitation of an offer to purchase any fund managed by Nightview Capital. This is not a recommendation to buy, sell, or hold any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Nightview Capital makes in the future will be profitable or equal the performance of the securities discussed herein. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. Nightview Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request. Past performance Is not indicative of future results. Returns are presented net of investment advisory fees and include the reinvestment of all income. The S&P 500 Total Return is a market-value-weighted index that measures total return, including price and dividends, of 500 leading companies in leading industries in the U.S. economy. The volatility (beta) of the accounts may be greater or less than benchmarks. It is not possible to invest directly in this index. Nightview Capital, LLC (Nightview Capital) is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Nightview Capital including our investment strategies and objectives can be found in our ADV Part 2, which is available upon request. WRC-22-02